November was a big month for the market. Inflation flashed signs of a slowdown, and as a result boosted the market for one of the biggest single day rallies in years. While we aren’t out of the woods yet, rate hikes are likely to slow and economic growth may not decline as much as previously forecasted. There are still risks due to energy scarcity heading into winter, and the ongoing war in Ukraine hasn’t shown signs of ending anytime soon either. China is still grappling with its Zero Covid policy, and political tensions between them and the US continue persisting. But inflation has always been the biggest issue for global markets, and signals of it slowing are good news for equities.

November also reminds us why trying to time the market is so difficult. Despite some positive news, many economic indicators imply markets should probably be about 8%-10% lower than they currently are. I’d love to be able to buy stocks 10% below current prices, as I feel almost every stock on my watchlist or in my portfolio is overvalued to some degree. But I can’t predict the future, so I’ll continue to add to my positions periodically.

Buys

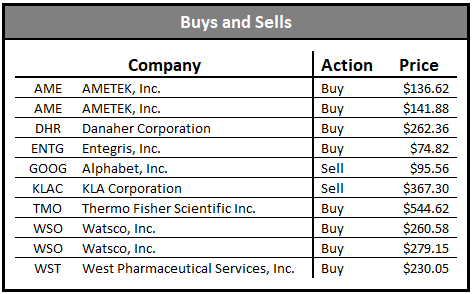

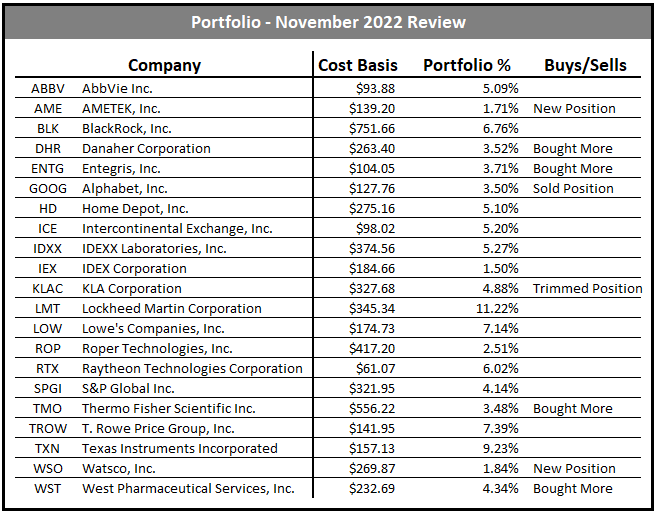

In November I made a handful of buys, adding to existing positions as well as starting two new positions. The new positions were AMETEK (purchased at $136.62 and $141.88) and Watsco (purchased at $260.58 and $279.15). I think AMETEK is a little overvalued at the moment, but this is a small starter position and with the way the market has been behaving lately, I’m not sure if there will be any large discounts in the near future. Rather than trying to time the market, I’m more than happy to just average in. I feel similarly about Watsco, but it’s much closer to a fair value.

Alongside two new positions, I spent the majority of my cash position on life science companies. Additions were made to Danaher at $262.36, Thermo Fisher at $544.62, and West Pharmaceutical at $230.05. I think this sector is one of the best long-term plays, and will likely continue periodically buying them over time. As the building blocks of so many medical treatments, research, and pharmaceuticals, I’d be more than happy to be overweight these companies over the next decade or two.

I also added a few shares of Entegris at $74.82. They are one of my favorite plays in the semiconductor space, and their acquisition of CMC Materials should be accretive for long-term company performance. They may have overpaid a bit given the timing of the move, but I’m not sure how much of a drag that will be 5 or 10 years from now. Additionally, it doesn’t appear that the US semiconductor sanctions against China will have too big of an impact on sales.

Sells

I made two sales this month, one being for trimming a position and the other for selling out completely. KLA Corporation was a trim, as I still think there is moderate risk in the semiconductor space. After it’s big drop the last couple months, I wanted to add a little to Entegris but still come out with slightly less exposure to the industry overall. As a result I trimmed KLA a little, but as of the time of this post it still sits at about 5% of the total portfolio.

The big sale for this month was Alphabet, or Google. This move was made for several reasons, and also a good chance to reflect on bad investment decision making. First off, I started the Google position because the stock had come down off its highs back in March and a stock split had been announced. I figured even if I didn’t want to hold long-term, the combination of the stock rallying back to its highs and a split pushing it higher could be a recipe for some easy gains. It also looked like the cheapest cloud play at that time. So I pre-emptively bought shares not because I loved the company, but for reasons I would more closely associate with technical analysis. Not smart investing.

That being said, I do want exposure to the big cloud players, or hyperscalers, as I’ve seen them referred to as. But I don’t like the idea of increasing my exposure to only one, and arguably the weakest one at that. I’d like to increase exposure to all three (Google, Amazon, Microsoft) and think the best way to do that will be through QQQ, the Nasdaq 100 ETF. I’ve been contemplating adding a bit more tech exposure to my retirement accounts, as I have an extremely long-time horizon and think a little extra tech exposure could be beneficial. Currently, my Roth IRA is 100% VTI, so I am going to start adding QQQ to that portfolio as well.

Although a long shot, I haven’t ruled out adding some shares of each company to the Roth as well. Ultimately, this will give me greater cloud exposure through an ETF that enables a hands-off approach to investing. And lastly, I was down a fair bit on Google, but have generated some sizable short-term gains this year. So for tax purposes, selling Google helps me balance a large portion of those gains. That money was then put into the life science purchases discussed above, which is an industry I think could even potentially outperform cloud players over the next decade.

I really don’t like the idea of high portfolio turnover, so hopefully this is the last sale made for a while. In the end, the Google sale was a 25% loss, and the shares of KLA sold resulted in a 13.9% gain.

Dividends Received

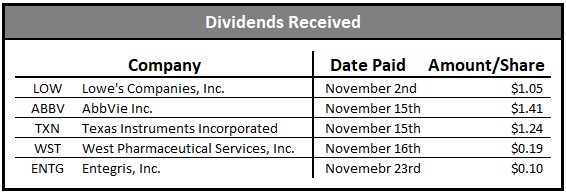

November is a good month for dividend income, thanks in large part to AbbVie and Texas Instruments. Lowe’s also pays out a reasonable dividend. While AbbVie pays a nice dividend, I expect dividend growth to continue to slow in the coming years. Last month we saw them announce an uncharacteristically small increase of only 5%. With the Humira LOE fast approaching, the upcoming years may prove to be a bit challenging as Skyrizi and Rinvoq attempt to offset Humira sales declines. Texas Instruments is also spending billions on building out more manufacturing capabilities. So there is a chance their dividend growth is slower in upcoming years as well. However, with inflation slowing, in real dollar terms smaller raises won’t be as much of a drag overall. Proceeds from this month were put towards the Watsco position.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

Dividend News

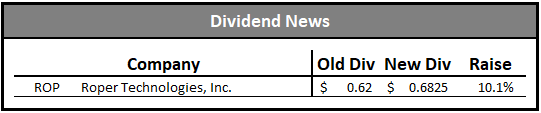

Roper Technologies announced a 10.1% increase, raising their quarterly dividend from $0.62 per share to $0.6825 per share. The annual dividend increased from $2.48 to $2.73 and the company has now raised its dividend for 30 consecutive years. Following the increase, the company now has a five-year dividend CAGR of 10.60%. While not a high yielding company, Roper has raised its dividend by 10% or more in 17 of the last 18 years, with their 2020 raise of 9.75% being the only one to fall short of double digits.

Future Plans

As mentioned last month, I’d like to add more boring businesses to the portfolio. My end goal with the portfolio is to outperform the market, but I’m not looking to 10x my money over the course of a decade. Instead, I’m looking for durable, reliable, and mostly non-cyclical businesses that (preferably) provide a growing stream of dividends. Waste Management is one that fits that criteria well, and will probably become a member of the portfolio at some point over the next couple months. It still looks overvalued, but it’s looked expensive for years, even before the pandemic. I’ll likely initiate a small starter position and buy on any meaningful dips. Service Corp International, the deathcare company, is a trickier buy due to its debt load. Rollins, the pest control company, is just insanely expensive at around 50x earnings. They’ve also had a few interesting events over the past few years that make me a little cautious, but the business model as a whole is fantastic and recession-proof.

MSCI remains on the watchlist, and will eventually make its way into the portfolio. The question is at what price, as its ridiculously expensive. However, compared to a company like Rollins, MSCI has had better free cash flow growth, better margins, and those trends look poised to continue heading into the future.

A few other names I’ll throw out there that remain on the watch list are Verisk Analytics, Nordson Corporation, Veeva, Amphenol, and LVMH. Verisk essentially has a monopoly on insurance data used by insurers in the US, but has had some management challenges in the last decade. However, with a new CEO now in place, they may be able to turn things around. Amphenol has a large percentage of sales coming from China, but I haven’t seen anything expressing serious concern when looking through their recent earnings transcripts of financial reports. Yes, it’s a risk, but seems lower than that of the semiconductor companies (for example).

With 20 stocks in the portfolio, I don’t want to add too many more, and would probably set 25 as the absolute max. Waste Management and MSCI would be 22 in total, but I do like the businesses mentioned above as well. Will need to really dig into each and determine which to keep and which to set aside for now.

Disclosure: I have a beneficial long position in ABBV, AME, BLK, DHR, ENTG, HD, ICE, IDXX, IEX, KLAC, LMT, LOW, ROP, RTX, SPGI, TMO, TROW, TXN, WSO and WST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.