April was one of the worst months for the stock market we have seen in years. The Nasdaq fell about 13.3%, its worst monthly performance since October 2008. The S&P 500 lost 8.8%, its worst month since March 2020. Fears over inflation, economic growth slowing, and rising interest rates all contributed to stocks taking a beating. As a result, many quality dividend growth stocks are starting to look attractively priced, which should bode well for investors heading into May.

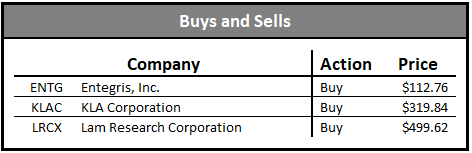

Buys and Sells

I didn’t make too many buys in April. I usually transfer a little money at the beginning of each month, but outside of that didn’t make any additional contributions as the market sold off. The month of May might be a different story, as more stocks are now trading closer to what I would consider fair value. Between the money I transferred and dividends I received, I added to my positions in semiconductor stocks Entegris (ENTG) at $112.76, KLA Corporation (KLAC) at $319.84, and Lam Research (LRCX) at $499.62.

As I’ve said in past articles and on Twitter, I remain bullish on semiconductors and will continue to add stocks in the sector to my portfolio. Semiconductor demand will remain strong and growing over the next decade or longer, so these equipment companies should continue to do well.

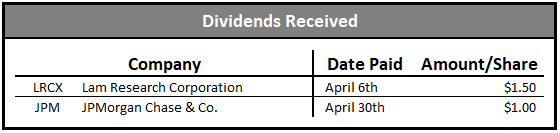

Dividends Received

April was a light month for dividends for me, having only received payouts from Lam Research (LRCX) and JPMorgan Chase (JPM). I don’t buy companies based on dividend yield or payout schedule, so this doesn’t bother me. However, it would have been nice to have a larger stream of dividends this month in order to capitalize on the market downturn.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

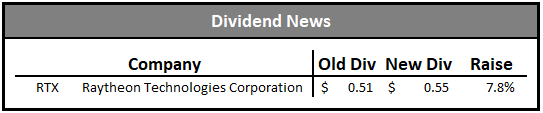

Dividend News

Raytheon Technologies (RTX) announced a dividend increase of 7.8% to $0.55 quarterly, up from $0.51 quarterly. This bumps the annual dividend payout to $2.20 per share, up from $2.04. This follows a 7.5% dividend increase last year, their first raise as a newly merged company. While this dividend growth is a little lower than I would prefer to see, it’s important to consider the economic challenges faced by the commercial aviation side of RTX. 7.5% – 8% in the face of headwinds shows management is confident that they have plenty of room to grow and sufficient cash flow to cover the dividend.

Future Plans

With stocks continuing to sell-off, I plan on taking advantage of deals in the market to grow my portfolio and passive income. Financials and semiconductors remain cheap, although financials aren’t a priority at this point in time due to the risks facing the economy. With other companies starting to also look like good deals, I think my plan will be to prioritize stocks I don’t own (but want to) or others in the portfolio that I haven’t added to recently. For example, medical device companies like Abbott, Medtronic and Stryker have all dropped within a few % of what I consider fair value.

Since I didn’t buy much in April, I’ve been able to build up my cash position a bit, which should allow for some meaningful purchases throughout May. If markets continue to drop, I will continue to deposit cash to invest. If markets rebound, I’ll make sure I was able to take advantage of a few deals before that happens. With a long time horizon before retirement, volatility like this is a great way to buy quality companies at a discount.

Disclosure: I have a beneficial long position in ABBV, AMGN, BLK, BMY, ENTG, GOOG, HD, JPM, KLAC, LHX, LMT, LOW, LRCX, RTX, TROW and TSCO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.