Business Overview

Amphenol Corporation is an industrial technology company that specializes in the design and manufacturing of electrical, electronic, and fiber optic connectors. The company’s product catalog includes connectors, antennas, sensors, cables, PCBs, fiber optics, and their value-add components. Value-add includes things like cable assemblies and cable management solutions.

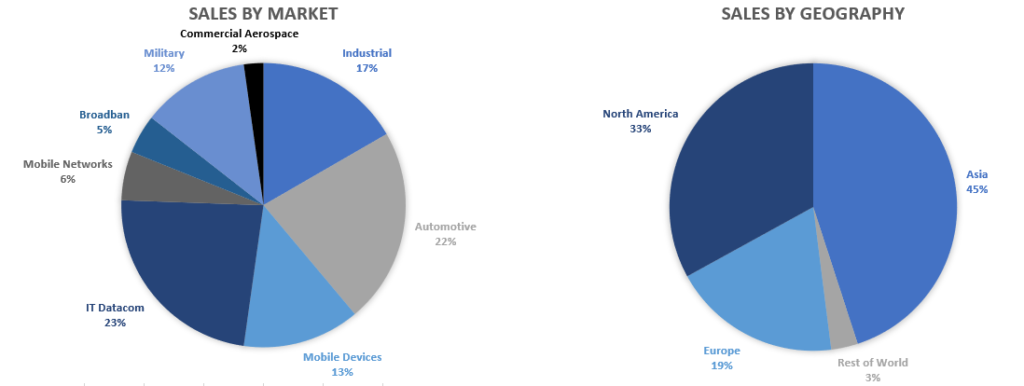

Amphenol operates through 3 business segments: Harsh Environment Solutions (HES), Communications Solutions (CS), and Interconnect and Sensor Systems (ISS). The HSE segment accounts for roughly 25% of revenue, CS 44% and ISS 31% – relatively balanced overall. Customers of the company include various manufacturers in the electronics and industrial spaces, as well as automotive, broadband communication, commercial aerospace, information technology and data communication, military, mobile device, and mobile network markets. Their largest end market is industrial, which sits at 25%. Their next two largest segments are IT Datacom at 21% and Automotive at 20%.

From a geographical perspective, almost half of their sales come from Asia, with North America a distant second at around one third of sales, and Europe plus the rest of the world making up the last 20%. China alone is responsible for about 25% of total sales. While I wasn’t able to find a further breakdown, it’s possible that the 25% might include sales to companies that simply manufacture in China, not necessarily Chinese companies. This is the case for other companies like Texas Instruments, so I wouldn’t be surprised if some of Amphenol’s sales numbers follow a similar pattern. That being said it looks like they still have considerable direct exposure to China’s economy too.

Amphenol’s connectors are used in a multitude of applications, and are designed with durability and reliability in mind. Their HSE segment specializes in mission-critical connectors and components used in environments exposed to harsh temperatures, pressure, and vibrations. With a continual growing reliance on electronic devices, and the need for more data centers, cell towers, internet connectivity and internet bandwidth Amphenol appears poised to capitalize on these trends.

Growing Through Acquisitions

Like many other compounding businesses (Danaher, Roper, Ametek), Amphenol relies on acquisitions to help fuel top-line revenue growth. Since 2011 they have made approximately 50 acquisitions, with a focus on complimentary pieces to the core business. They operate in a highly fragmented industry, making consolidation through acquisition a profitable endeavor. Over the past few decades, some of the best “under the radar” stocks have been those operating in fragmented or previously fragmented industries, such as AutoZone and O’Reilly in auto parts retail and Rollins in pest control.

However, like all serial acquirers there is always execution risk and the risk of paying too much. Management needs to be able to find targets that they can pay a reasonable price for and integrate into the existing business structure. I think Amphenol’s strategy of finding complimentary pieces, similar to Ametek, is the best way to approach M&A. Rather than trying to expand into entirely new markets, it’s easier to manage a cluster of businesses operating in the same/similar industries. For Amphenol, management states their goal is for acquisitions to account for approximately one third of the company’s growth.

Financials and Balance Sheet

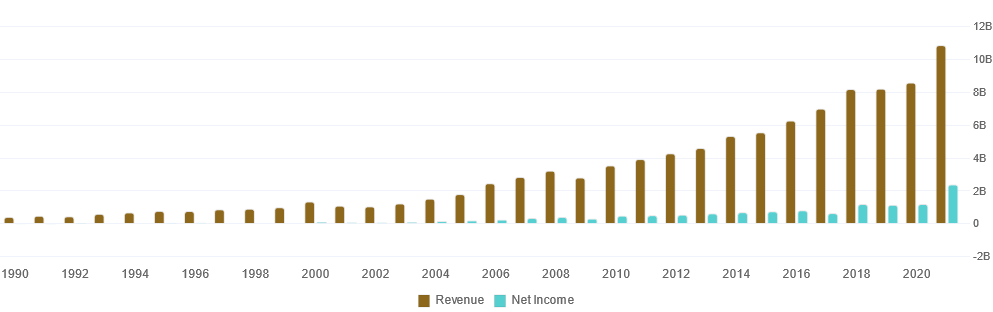

For being a company with considerable exposure to industrial applications, Amphenol has done a great job of consistently growing revenue and net income over the years. I suspect much of the steady growth has been due to the rise of data centers and broadband technology as a way to offset some of the more cyclical sectors like industrials. For example, in 2019 IT Datacom was 19% of sales, in 2021 it had increased to 21%. M&A activity is likely another factor in the less cyclical nature of their growth.

Revenue has grown at a 10.7% CAGR over the last 10 years, and on a 20-year basis that growth rate increases to 12.1%. Since 2002, they’ve only had 1 year of negative revenue growth, that being 2008 to 2009 during the Great Financial Crisis and subsequent recession. Net income has grown at a rate of 11.6% over the last decade.

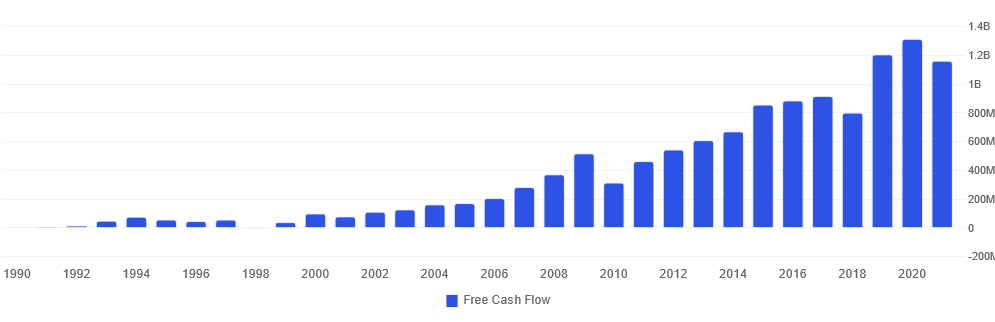

Like many other companies I own or discuss, Amphenol has done a great job growing free cash flow over the years. This is thanks to their strong operating performance, disciplined management team and their ability to efficiently reinvest back into the business. Gross margins haven’t really changed much over the years, as far back as 1990 they were 31.8% while in 2021 they were 31.3%. However, their net margins have grown nicely, from single digits in the 90s to mid-double digits in more recent years. 2021 saw their net margin jump to 22%, but for now I’m discounting that as a one-time event.

Amphenol has generated consistent returns on invested capital and equity over the past decade. ROIC has averaged 13.9% and ROE 24.7%. These are great numbers, especially for ROIC. I typically look for businesses that average at least 10%, and Amphenol lowest return going back to the mid-2000s is 8.4%. Every other year has generated double digit ROIC. The strong numbers combined with the consistency combined is exactly what I look for in a high-quality business.

In terms of the Amphenol’s balance sheet, it’s pretty solid with the exception of goodwill. The company has more current assets than long-term debt, which is always nice to see. After netting out cash from long-term debt, it appears they generate enough free cash flow to pay off their debt in about 3 years. The company’s debt is financed at low enough rates that it wouldn’t make sense to aggressively pay down, but it’s good to see they aren’t significantly overleveraged. Debt to equity comes in at 1.3x.

Amphenol has a history of acquisitions, having performed approximately 50 since 2011. This has led to goodwill accounting for 43% of the company’s total assets. This is a pretty significant amount, although on a percentage basis hasn’t been a big increase since 2007. Back in 2007 goodwill was only about $1.1 billion, whereas today its about $6.4 billion. However, in 2007 it accounted for 40% of total assets while in 2021 the number only grew to 43%. So the rate at which they are growing goodwill isn’t significantly outpacing overall company growth.

Future Expectations

Amphenol looks poised to continue benefiting from the “Electronics Revolution.” Their exposure to data centers, EVs, communications equipment and mobile devices should all be strong tailwinds for the company, even if we see an economic slowdown in the upcoming years. Being a big player in a highly fragmented market should also help by allowing them to use their size and scale to out-innovate or acquire smaller competitors.

During their Q2 July earnings call, they not only beat on EPS and revenue, but also grew revenue 18.5% YoY. They guided for Q3 2022 to provide 8% to 10% growth over Q3 2021, with EPS guided to a 12% to 15% increase over last year’s respective quarter. To me, it’s not so much about beating analyst estimates as it is about delivering YoY growth, and the company has not disappointed in 2022 so far. They’ve navigated a challenging landscape of supply chain disruptions with precision and skill, and I think that bodes well for the company in a more normalized economy.

Unfortunately, I wasn’t able to find much in terms of long-term forecasts by management. But based on what we’ve seen out of the company over the last decade, and the growth prospects of the industries it supplies, I think high single digit revenue growth is possible. Combine that with slight margin expansion and a few share buybacks and we should definitely be able to see low double earnings per share growth over the next decade.

Business Risks

There are a few primary risks with Amphenol that are worth considering. The first being their exposure to cyclical industries that may struggle during a prolonged economic downturn. While growth from areas like data centers have been a key part of the company’s success in recent years, I don’t think it would be able to completely offset the declines in other sectors.

The company also has a lot of exposure to China, both directly and indirectly. China’s economy has been struggling recently, and could be at risk of facing a serious downturn. There are also inherent political risks between China and countries like the United States, so there is a chance for disruption from that angle as well.

Lastly, Amphenol has a history of using acquisitions to help grow. They operate in a highly fragmented industry, meaning that their larger size allows them to consolidate the industry by buying up smaller competitors. While they focus on complimentary pieces, there is always execution risk when it comes to M&A. There is also the risk of overpaying for acquisitions.

Fair Value Estimate

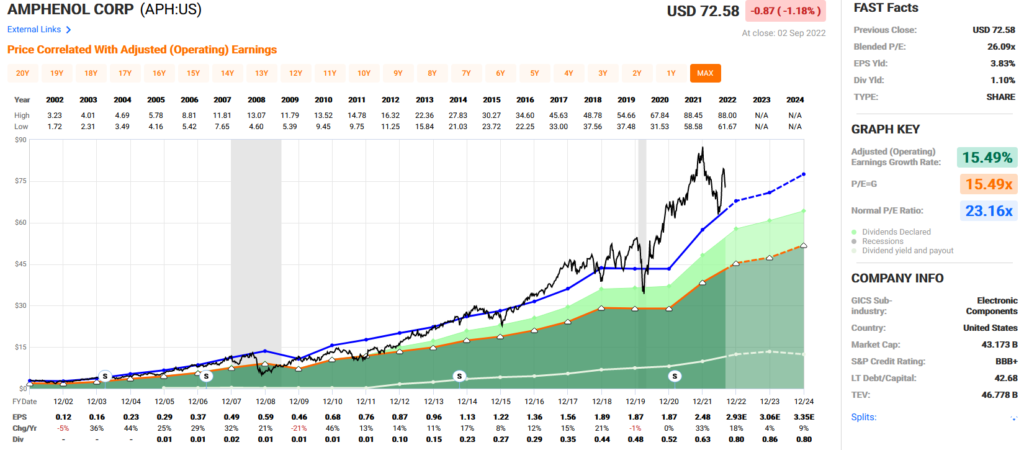

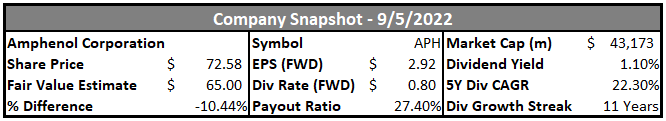

For an industrial-based technology company, Amphenol trades at a relatively high premium. Over the past 20 years they’ve traded at an average P/E of about 23x. It recently bounced off that long-term trend during the sell-off in June, getting down below $63 per share. While earnings growth has been pretty strong historically at about 15.5%, note that analysts are forecasting lower growth beyond 2022. While it’s obviously difficult to forecast that far into the future, it’s still something to consider. What is a fair P/E to pay for something that could average mid-single digit earnings growth over the next couple years?

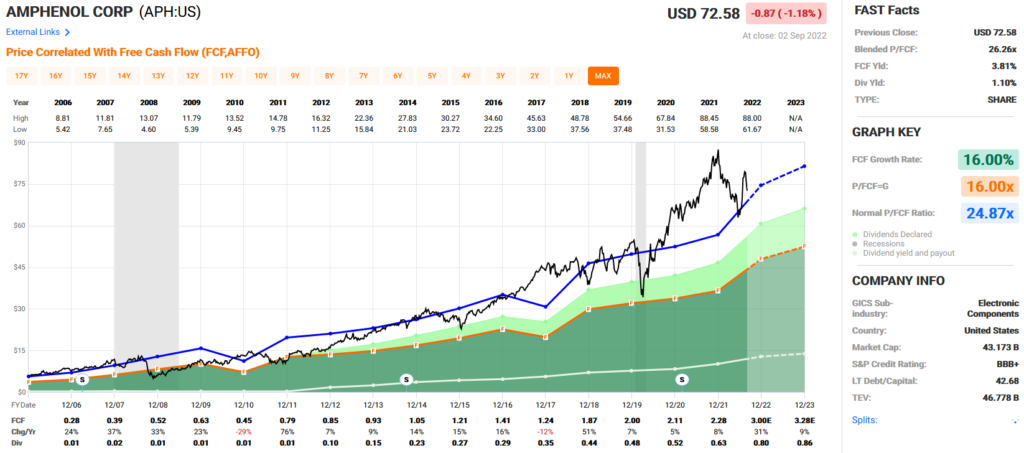

On a free cash flow basis, the stock also trades at a pretty similar valuation to P/E. Free cash flow has grown at a slightly higher rate relative to earnings over the past 20 years, and is forecasted to grow stronger into the future as well. At an average P/FCF of 25x, the long-term average would mean we could expect fair value to be somewhere around $65 per share.

When performing a quick DCF, it looks like a roughly 7.5% rate of return is currently priced into the stock at today’s prices. All things considered, it seems somewhere in the mid-60s is a good share price to pay for Amphenol. But given the quality of the business and the tailwinds stemming from greater numbers of electronics in everyday life, I don’t think $70 per share is unreasonable either.

Dividend Outlook

Amphenol has raised its dividend for 11 consecutive years, with its latest raise being 37.9%. The company has a 5-year dividend CAGR of 22.3%, and a free cash flow payout ratio of only around 27%. Considering free cash flow per share has grown at 16% over the last 20 years, I don’t think its unreasonable to believe that Amphenol can continue to raise the dividend at double digit rates. A 38% raise isn’t something to expect very often, but 10%-15% is definitely an attainable target.

The company has also done a good job of buying back shares over the last 10 years. They’ve reduced shares outstanding from 687 million down to 626 million, for a CAGR of about -0.9%. While they aren’t burning through shares as quickly as a company like Apple, I like the balanced approach with some buybacks and sizeable dividend raises.

Overall Amphenol’s dividend looks very safe, poised to continue growing at a double-digit rate, and is being supported by moderate share buybacks in addition to strong free cash flow growth.

Summary

Amphenol is a picks and shovels play on the electronics revolution. They provide key components used in data centers, broadband and fiber optic, 5G, mobile devices, EVs, and numerous other high-tech applications. With all of these industries expected to grow considerably moving forward, this is a serious tailwind for the company.

Historically, they’ve driven a large percentage of revenue growth through M&A. Due to operating in highly fragmented industries, they should continue to have plenty of opportunities for future acquisitions. Being a big player in a fragmented market also allows them to leverage their economies of scale when competing against smaller competitors.

Management has done a great job at running a profitable and resilient company that is positioned at the forefront of a number of key industries. Amphenol has also been an exceptional dividend growth stock with a low payout ratio and strong free cash flow growth. Combined with buybacks, the company is poised to continue raising the dividend at a double-digit rate. If I can get it at a fair price, I’d definitely be interested in adding it to the portfolio.

Disclosure: I do not have any position in Amphenol Corporation and no plans to initiate one within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.