September followed a common theme mentioned in the August portfolio update: “Don’t fight the Fed.” The Federal Reserve has been signaling inflation is too high and employment is too strong. They’ve even come out and said that people need to feel some “pain” when it comes to the economy. Combine that with the ongoing energy crisis in Europe and the inevitable downstream impact on US energy markets, soaring consumer debt and persistent supply chain issues and the future doesn’t look bright for stocks.

As interest rates rise, treasuries start to become more attractive than stocks trading at high valuations. Why pay 30x earnings for a company that could experience a downturn in the near future if you can get 4%+ risk free? And as rates are expected to rise another 1% or so before the end of the year, it’s tough to image a scenario where the market begins recovering. Unless of course, the Fed pivots off it’s current course of raising rates.

All things considered; I’m not trying to turn into someone heavily focused on market timing. Admittedly, I haven’t made any new contributions to the portfolio since the very beginning of July. Prices are much lower than they were a couple months ago, and in some cases companies are now trading below their June levels as well. My own armchair analysis says the market bottoms somewhere around 320 on SPY, which is a little over 10% further down from here. From top to bottom that’d be a 33% drawdown. That being said, I’m not planning to wait in hopes things fall that far to start buying, and may resume new contributions in the upcoming month of October.

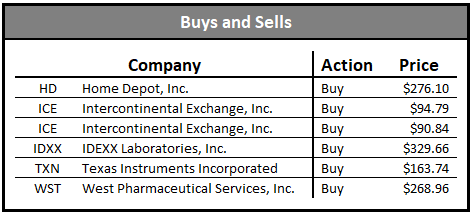

Buys and Sells

In September, I added to 4 existing positions and started 1 new position. I added to Home Depot at $276.10, Intercontinental Exchange at $94.79 and $90.84, IDEXX at $329.66, and Texas Instruments at $163.74. IDEXX is one I’ll probably have to continue averaging into over time, I was a little impatient with my initial buys, but the stock is within range of what I would consider fair value at the current price point. Home Depot, Intercontinental Exchange and Texas Instruments are all solid blue chip dividend growth stocks spanning different industries that should be able to weather the current economic situation and emerge from it stronger than before.

The new position I started was in West Pharmaceutical, at a price of $268.96. West is both a dividend aristocrat and market leader in its industry. The company has been on my watch list for a while, but its valuation became ridiculously inflated over the course of the pandemic. The stock is actually trading at its lowest valuation since around 2014 and 2015. Amazingly it still doesn’t look very cheap despite such a significant drop in price. It’s another high quality name, similar to IDEXX, that I’ll continue to average into over time.

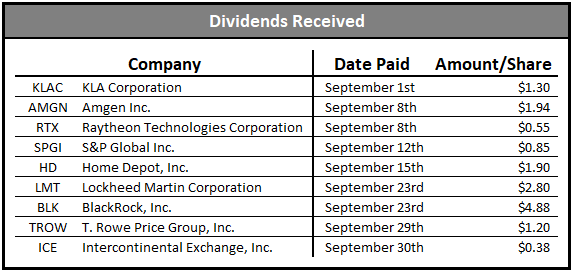

Dividends Received

September is one of the biggest months for dividends for my portfolio. Some of my biggest payers like Lockheed Martin, T. Rowe Price and BlackRock all pay out on the same schedule of March, June, September and December. All dividends received went towards buying more Intercontinental Exchange.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

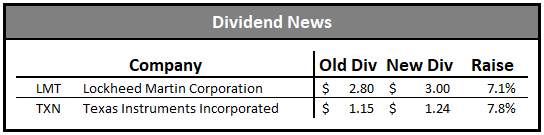

Dividend News

Lockheed Martin announced a 7.1% dividend increase, raising their quarterly dividend from $2.80 per share to $3.00 per share. This raised their annual dividend from $11.40 to $12.00. The company’s five-year dividend CAGR is now 8.85%. Lockheed has now raised its dividend for 20 consecutive years, and is now only 5 years away from reaching dividend aristocrat status.

Texas Instruments announced a 7.8% dividend increase, raising their quarterly dividend from $1.15 per share to $1.24 per share. Their annual dividend increased from $4.60 to $4.96. The company’s five-year dividend CAGR is now 17.21%, a slight decline due to the lower raise. Texas Instruments has now raised its dividend for 19 consecutive years.

Future Plans

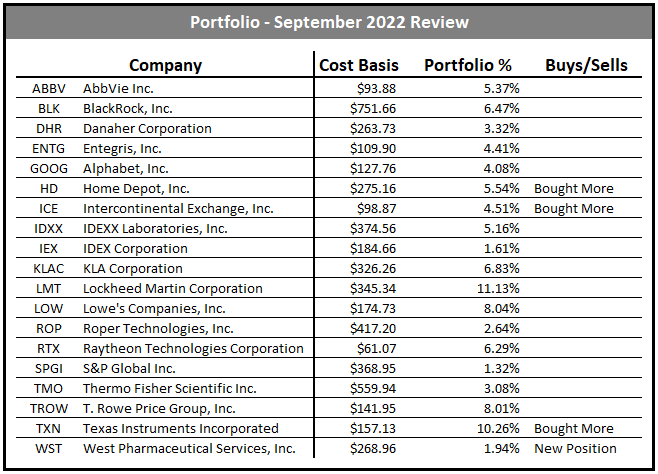

As mentioned at the beginning of this post, I may start to add new contributions to the portfolio this upcoming month. I’m not trying to time the bottom perfectly, but have definitely felt like the fall in stocks was justified and somewhat predictable. With that being said, my focus moving forward will be to continue growing my dividend growth core of companies like Texas Instruments, Home Depot/Lowe’s, and maybe even begin adding to T. Rowe and BlackRock again.

Besides that, I am looking to add more quality boring businesses to the portfolio. Primarily companies in industries where technological disruption is low. A few that come to mind are Waste Management and Rollins. Garbage collection and pest control are pretty boring, but the returns and stability by both companies have been considerable. Watsco and Carrier, two companies operating in the HVAC space are also on my radar. Unfortunately, most of these are still quite expensive, so it will be a matter of biting the bullet on paying a premium for them or hoping they finally fall alongside the market.

I’m still watching companies I’ve talked about previously, like Ametek, Nordson, MSCI, and Veeva Systems, but have also added the above companies to my higher priority list. I’ve worked to reduce some of the overall cyclicality in the portfolio, removing names like Lam Research and JP Morgan alongside pharmaceutical companies like Bristol-Meyers and Amgen. As I may have mentioned before, I’m not looking to buy the next big thing and swing for home runs with every stock pick. Durable companies in strong industries that can provide continuous base hits and doubles are my primary focus.

Disclosure: I have a beneficial long position in ABBV, BLK, DHR, ENTG, GOOG, HD, ICE, IDXX, IEX, KLAC, LMT, LOW, ROP, RTX, SPGI, TMO, TROW, TXN and WST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.