With 2022 officially in the books, I thought I’d share some metrics from my dividend growth portfolio. A quick disclaimer, this is my taxable brokerage account but I also have a 401k and Roth IRA, both of which are in index funds. So while this portfolio night be overweight in certain sectors (like industrials) and underweight tech (big tech in particular), I do have retirement accounts that cover my bases in those areas.

Portfolio Performance

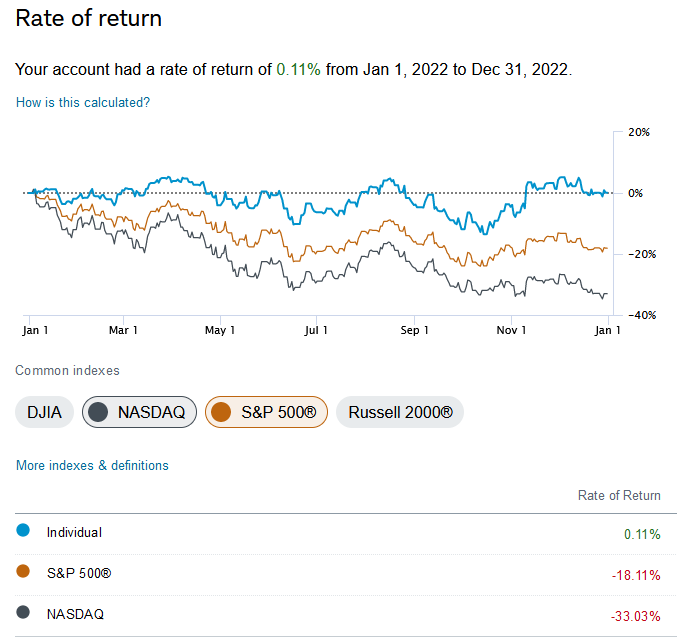

Based on Schwab’s Portfolio Performance tab, the portfolio had a daily time-weighted return of 0.11% for 2022. While obviously not great, that was significantly better than both the S&P 500 and the Nasdaq. In the worst year for markets since 2008, I think finishing slightly above breakeven is a massive win and I’m happy with the overall performance. Much of the heavy lifting for this outperformance was driven by Lockheed Martin, AbbVie, and Raytheon Technologies. Strategic capital deployment was also a key factor in outperforming the broad market.

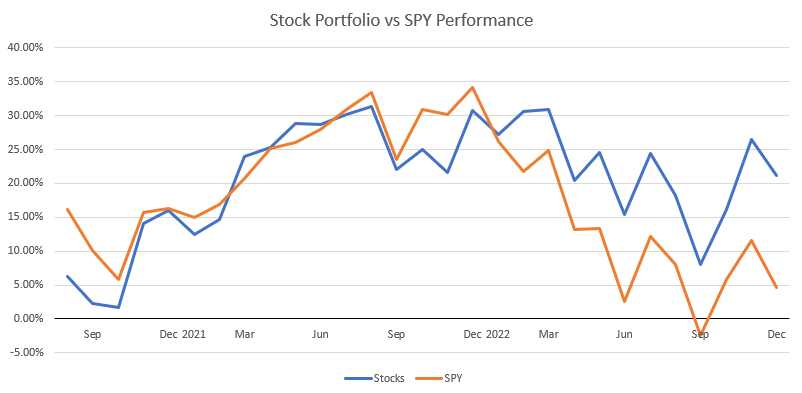

On a longer-term basis, the portfolio is also comfortably ahead of the broad market. The following chart unfortunately doesn’t start at the inception of my portfolio, but it’s good enough and provides still provides interesting insight. The way this chart works is that every time I make an investment with new funds in my brokerage, I make a hypothetical identical contribution into SPY. I also reinvest the dividends SPY pays based on ex-date and everything else. The point being to compare if I would have been better off just buying SPY instead of individual stocks.

That may have looked like a better idea in 2020 and 2021, but I’d also like to mention that back in the earlier days of investing I didn’t really know what exactly my long-term goals were. I knew I wanted to buy dividend paying stocks, but wasn’t necessarily focused on dividend growth investing. I started off buying stocks like Coca-Cola, AT&T, Verizon, Exxon, Chevron, 3M, Pepsi, Johnson & Johnson, etc. While most of these companies are still solid, I was buying them following the market crash during the pandemic in 2020. At that same time, many of the companies I’m interested in now were much cheaper at that time, and recovered quicker than the above names. So I missed out on a lot of upside holding low growth names in a dynamic market environment.

While I’m disappointed I didn’t steer towards dividend growth names sooner, I think holding those companies for a short period taught me a lot. It helped me learn more about the importance of dividend growth rate, plus overall company growth and other factors like dividend payout ratio. However, if I had been buying the stocks I’m focused on now back then, the portfolio would be considerably further ahead than it is now.

Still, the outperformance in 2022 has been solid, and I think things are well-positioned for continued strong performance heading into 2023. One unofficial goal of the portfolio has been to match the S&P 500 from a capital appreciation perspective while also generating higher dividend income. Up to this point, that goal has been met.

Dividend Income

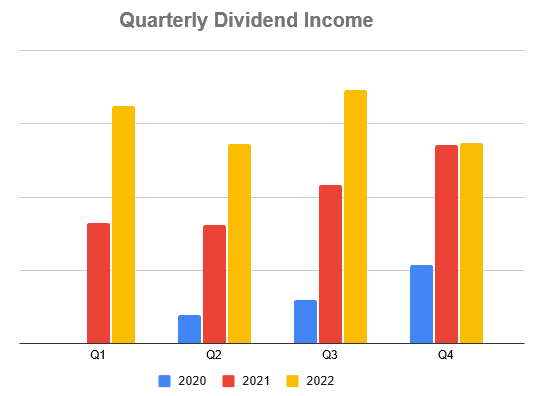

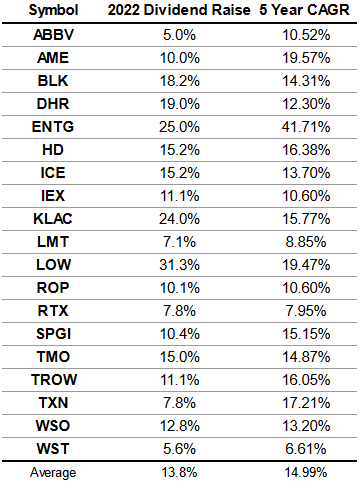

Dividend income has been relatively volatile over the last year. But that’s not due to the market or any particular companies I hold. Rather, it’s been the result of rebalancing efforts on my part. This is most clear when comparing the drop between Q1 and Q2, and then Q3 and Q4. On a year over year basis, dividends collected for 2022 were 50% higher than 2021. Much of this was contribution based, but on an organic basis the average dividend increase in the portfolio was 13.8% this year. Using the Rule of 72 for a quick approximation, we could estimate the existing dividends in the portfolio to double every 5.2 years with a 13.8% growth rate.

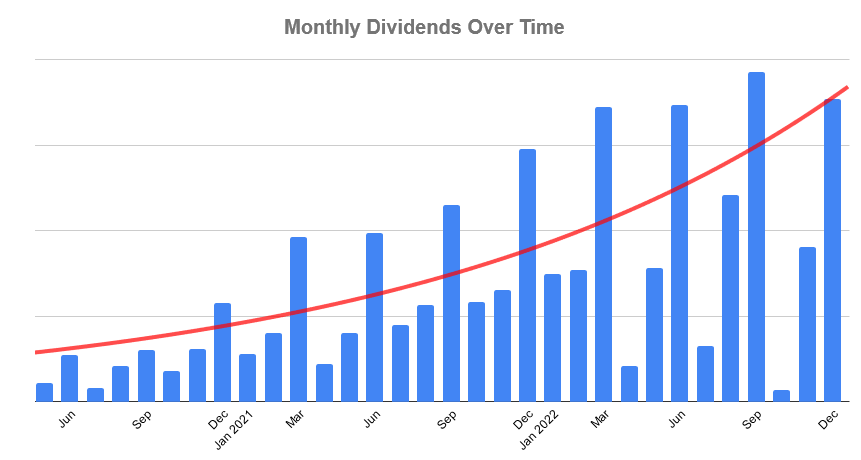

When charting out every month in chronological order, the changes made over 2022 become much more clear. Selling stocks like JPMorgan and Lam Research, who pay out dividends in January/April/July/October really disrupted the passive income generated during those months.

While I don’t buy stocks based on when they pay dividends, I think those lower months will eventually pick it up in the future. Watsco is a higher yielding stock, and some of the other names that pay out in those months have very high dividend growth. Thermo Fisher and Danaher for example raised their dividends by 15% and 19% during 2022.

For 2022, the average dividend raise in the portfolio was 13.8%. This exceeds my target of 10% organic dividend growth per year, although on a weighted basis the number was likely closer to 11%. The portfolio’s weighted 5-year dividend CAGR is 14.06%, although I expect that to fall a bit in the coming years due to some of the lower raises by my larger holdings. Fortunately, the reasons behind these lower raises can easily be explained and I don’t believe they are warning signs of the companies struggling.

Texas Instruments is using excess free cash flow to build out new manufacturing facilities, which will reduce their ability to grow the dividend in the short term, but should pay off nicely over the long-term. AbbVie is preparing to deal with Humira’s loss of exclusivity, but has promising up-and-coming drugs that should offset Humira sales. And Lockheed has been striking a balance between dividends, buybacks, and building out new facilities for projects like hypersonic missiles.

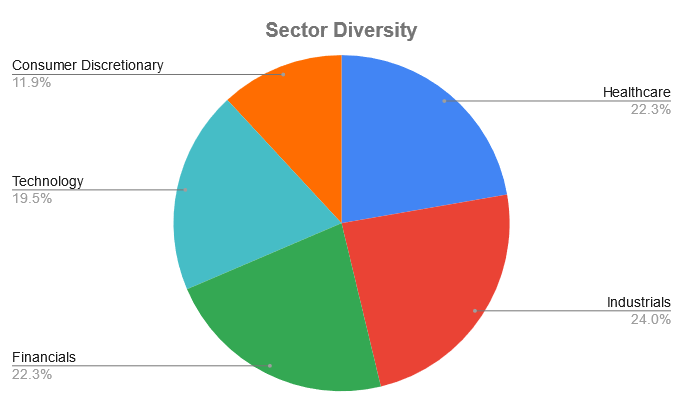

Portfolio Diversity

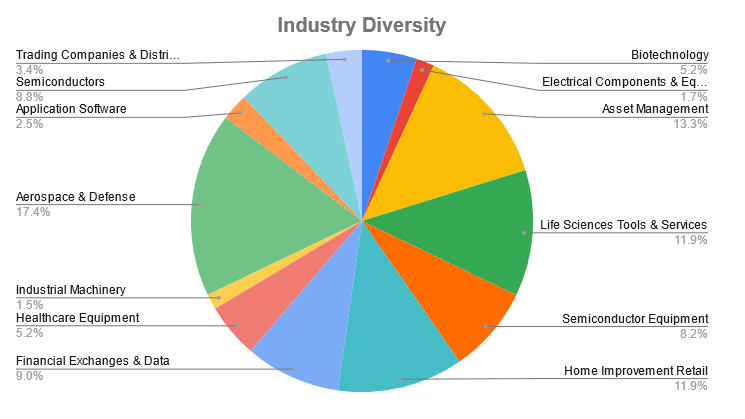

Overall, the portfolio is relatively concentrated. Both in number of holdings and in overall sector/industry diversification. Industrials is the largest sector, and I expect it to stay that way based on some of my watch list targets. Technology is about 20% of the portfolio, but I wouldn’t be surprised if that amount trends down over time. My watch list is overwhelmingly industrials, healthcare, and some financials, so I expect to add more to those sectors in the future. Additionally, Texas Instruments is my largest holding in technology and the second largest in the portfolio. I don’t really have plans to add more to it anytime soon, so ultimately tech will likely shrink.

From an industry perspective, my largest exposure is to aerospace & defense, followed by asset management and life sciences tools & services. While I prefer to focus on buying companies regardless of sector or industry, I feel the exposure to asset management is too high. Asset management companies do great during bull markets, but are more likely to lag during bear markets thanks to the way management fees are based on a percentage of assets. With MSCI also on my watch list, I don’t want so much of the portfolio dependent on the market itself for strong performance. Essentially, that may be an area I look to reduce in the future.

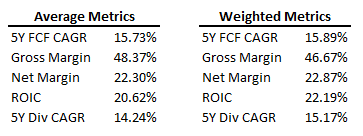

From a metrics standpoint, the portfolio looks quite strong. While valuation and qualitative metrics also matter, I’m pretty happy with the performance of the companies in the portfolio from a pure numbers perspective. Both FCF and dividend growth are strong, which will result in outsized future returns if they can be maintained. Averaging margins across a portfolio isn’t necessarily useful since different industries will have different levels of profitability, but it’s still nice to see the overall average above 20%. Lastly, high ROIC is extremely important for measuring the capital efficiency of a business. I typically aim for businesses that average at least 10% over a 5 year period.

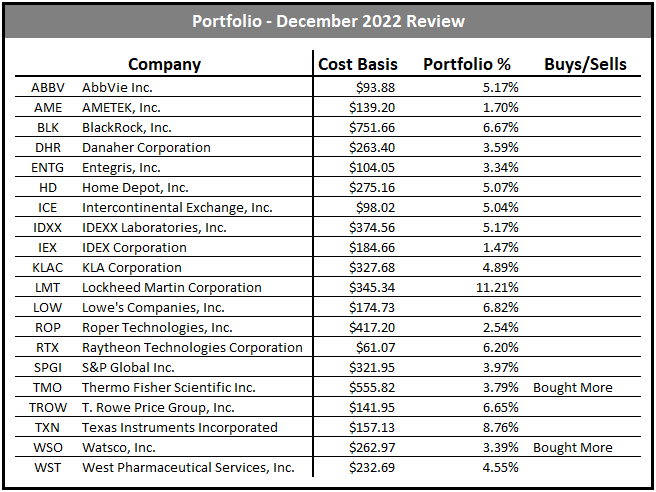

And lastly, here is the final state of portfolio from the December Portfolio Recap. I’m pretty happy with the holdings overall, and am continuing to lead into themes like quality and durability alongside dividend growth. I removed a fair bit of cyclicality from the portfolio over the course of the year and also consolidated some of the areas I already have considerable exposure to.

Disclosure: I have a beneficial long position in ABBV, AME, BLK, DHR, ENTG, HD, ICE, IDXX, IEX, KLAC, LMT, LOW, ROP, RTX, SPGI, TMO, TROW, TXN, WSO and WST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.