Business Overview

IDEX Corporation is a diversified industrial machinery company with a focus on providing fluid control solutions. The company offers pumps, flow meters, injectors, valves, monitoring systems, drying systems, sealing solutions, and pneumatics, as well as various engineered and mixing products. Its business operations are broken down into 3 segments: Fluid & Metering Technologies (FMT), Health & Science Technologies (HST), and Fire & Safety/Diversified Products (FSDP). The Fire & Safety division provides firefighting pumps, valves, and rescue tools (including the Jaws of Life).

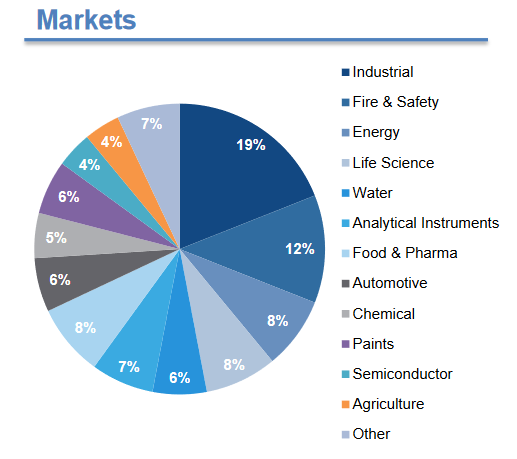

IDEX primarily serves the industrial, fire & safety, energy, life science, water (and wastewater), analytical instruments, food & pharmaceutical, and automotive industries. Industrial, fire & safety, and energy account for about 40% of sales. The company also provides products and services to the chemical, paint, semiconductor and agriculture industries.

Many of the company’s products are highly engineered and specialized for fragmented market niches. The company holds a #1 or #2 position in many of these niches, which gives them pricing power and competitive advantages against smaller firms. Their equipment is also integrated into many mission-critical systems, whether that be for fire & safety, water & wastewater, energy, or other industrial applications. Through continuous operation or harsh environmental exposure, some of these systems experience considerable wear and tear, requiring parts to be replaced frequently.

Morningstar points out a few key concepts that I think are worth highlighting about IDEX. They say, “considering that Idex’s equipment often accounts for a small fraction of a customer’s bill of materials but performs a vital function, we believe that customers are loathe to switch to cheaper but less proven alternatives, as the potential cost of failure (including unscheduled downtime and safety considerations) could far outweigh potential cost savings.” IDEX being a smaller part of larger systems helps avoid cost-cutting measures. Morningstar also estimates that about 30% – 40% of sales are recurring revenue, depending on the business segment.

About half of the company’s revenue is generated in the US, with another 25% from Europe and the rest of the world providing the remaining quarter. On a per-segment basis, FMT accounts for about 36% of sales, HST 41% of sales, and FSDP 23% of sales. On a profitability basis, all 3 segments are approximately equal, with operating margins of about 26% – 27%. The diversified nature of the business is one of its strengths, with no individual segment over 50% and no individual end market over 20%.

Acquisition-Fueled Growth

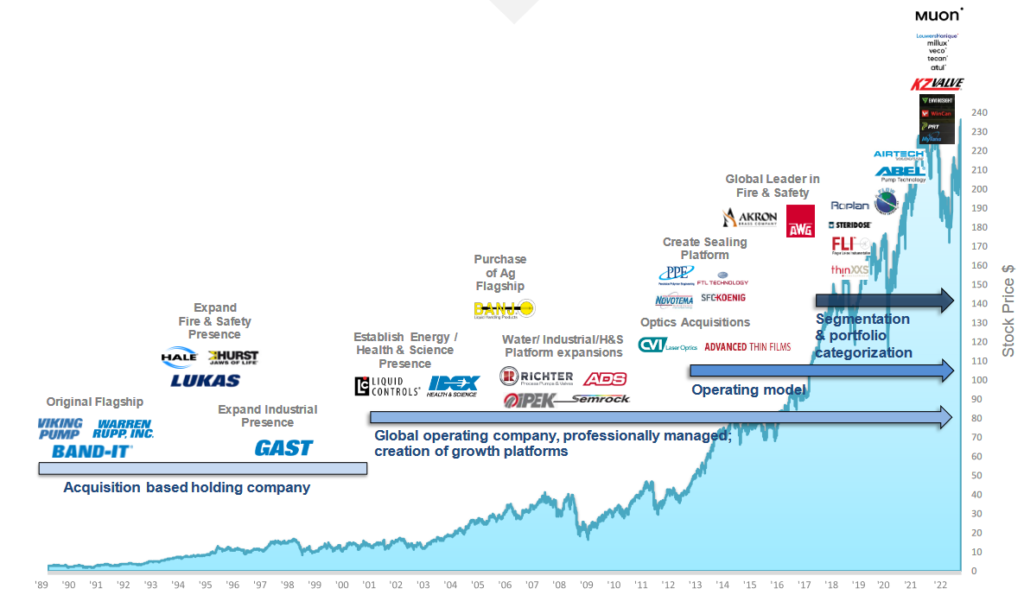

IDEX has a history of making strategic acquisitions to grow the overall business. The company tends to focus these moves into industries that align with the existing business structure, rather than chasing new end markets or business applications. This capital allocation has been key in their long-term success, as it keeps the business focused, concentrated, and manageable. We’ve seen with conglomerates like GE or 3M that having a highly fragmented business can introduce challenges and restrict shareholder value. By staying focused, IDEX reduces their risk of execution failure.

Over the years, the company has expanded its fire & safety presence, water & industrial presence, established the health & science segment, created a sealing platform, as well as various other moves. Management has done a good job of integrating these moves and reorganizing the company to most efficiently run its operations, which in turn has led to strong returns on capital. They don’t appear to be trigger happy making deals left and right, and instead take a more disciplined approach.

Financials and Balance Sheet

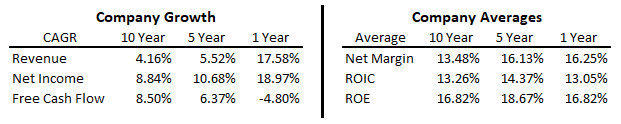

IDEX is a financially strong company with a sound balance sheet. Gross margins have slowed trended up over the past couple decades, and operating/net margins have grown at an even faster rate. This shows us that the company is doing a respectable job of improving its internal operations. Since 2012 gross profit is up about 50% while SG&A is up only about 30%.

For a business centered around industrial machinery, sales haven’t been overly cyclical, especially when compared to industries like heavy machinery (Caterpillar is a good example). Acquisitions can help offset some of the year over year changes, but even during the great financial crisis the company weathered the storm without losing much. They’ve had positive revenue growth in 17 of the last 20 years, with the 3 years of negative growth being 2009 (-11%), 2015 (-6%) and 2020 (-6%).

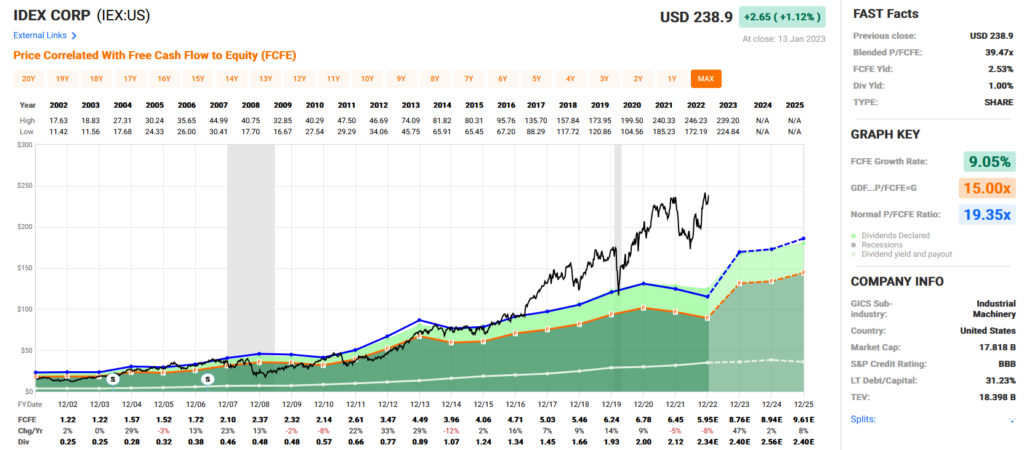

At the enterprise level, free cash flow (FCF) has grown at a 9.3% CAGR over the last 20 years, and 8.5% over the last 10. During the early 2000s the company was issuing some shares, likely to fund acquisitions. On the flip side, the company has started buying back some shares over the last decade, so on a per share basis the 20 year FCF CAGR is 8.9%, and 10 year CAGR is 9.5%. Any business that can consistently generate close to 10% FCF per share growth over the long-term is going to provide significant shareholder returns.

On the balance sheet, the company doesn’t have a lot of long-term debt ($1.2 billion), especially after accounting for the almost $900 million in cash they have on-hand. As a whole, the company currently has about $1.7 billion of current assets with only $2.1 billion of total liabilities. Not bad, especially given their acquisition-heavy business strategy. Long-term debt hasn’t even doubled over the past decade. Contrast that with an acquisition-hungry company like Broadcom, whose long-term debt went from $0 to almost $40 billion over that same time. Obviously Broadcom has grown substantially more than IDEX over that time, but their capital allocation strategy isn’t sustainable compared to that of IDEX.

Future Expectations

Based on the businesses IDEX operates in and management’s execution record, I think the company has a long, steady runway for future growth and outsized returns. From their own investor presentation, IDEX states, “Our objective is to provide consistent DOUBLE–DIGIT EARNINGS GROWTH and STRONG CASH FLOW with SUPERIOR RETURN on invested capital.” Earnings growth, cash flow, and ROIC are all important metrics for long-term success, so it’s good to see management explicitly call them out.

Some of their end markets like fire & safety probably don’t offer a ton of growth, but should be steady and non-cyclical. Markets like life science, analytical instruments, pharma, and semiconductor should all benefit from secular tailwinds, which is a plus for IDEX. Water and wastewater treatment is a considerably large market for the company, and at least in the short to medium term should be a driver of growth, thanks in part to infrastructure spending passed by the US Government. Water should also be a relatively stable and defensive industry outside of that near-term boost, and similar to fire & safety be non-cyclical.

Ultimately, they are supplying many industries with positive growth opportunities, and that’s without factoring in potential future acquisitions. One benefit of a potential economic downturn is that it could allow for IDEX, with their strong balance sheet and cash flows, to scoop up a new business or two at a discount. Interest rates being higher could also mean that they are less likely to face competition from other bidders during such deals. A downturn could hurt sales some in the short term, but strengthening the business during these times means they come out of the entire situation much stronger than before.

Business Risks

There are two main risks I can see facing IDEX, one short-term and one long-term. In the short-term there is risk of economic contraction and a slowdown in industrial spending. While the company is diversified in its overall operations, much of the total revenue still comes from industrial and industrial-adjacent markets.

Over the long-term, the biggest risk is associated with acquisitions and execution risk. If IDEX overpays for acquisitions (think Adobe with Figma) or makes acquisitions that don’t synergize or smoothly integrate into the business (AT&T with Time Warner) there is a cost for shareholders. Additionally, if management feels pressured into expanding or increasing growth they could try to push into new markets, where the company lacks expertise. For example, if the company started making acquisitions in the electrical component business (think power generation or something of the sort) that could be a red flag since it strays from the primary focus of the existing business.

Fair Value Estimate

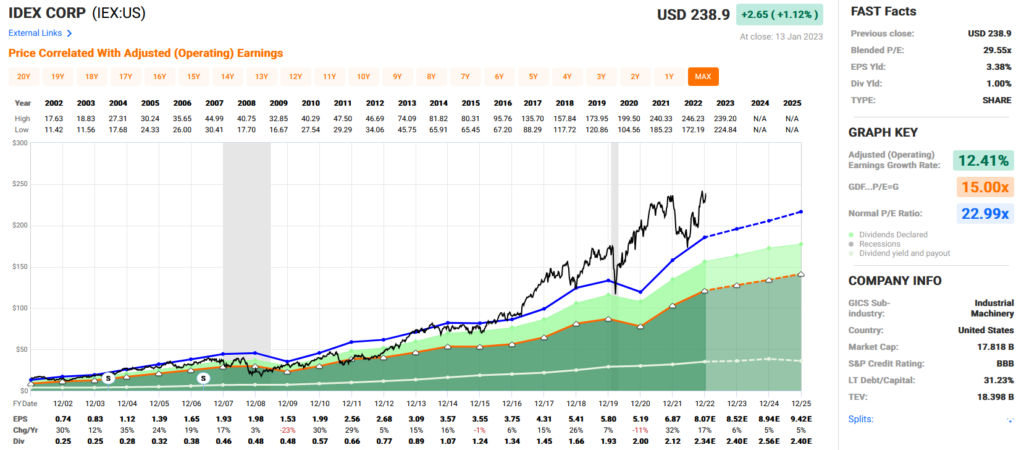

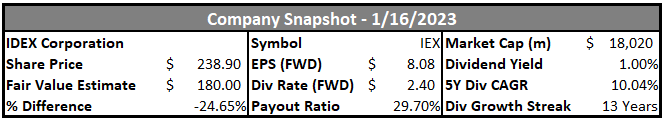

IDEX has traded at a premium valuation over the last 5-7 years. The average P/E from 2016 to 2022 was 28.4x, and average P/FCF has been about 27x. The stock currently trades at a 29.6x P/E and 39.5x P/FCF. Multiple expansion over the last decade may have been due to a variety of factors, such as low interest rates and the pandemic market craze. However, at the end of the day the current valuation is just too high. IDEX is no doubt a well-run business in a stable and steadily growing industry, but multiples around 30x for high single-digit/low double-digit growth just isn’t reasonable.

With a long-term average P/E of 23x, I think that’s a more reasonable price to pay for the stock. Obviously that’s not cheap by any means, but the stock hasn’t dropped below 23x earnings since mid-2016 (with the exception of March 2020). Based on 2022 earnings, this would put a fair value on the stock at $186 per share.

On a FCF basis, the company’s historical multiple is about 20x FCF. For 2022 FCF is expected to be down a bit, but is expected to rebound in 2023. Obviously it’s too early to tell what will happen in 2023, but based on analyst estimates and expectations, 20x FY23 FCF is $175 per share.

And lastly, prior to the pandemic the stock would often trade around a 1.2% – 1.3% dividend yield. While not a perfect metric, we could also use that as a proxy for fair value. Based on the forward dividend of $2.40, a 1.2% yield would be $200 per share and a 1.3% yield would be $185 per share.

Using these data points as an approximation, we can estimate a fair value of about $180 per share. I think that’s reasonable, especially because I think the growth we’ve seen out of them is sustainable moving forward. High single-digit and low double-digit earnings and FCF growth are attainable, and dividends should increase approximately in line with those figures. Add in some small buybacks and that the company tends to trade at a premium and I think paying $180 per share could allow for 10% annualized returns. Unfortunately, that still makes the stock about 25% overvalued.

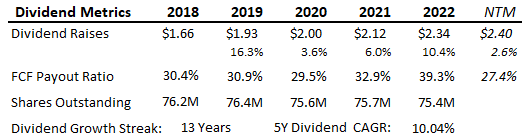

Dividend Outlook

IDEX currently has a lackluster dividend yield of 1.00%, but a respectable 5-year dividend growth rate of 10.0% and dividend growth streak of 13 years. While they did not cut the dividend during the Great Financial Crisis, they did not raise it in 2009. The company tends to have a FCF payout ratio in the low 30% range, but with FCF dropping a bit in 2022, the payout ratio increased to 39%. Looking ahead, FCF is expected to rebound, which should push the payout ratio back down. As discussed earlier, the company has a sound balance sheet and relatively little debt, so even in the event of a serious recession over the next few years, they should be able to weather the storm.

Moving forward, I think 8%-12% dividend growth is both likely and sustainable. Their 2023 increase could be a bit lower, perhaps around 6% depending on the state of the business and economy, but beyond that I’d expect greater increases. During the pandemic they raised the dividend about 3% and 6%, likely out of an abundance of caution. Since leaving the dividend unchanged in 2009, they’ve had double-digit increases in 8 out of 12 years and an average growth rate of 12.8%.

On a share buyback perspective, shares have declined over the last decade, but not at a significant rate. Shares outstanding went from 82.7 million in 2012 to 75.4 million as of the latest quarter. This translates to about a -0.9% annual reduction in shares. Not amazing, but solid. It helps ensure that FCF per share continues to outpace enterprise-level FCF, and also helps promote strong dividend growth. Fewer shares outstanding means fewer dividends to pay out as a whole, which in turn means there’s more room to raise the dividend for the remaining shares.

Summary

IDEX is a well-run industrial firm serving a diversified collection of essential industries. Many of the end markets it serves will benefit from tailwinds in the short, mid or even long-term. The stock doesn’t generate a lot of attention and tends to fly under the radar in most stock discussions. The company has easily beaten the market over the last 10 and 20 years, and with the exception of valuation has all the tools needed to continue that performance. In large part, outperformance has been due to management’s ability to grow the business through accretive acquisitions. Like many serial acquirers, IDEX’s biggest risk is from management making poor future acquisitions. The dividend yield is weak, but to offset that it offers strong dividend growth. I currently hold a small position in IDEX, initiated when they temporarily dropped back in May/June of 2022. I’d love to add more when the valuation is more reasonable, but for now I’d rate it a hold.

Disclosure: I have a beneficial long position in IDEX Corporation. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.