Business Overview

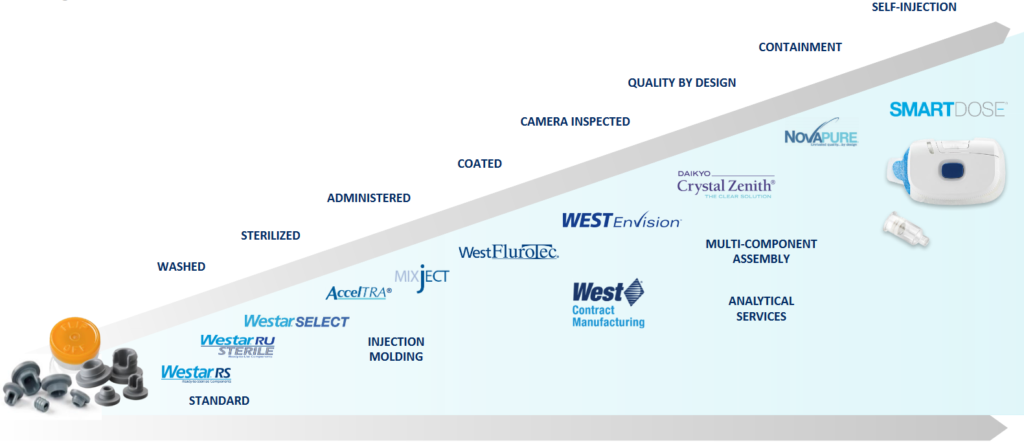

West Pharmaceutical Services is the global market leader in packaging and delivery components for injectable drugs and healthcare products. The company maintains a market share of approximately 70% of the injectable primary packaging industry. In 2021 they produced almost 45 billion components, which were used for vial containment, syringes, drug delivery and diagnostics. The company primarily serves the pharmaceutical, medical device, and life sciences industries.

West divides its business operations into two segments, Proprietary Products and Contract Manufacturing. The Proprietary Products segment accounts for about 80% of sales, and consists of their high-value and standard packaging, components and delivery systems. Contract Manufacturing, where they produce components for other companies, makes up the remaining 20%.

The global injectable packaging market is an oligopoly, with only 3 primary competitors. West Pharmaceutical, Datwyler, and Aptar group. This is due to a variety of factors including governmental regulations and company reputation. Companies that produce vaccines, pharmaceuticals or medical devices need to ensure that their treatments can be delivered safely and reliably to patients, which means they opt for companies known for quality control and consistency like West.

Reliability, Reputation, Regulation

During a time of global turmoil, West has one big advantage over many other companies, both in healthcare and other industries. They have a global manufacturing presence and stable supply chains with 25 manufacturing sites spanning the US, Europe, and Asia. While many businesses have struggled the past couple years, West has done an exceptional job navigating a challenging environment in order to capitalize on Covid-19 vaccine delivery and distribution. Struggles to provide the necessary components to vaccine manufacturers and distributors could have led to them losing market share to their peers.

Another advantage West possess over potential challengers to its market share are regulatory requirements and its reputation within the industry. Companies bringing a vaccine, drug, or similar product to market can’t just use any delivery system they want. Instead, it must be something approved by healthcare regulators to meet safety and performance requirements. West is one of the few companies with the necessary approvals in these areas. West also has a long-term reputation for quality and reliability. This has led to them establishing partnerships with their customers, entrenching West and its products into the industry.

West is also willing to partner with other companies to advance its own product suite and premium offerings to customers. The company recently announced a collaboration with Corning, the materials science company known for products such as Gorilla Glass. The collaboration will involve expanding Corning’s Valor Glass technology in order for it to be used for advanced injectable drug packaging.

Financials and Balance Sheet

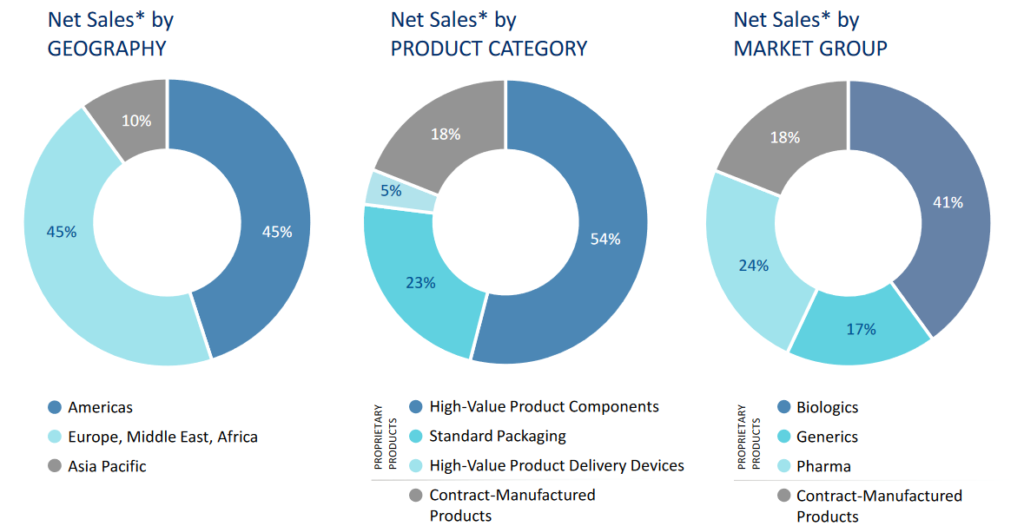

West breaks its sales down into four categories. The largest is High-Value Product Components at roughly half of all sales. Standard Packing is second largest at about a quarter of sales, and Contract Manufacturing and High-Value Product Delivery Devices make up the remaining quarter. In 2021, high-value products (HVP) collectively made up about 60% of all sales.

When dividing by market group, Biologics made up the majority of 2021 sales at 41%. Pharma was the second largest at 24%, Contract Manufacturing third at 18% and Generics last at 17%. Biologics has been the fastest growing out of the four segments, aided in large part by the pandemic. In 2016, Biologics made up 22% of total sales. In 2021 they made up 41% of total sales and by Q1 2022 they made up 45% of total sales.

Geographically, the company is primarily exposed to North America and Europe while Asia Pacific is only 10% of total revenue. I find this surprising due to there being a number of large, population dense countries in Asia. However, a possible explanation for this could be that in countries like China they may prefer to source components from domestic companies.

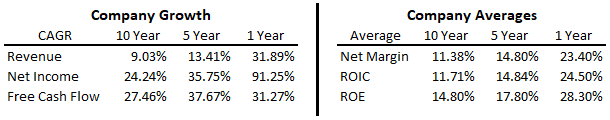

Overall, growth has been strong over the last decade for West. Even when subtracting the pandemic years of 2020 and 2021, we still get a revenue CAGR of 5.6%, net income CAGR of 15.7%, and free cash flow CAGR of 26.1%. The pandemic may have accelerated growth, but even without it the company has still showcased respectable performance.

Their net profit margin has been growing steadily, increasing from around 6% to 7% during 2006-2012 up to 12% and 13% in 2018 and 2019. During the pandemic margins grew even further, up to 16% and 23% in 2020 and 2021. I don’t think these are sustainable numbers but based on past improvements somewhere around 14% sounds reasonable moving forward. ROIC has followed a similar trend as net margins, going from 7% to 9% up to 12% prior to the pandemic. Since then, it’s ballooned to as high as 24%. Again, likely not sustainable but low to mid double digits seems like a target they can meet.

West’s balance sheet looks good, with more current assets than total liabilities. In fact, they have almost three times as much cash on hand as long-term debt. Goodwill is an insignificant amount, and PP&E plus cash are over half of total assets. Their balance sheet looks very safe, and perhaps even a bit conservative. They could certainly afford to take on more debt if needed for growth, but perhaps management prefers to keep leverage on the light side.

Future Expectations

Given the nature of their business, West has benefited tremendously from the pandemic. Their packaging and delivery components were widely used for distributing and administering Covid-19 vaccines worldwide. While past growth rates won’t be sustainable, I still think West is well positioned heading into the future. Improving margins and efficient use of capital combined with moderate organic growth have the makings for strong returns. They operate in an essential segment that is a cornerstone to the healthcare industry, so demand for their products should remain high, even with pandemic tailwinds waning.

Management is also confident that the company can exhibit strong growth moving forward. During the Q3 2022 earnings report, CEO Eric Green had this to say, “We project our full-year 2023 base business, led by our Biologics market unit, to exceed our financial construct of 7% to 9% annual organic net sales growth. While we expect further decline in COVID-19-related net sales, our base business growth will more than offset the decline, resulting in overall organic net sales growth in 2023.”

We are already starting to see the effects of slowing Covid-19 sales, as the company missed analyst estimates for EPS and revenue during the third quarter. Revenue declined 2.8% year over year and full year 2022 guidance was also lowered. One or two quarters of slowing growth shouldn’t be a reason to avoid West (or any business) when investing for the long-term. If anything, this talk of slowing Covid-19 sales (even with strong organic growth in 2023) could cause the stock price to fall, opening up an attractive entry point for investors.

In order to compensate for future organic growth expectations, the company is continuing to expand its global footprint with ongoing construction of new facilities in the US, Europe, and Singapore. This will ensure they aren’t reliant on a single country to manufacture all components and may allow for new supply chain relationships to be built with other distributors. Given the mission-critical nature of their products, bolstering reliability and availability is never a bad move.

Expanding their manufacturing and research facilities will cost the company in the short term. Waning Covid-19 sales will also be a short term drag. Therefore, when looking at West as an investment, its important to consider that the next year or two may be a bit slow. However, I think the long-term prospects are intriguing. As mentioned before, revenue was growing at a 5.6% CAGR pre-pandemic, which is solid. Management is also guiding organic sales growth in 2023 to be 7% to 9%. Combine that with margin expansion and the potential for buybacks and higher dividends and future returns could definitely be market beating.

Business Risks

There are a few risks that I think are worth considering before investing in West Pharmaceutical. The first being that much of their recent success stemmed from a global pandemic. While Covid-19 is likely to remain in circulation for years to come, its lethality of the virus has declined considerably. Most individuals have already received the vaccination, and a sizable amount of people have received one or more booster shots. Therefore, sales tied to Covid-19 vaccines will decline in the coming years.

Due to suggested guidance that elderly and high-risk populations continue to receive periodic boosters, West should still be able to generate some revenue from this dwindling tailwind. While it may become a smaller part of overall operations, it’s still an additional revenue stream. However, it’s unlikely we see future growth at a rate comparable to the past couple years. Therefore, we need ensure our expectations are centered around more sustainable growth rates. Paying pandemic valuations for a business no longer benefiting from a pandemic is unlikely to produce meaningful returns.

Second, West has a global reputation as a market leader in the global injectable packaging market. A decline in the quality of their products or any defects could hurt their relationship with their customers. This could lead to customers looking to competitors, eroding West’s market share and hurting future growth expectations.

Lastly, there are several companies out there working towards new types of needle-less delivery systems that greatly differ from those produced by West. These technologies are still new, and are likely years away from making any notable impact. I’m not even sure how they would work relative to traditional delivery systems, but in the event they receive regulatory approval and gain popularity, they have the potential to be disruptive. It’s possible that West could look to acquire a company behind any new technologies, but for the time being there doesn’t seem to be any real threat. Keep in mind there are still regulatory hurdles for newcomers and customers that may be hesitant to switch to a new and unproven manufacturer and system. However, it’s still something I feel is worth mentioning and monitoring.

Fair Value Estimate

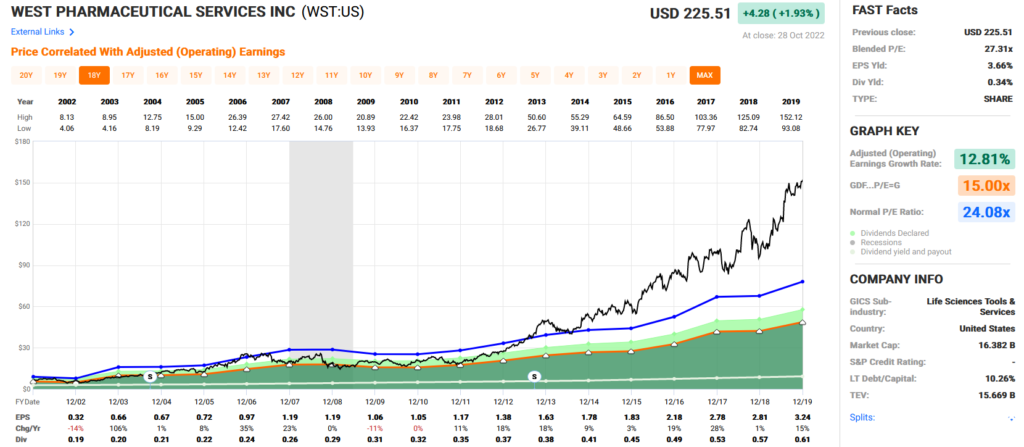

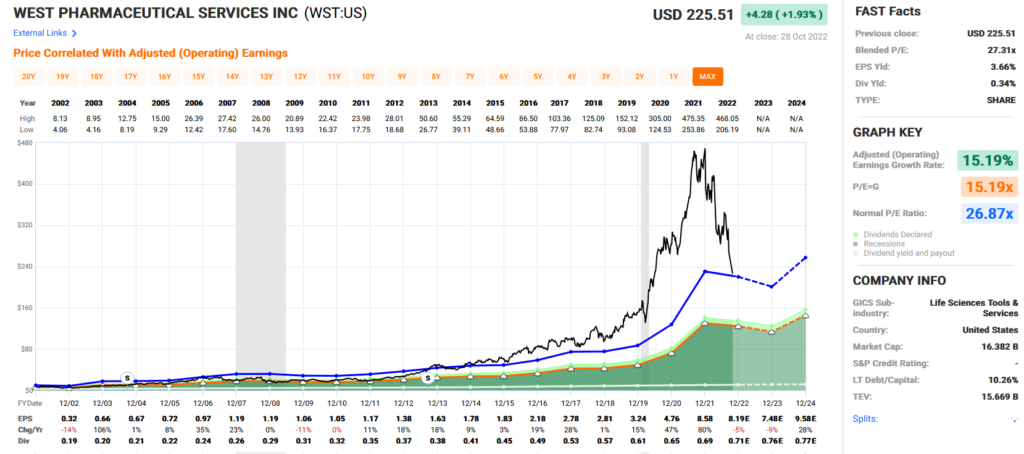

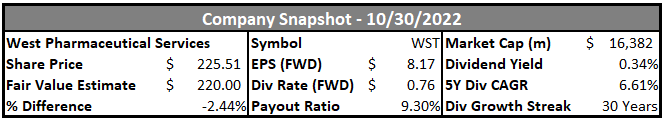

West is a little tricky to value due to the strong financial performance during the pandemic. The stock has also been known to trade at a premium valuation, even prior to Covid-19. Excluding 2020-present on Fast Graphs shows the stock grew earnings at a rate of 12.8% and traded at an average of P/E of 24x. In more recent years, earnings have exploded but so has the valuation. During late 2021 the stock even traded as high as 60x earnings. Keep in mind that future growth will not be comparable to the pandemic years.

If we use a 24x multiple and multiply by 2022 earnings estimates of 8.19 we get a price of $196.56. Using the more expensive 20-year average multiple of about 27x gets us a price of $221.13. Keep in mind this 2022 value of 8.19 EPS is a recent revision due to lower guidance by West. Analyst estimates on earnings dropped from 9.08 before the Q3 earnings call down to 8.19 afterwards.

I don’t think one bad quarter or lower guidance for next quarter is a reason to panic or overreact. On a long-term basis paying 27x isn’t unreasonable if they continue to generate strong earnings (and cash flow) growth. Again, the company grew earnings by 12.8% over the last 18 years prior to the pandemic. Earnings didn’t decline much during the Great Financial Crisis due to the defensive nature of the industry. The stock also rarely trades at what most would consider to be cheap valuations. Therefore, I think around $220 is a fair price to pay for the company, and around $200 is a good deal.

Dividend Outlook

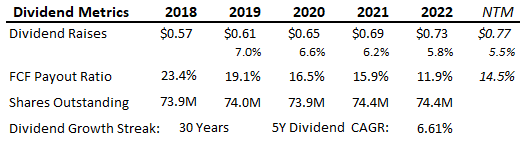

West is not a company that is known for their dividend growth. While they are a dividend aristocrat and have now reached 30 consecutive years of dividend increases, recent raises have only been $0.01 per quarter or $0.04 per year. From 2018 to 2022 they paid out $0.57, $0.61, $0.65, $0.69 and $0.73 per share. The yield is currently only around 0.35% and 5-year dividend CAGR is 6.61%.

On a free cash flow basis the payout ratio is only around 13%. Free cash flow per share has grown at a rate of about 25% since 2014, suggesting there is still plenty of room to grow the dividend.

West is also not a company known for buying back shares. Shares have actually trended up slightly over time, although they have been increasing their buybacks slightly in more recent years. Shares outstanding went from 68 million in 2012 to 74 million as of the most recent filing. Ultimately, this is not a stock to buy for generous returns to shareholders and is instead one that generates strong capital appreciation due to underlying business growth.

Summary

West Pharmaceutical is strong business in a mission-critical industry the mostly flies under the radar. The company provides essential components used in vaccines, pharmaceuticals, and other treatments to global healthcare markets. The company has a wide moat bolstered by its global manufacturing scale, regulatory hurdles, and customer relationships. Due to the importance of its products, sales are relatively consistent without much cyclicality. While a big beneficiary of the Covid-19 pandemic, West has still shown its capable of generating respectable long-term growth. Like many other high-quality businesses, the biggest weakness appears to be the valuation. In my view, if purchased at a reasonable price, West Pharmaceutical has the potential to consistently generate market beating returns.

Disclosure: I have a beneficial long position in West Pharmaceutical Services. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.