October was a volatile month for the stock market. It started with a small but strong rally, sold off to new yearly lows, then rallied considerably over the second half of the month. We also saw the US government enact strict sanctions over advanced semiconductors and semiconductor equipment sales to China, and big tech earnings were a mixed bag. The semiconductor news in particular was significant, as it greatly diminishes China’s capabilities in areas like A.I. But is also means lower sales for companies like Nvidia, KLA Corporation, and Lam Research.

One reason I sold Lam Research a few months ago was due to concerns over their high revenue concentration from China. With political tensions increasing, I wanted to reduce overall exposure to China, especially in technology. However, I didn’t expect a ban on equipment sales to the extent brought forth by the new sanctions. My timing on Lam worked out well, but I will admit it wasn’t fully intentional. A trade war between the US and China is bad news for both economies and not isolated to the chip industry, so hopefully things don’t escalate significantly from here. Chips are an important aspect of modern economies though, so I won’t be surprised if/when China retaliates.

Speaking of risk management, I’ve found myself shifting my preferences to more “boring” industries and companies as opposed to leading edge technology. This isn’t specific to China or foreign markets, but rather the chances for disruption as a whole. Software, for instance, is something prone to disruption. Garbage collection, pest control, or funeral services are less so. And while these may sound like boring investment ideas, they’ve all handily beat the market over the past couple decades. Sometimes, boring is better.

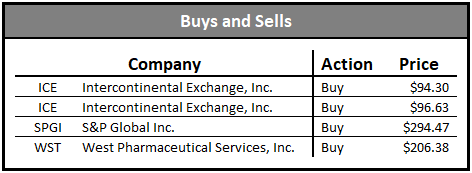

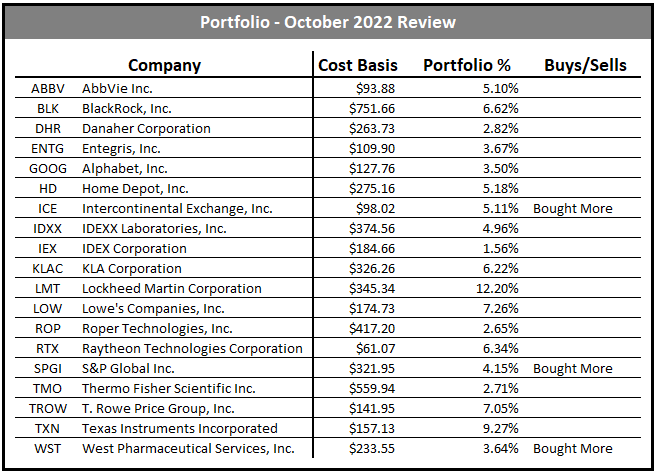

Buys and Sells

In October, I made several buys and no sells. I added more Intercontinental Exchange at $94.30, S&P Global at $294.47, and West Pharmaceutical at $206.38. Intercontinental Exchange has been trading in the $90-$100 range for a little while now, offering an attractive valuation for anyone looking to hold for the long term. S&P Global under $300 seems to be a good deal as well. While I have some small concerns that the massive rise in interest rates will lead to less business for S&P in the short term, over the long run the stock should continue to be a strong performer.

West Pharmaceutical has always traded at quite expensive valuations. On the morning of their earnings release, they missed on both EPS and revenue, and lowered guidance for the fourth quarter. Shares plunged almost $50, which I felt was an overreaction and presented a great buying opportunity. I managed to add to my position with new shares at an average cost of $206.38. The market seemed to realize it overreacted, and the stock eventually rebounded, getting as high as $230 and closing the day at $220. Over the long term $15 or $25 on the share price may not make a huge difference, but it was still satisfying to grab shares for a cheap price. If the stock sells off back to the range in the coming weeks I’d be happy to buy more.

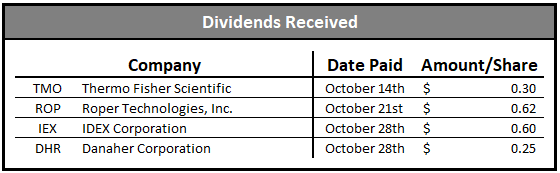

Dividends Received

October doesn’t provide me with much dividend income, especially compared to other months. I don’t buy companies based on when they pay dividends, but even if I did I don’t think there are many high quality and high dividend payers for the January/April/July/October set of months. For this month, I received dividends from Thermo Fisher, Roper, IDEX and Danaher.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

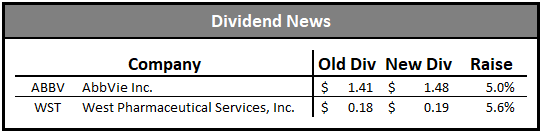

Dividend News

AbbVie announced a 5.0% dividend increase, raising their quarterly dividend from $1.41 per share to $1.48 per share. The annual dividend increased from $5.64 to $5.92 and the company has now raised its dividend for 10 consecutive years since being spun-off from Abbott. Following this increase, the company’s five-year dividend CAGR fell from 17.11% down to 10.52%. This is due to lower raises in recent years, 5% this year and 8.5% last year, as well as larger increases from the past falling outside of the 5 year window. Dividend growth may stay low in the coming years due to the Humira loss of exclusivity.

West Pharmaceutical Services announced a 5.6% dividend increase, raising their quarterly dividend from $0.18 per share to $0.19 per share. The annual dividend increased from $0.72 to $0.76 and the company has now raised its dividend for 30 consecutive years. West is not a high dividend grower despite having a low yield and payout ratio, and has been giving $0.01 raises now for the past 9 years. Interestingly, when looking at the dividend history on Seeking Alpha, they split their stock 9 years ago and followed a similar dividend increase pattern prior to the split. Perhaps another 2 for 1 split is coming soon.

Future Plans

My plans moving forward are to continue finding high quality businesses and ideally purchase them at attractive valuations. As talked about at the beginning, I would like to add more boring businesses to the portfolio. Boring businesses are capable of beating the market and tend to have less overall volatility as well. Seeing stocks drop 50%, 60% or more the last year isn’t fun for anyone that’s buying, and it could take years for many of those names to recover. While many are still up considerably on a five-year timeline, the volatility is not something I’m really interested in. Additionally, many of the stocks that have performed this way operate in industries more prone to disruption.

While these highly volatile companies likely offer the best chance for investors to hit a home run, figuratively speaking, I am more interested in consistent base hits and doubles. A company like Home Depot isn’t going to triple in a year, or even five years, but can still beat the market while providing investors with less overall risk. Blue chip dividend growth stocks are the core of my portfolio, and I intend to keep it that way.

Moving forward, I’m potentially looking to add names like Waste Management, Rollins, Service Corporation International and Watsco to the portfolio. Ametek and MSCI are still on the watch list too, and I’d definitely like to add them at some point. The problem with some of these companies, namely Rollins, MSCI and Waste Management is that they always trade at premium valuations. Rollins currently trades at forward P/E of 57x and MSCI trades at 40x. At some point I may just pull the trigger and dollar cost average into them over time, but for now I’ll just keep watching.

Disclosure: I have a beneficial long position in ABBV, BLK, DHR, ENTG, GOOG, HD, ICE, IDXX, IEX, KLAC, LMT, LOW, ROP, RTX, SPGI, TMO, TROW, TXN and WST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.