After markets rallied throughout November, December reminded us that there are still significant economic uncertainties and likely more pain ahead for investors. Even with inflation slowing, it still hasn’t eased to more manageable levels yet. Additionally, there are still geopolitical tensions, uncertainty around China’s reopening, a slowdown in the housing market, and higher interest rates. There is a lot to be negative about, and frankly I don’t see too many positives on the horizon, barring an unexpected end to the Russian invasion of Ukraine.

But bad news is good news for long-term oriented investors like myself. While many stocks still look expensive, opportunities exist and prices are still cheaper than they were a month or year ago. Many quality stocks rarely go on sale, so you have to take what you can get with lower prices. For example, IDEXX Labs traded as high as 37x earnings back in 2004, but still massively outperformed the market since then thanks to being a well-run business that was able to capitalize on strong growth trends in the pet space. Stocks that may look expensive today could look laughably cheap in 20 years, so even if they don’t drop to what many would consider cheap, they can still be a great investment.

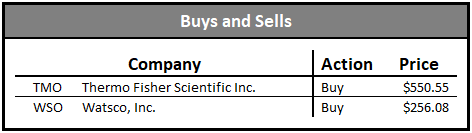

Buys and Sells

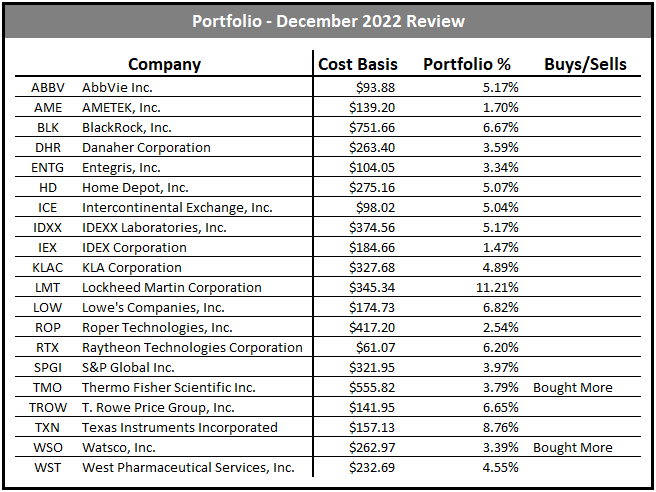

I only made 2 buys during the month of December, and no sells. I added funds to the brokerage account to essentially double my position in Watsco (purchased at $256.08), and used my monthly dividends to increase my Thermo Fisher position (purchased at $550.55). One thing worth mentioning is that these transactions take place in my taxable brokerage account. I also have retirement accounts where I make recurring monthly contributions, so even on uneventful months like this, I’m always adding to my overall investment portfolio.

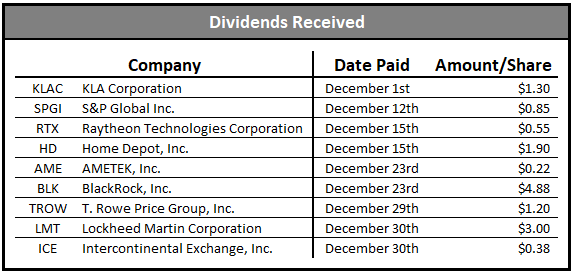

Dividends Received

December is a big month for dividends for my portfolio. It was almost my largest month yet, but came up short due to the Amgen dividend I received in September. However, discounting for that already sold position, this month was my largest dividend payout since starting this account. Still nowhere near what I would need to be financially independent, but a pretty solid jump year over year. For December, my dividends increased 156% from 2020 to 2021, and 20% from 2021 to 2022. When considering the sales I made in order to realign and consolidate the portfolio, I think a 20% year over year increase is pretty solid. As a whole, dividends for 2022 were up 50% over 2021.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

Dividend News

There were no announced dividend raises (or cuts) this month for my holdings.

Future Plans

As I’ve repeatedly said, I like the idea of adding durable, boring businesses to the portfolio. I prefer to avoid tech stocks due to the high innovation and disruption that takes place in the sector. However, I recently started adding some QQQ to my retirement accounts in order to maintain considerable exposure to the large cloud hyperscalers of Amazon, Microsoft and Alphabet. But on an individual stock basis, I’d still like to add Waste Management to the portfolio, as well as MSCI and Zoetis. Rollins is a possibility as well, but it continues to trade at extreme valuations. I also am becoming a fan of Copart, the auto auction company. They’re extremely well run with a huge moat and strong intangible assets.

Currently my watch list has a bunch of companies on it, and I need to work on narrowing it down. With the portfolio at 20 stocks already, I’d really like to keep it to about 25 at most. But my current watchlist has 11 companies, which would push me way over the edge of running a relatively concentrated portfolio. Every time I think I’ve looked at every company worth looking at, I find a few more that are intriguing. I made a considerable number of moves in 2022, but am hoping/planning that 2023 is more consistent. I feel like I’m getting close to rounding out my overall portfolio, and from that point will just be adding to existing positions. Of course, over time I’ll likely come across new companies, but would like to reach a point where the watch list is only 3 or so stocks instead of 10+.

As will be discussed in another post, I’ll be changing the format of these posts to be quarterly instead of monthly. Frankly, I don’t feel like they’re that productive to write, and I anticipate fewer overall portfolio moves in the future. I’d also prefer to dedicate time spent working on these posts towards working on an analysis post for whatever company I’m looking into at that time. And with the new quarterly format, I’ll add some new metrics to better highlight how the portfolio is performing and the quality of the companies within it.

Disclosure: I have a beneficial long position in ABBV, AME, BLK, DHR, ENTG, HD, ICE, IDXX, IEX, KLAC, LMT, LOW, ROP, RTX, SPGI, TMO, TROW, TXN, WSO and WST. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.