If you’re a dividend investor you’re probably quite familiar with AbbVie. The stock is known for its high dividend yield and high dividend growth, a combination that is rare in today’s stock market. The massive cash flows that have enabled such generous dividend increases are primarily fueled by one drug: Humira. With its loss of exclusivity (LOE) fast approaching, some investors are probably wondering if the company is still safe to own. Will they have to cut their dividend? Can the rest of their drug portfolio offset the Humira losses? Today we’ll take a look at the company’s current position as well as the safety of the dividend.

Humira – The Pharmaceutical Goliath

Humira is the top selling drug in the world. In 2020 it generated $19.8 billion worth of sales. The next closest drug was Merck’s Keytruda at $14.4 billion. Through Q3 2021 Humira has generated $15.4 billion in sales. Out of that $15.4 billion, only $2.6 billion was international sales, with $12.8 billion coming from the US market alone. This is because Humira has already lost its exclusivity rights in European markets, allowing for biosimilars and other copycat drugs to erode AbbVie’s market share.

As the 2023 LOE in US markets approaches, AbbVie has been on the offensive, both through M&A and in the court room. Through legal routes, AbbVie has been constructing what some have characterized as a “patent-thicket” around its prized drug, Humira. This “thicket” of 257 patents has enabled the company to control its competition’s rollout of biosimilars. Per CEO Richard Gonzalez, patents in that portfolio stretch all the way out to 2034 – a little over a decade after the loss of exclusivity first hits the company.

Biotech giant Amgen was the first to win a settlement against AbbVie back in 2017, which will enable them to launch their Humira competitor on Jan 31st 2023. The deal allows Amgen to bring its biosimilar Amjevita to market at the cost of patent licenses and royalties. Altogether 8 companies have signed deals with AbbVie, including Pfizer and Boehringer Ingelheim (BI). BI actually took AbbVie to court after the Amgen settlement was completed, eventually ceding to the patent fortress and settling in 2019. One company, Alvotech, is still in the midst of its legal battle, but if history serves as any indicator a victory looks unlikely.

The Sales Impact of Humira

While Humira’s days of exclusivity are numbered, we need to consider that even after the 2023 patent expires sales aren’t suddenly going to zero. Many patients already on the drug will likely remain on it, and some doctors will continue to recommend/prescribe it. Additionally, there will be royalties and licensing agreements from competitors to help offset the losses. AbbVie can also lower prices depending on competitors’ rates in an attempt to retain market share. Ultimately, total sales will still erode over the coming years, although they can continue providing meaningful cash flow to the business.

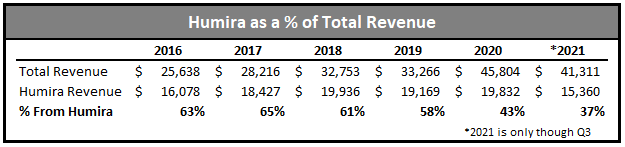

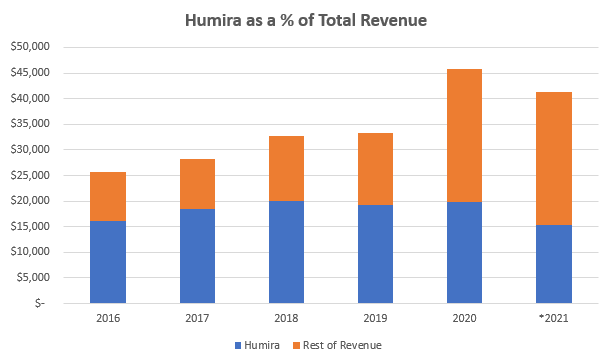

At this point, the next question would be how much of AbbVie’s revenue comes from Humira? Over the past several years the percentage of company revenue coming from the drug has declined significantly. In 2017 Humira made up 65% of revenue, followed by a drop to 55% in 2019, and 43% in 2020. Through the first 3 quarters of 2021, it accounted for 37% of sales. This is a good sign moving forward, as the company’s dependence on the drug has been drastically reduced. This decline has also happened as Humira’s sales have continued to trend upwards, meaning that the rest of their portfolio is outpacing the lead drug’s performance.

Filling the Humira Void

In 2019 AbbVie announced it would be acquiring Allergan for $63 billion. This enormous deal was made in a proactive attempt to diversify the company’s portfolio. As previously discussed, AbbVie had also been busy in the court room creating a near impenetrable patent wall. But this alone wouldn’t be enough to save the company long term. Instead, they needed to make some sort of deal to diversify their drug offerings. Allergan, famously known for Botox, expanded AbbVie’s portfolio into other segments of healthcare that the company had no exposure to. Beyond cosmetics, these segments included ophthalmology, gastroenterology and the central nervous system. Through Q3 2021 cosmetic products made up $3.8 billion in sales. Eye care produced $2.6 billion and neuroscience came in at $3.9 billion. Altogether (including other miscellaneous products) Allergan’s portfolio had brought in about $12 billion in sales.

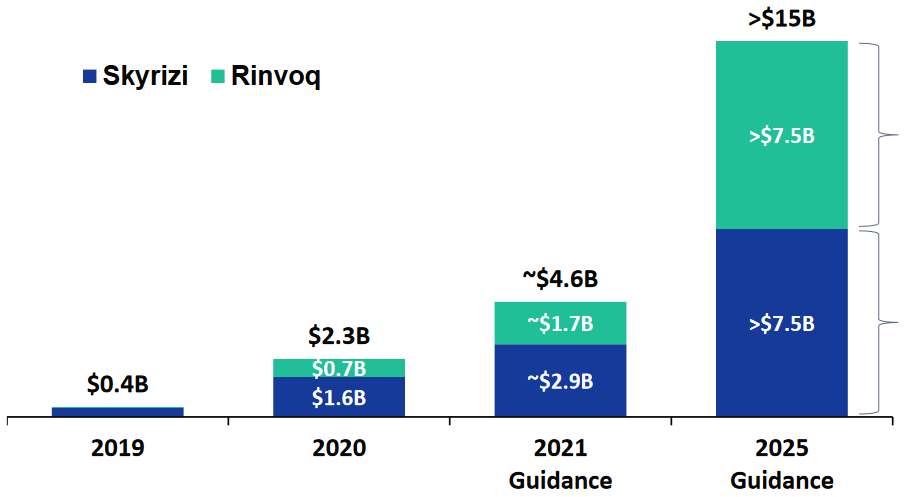

AbbVie also has its own up-and-coming drugs in addition to a relatively deep pipeline of potential treatments still in various R&D phases. Humira successors Skyrizi and Rinvoq have shown promise, and the company is hoping for the two drugs to combine for $15 billion in sales by 2025. Imbruvica, their top performing cancer drug, is another big part of their portfolio, accounting for over $4.5 billion in 2020 and $4 billion through Q3 2021. Similar to Humira, AbbVie is constructing another patent thicket around Imbruvica. As of 2020, 88 patents had been granted, which should earn AbbVie another nine years of protection.

It’s important to note that while these patent practices are effective at extending the profitability of the respective drugs, some analysts and experts are warning that the strategy is problematic and could eventually lead to reform of current laws.

Are AbbVie’s Moves Enough?

At the end of the day, the big question with AbbVie is whether or not its improved portfolio can offset Humira’s patent cliff. For now, the answer seems to be a favorable “maybe.” If we look at Botox and aesthetic sales year over year (YOY), they’ve seen a massive jump. But this growth isn’t organic growth and is instead due to the pandemic negatively affecting sales during 2020. Q3 2021 has YTD sales at $1.1 billion vs $442 million in 2020. There might be some additional room for recovery going into next year as the pandemic really starts to wane.

Products like Skyrizi and Rinvoq have also seen strong year over year growth. Skyrizi jumped from $1.1 billion to $2 billion and Rinvoq increased at an even faster rate from $450 million to $1.1 billion (per Q3 10-Q). And most important of all, Humira sales have declined as a percentage of total revenue, going from 65% of sales in 2017 to 37% in 2021.

As a sum of parts, we can think of the Allegan catalog + Imbruvica as essentially being equal to Humira. These products probably have less overall growth potential, but should be relatively consistent. The newer up-and-comers like Skyrizi and Rinvoq are where the growth needs to come from for AbbVie to excel. Ideally their sales growth needs to outpace (or at the very least match) the declines from Humira. The $15 billion in revenue that management has guided for is promising in this regard. The pipeline is also a wildcard, with a number of products in phase 3 and therefore close to potentially being approved. Any one (or more) of those approvals could turn into a multi-billion-dollar drug in the next several years.

Collectively, I think things are trending in a favorable direction for AbbVie. As 2022 continues on and the LOE deadline draws closer, things will continue to become clearer. 2023 may still end up being a down year for earnings, but their proactive measures should mitigate the drop. Beyond 2023 the potential for growth is relatively strong but not guaranteed. Still, things look more promising than a couple years ago. I think the market is already starting to price in the company’s more diversified revenue streams, as the stock has rallied almost 25% over the last 3 months and surpassed its previous all-time high set in January of 2018.

Dividend Outlook

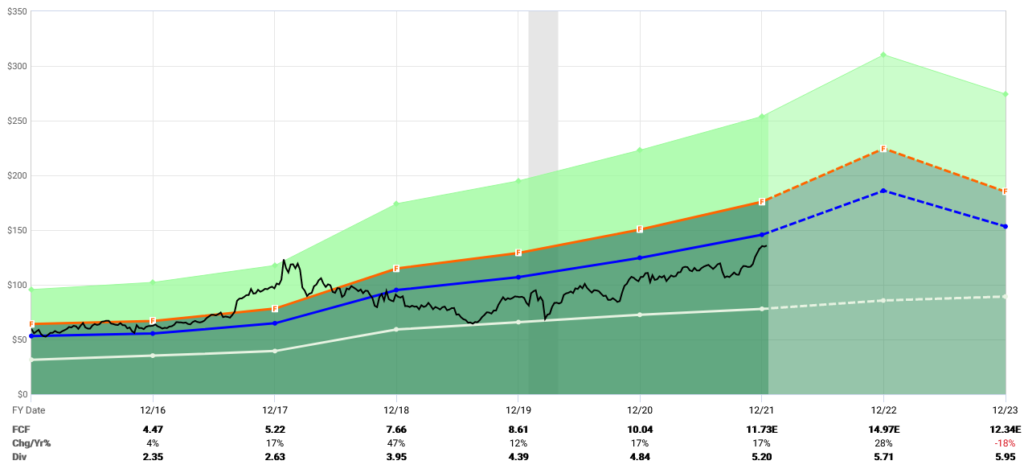

As a dividend growth focused blog, we need to talk about the dividend safety and long-term potential for raises. In October 2021 the company announced an 8.5% increase in the dividend. While still a respectable increase, it’s significantly below their 5-year CAGR of about 17%. However, I think 8.5% is more than generous given the headwinds the company is facing. We don’t want them raising the dividend at the expense of their long-term financial health. Their current payout ratio based on free cash flow is at about 44%. Based on analyst estimates for next year it is projected to be about 38% including the dividend raise. However, those same estimates forecast the payout ratio climbing to 51% in 2023 based on a drop in cash flow as Humira loses exclusivity.

In my opinion, the biggest risk to the company’s dividend isn’t Humira but instead the debt load. Per their Q3 10-Q they had $74 billion in long term debt. Much of this debt was the result of the Allergan acquisition. The company peaked as high as $82 billion in long-term debt in Q3 2020. An $8 billion reduction YOY isn’t great, and hopefully the reason they only raised the dividend 8.5% is because they are putting the rest into debt payments. Ideally, I’d want to see long term debt close to $50 billion by Q1 2023, but even mid-50s would probably be sufficient. Note that they also have over $12 billion of cash & equivalents on the balance sheet as well, so net debt is considerably lower than $74 billion.

Overall, the dividend looks safe from being cut, as the payout ratio is under 50% of FCF. The white line on the FAST Graphs chart above represents the dividend and relative payout ratio, the dark green section is free cash flow. Under 50% is ideal since it still allows the company to make extra debt payments, buyback shares, make acquisitions, or invest more in R&D. However, the 17% CAGR we saw from past dividend raises is probably unlikely moving forward, or at least until the patent cliff uncertainty is gone and the debt load is reduced. Still, given its current yield over 4% and potential for mid-single digit dividend growth, I think it’s still a respectable dividend growth choice.

Summary

AbbVie appears to be effectively strategizing to avoid a significant drop in revenue following the loss of exclusivity on Humira in 2023. Their “patent thicket”, Allergan acquisition, up-and-coming drugs, and pipeline all signal they should be able to offset the impending decline in sales. The company’s reliance on Humira has declined dramatically over the past 5 years, going from 65% of sales in 2017 to 37% through Q3 of 2021. What we don’t know yet is how fast competitors’ biosimilars will be able to gain market share, and how effective the remaining patents extending out to 2034 will be.

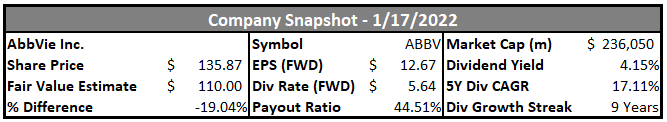

The dividend looks safe, although I wouldn’t expect to see any double digit increases in the next several years. Q4 earnings come out next month, so that will provide an opportunity to see where exactly the company stands with one year until competition. While I didn’t touch on valuation in this article, I have AbbVie fair value at about $110 per share, meaning it’s moderately overvalued by my standards.

Disclosure: I have a beneficial long position in ABBV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.