Business Overview

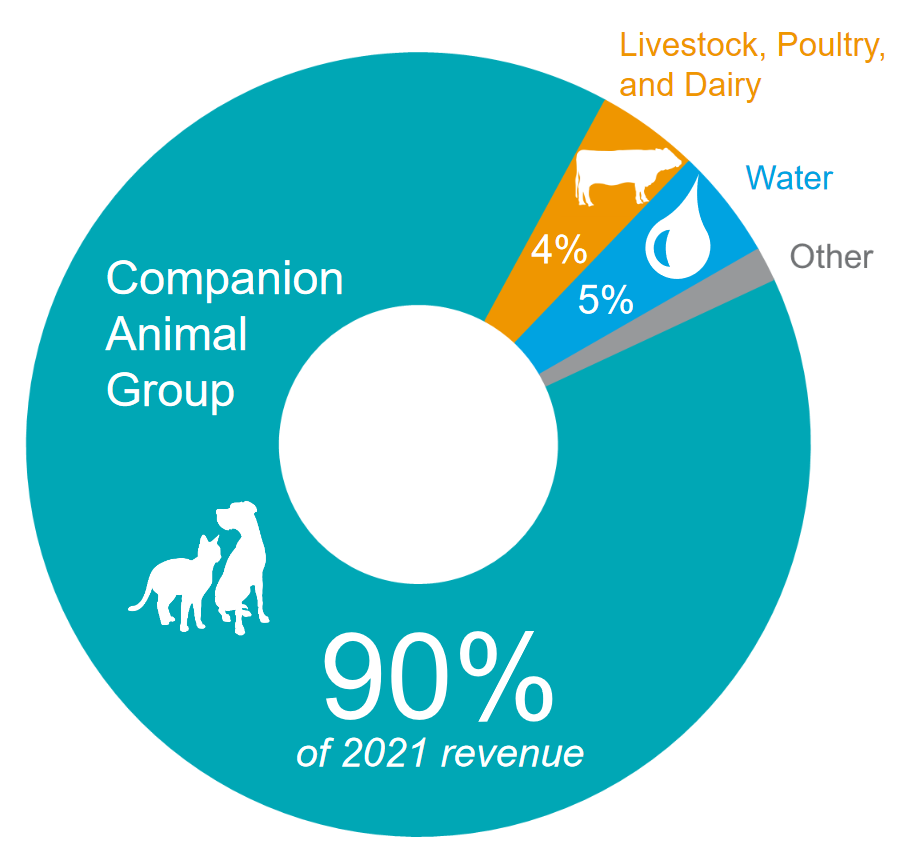

IDEXX Laboratories is a healthcare equipment company specializing in companion animal veterinary, livestock, poultry, and dairy products and services. The company also has a small segment dedicated to water testing products used for detecting various microbiological contaminants. The companion animal group (CAG) segment provides the overwhelming majority of the company’s total revenue, accounting for 90% of sales in 2021. IDEXX believes the total addressable market (TAM) for companion animal healthcare is roughly $37 billion. With about $2.9 billion of the company’s 2021’s revenue going towards CAG, there appears to be a significant runway for growth.

On a more granular level, IDEXX’s CAG segment provides a wide array of veterinary diagnostic products, instruments, consumables, and rapid assay test kits. Their clinical test kits are known for their accuracy and quick feedback, with some providing results in as little as 10 minutes. They also offer veterinary laboratory diagnostic and consulting services for both on-site and off-site facilities in addition to diagnostic imaging systems and services. Lastly, they provide software solutions for veterinary offices and clinics. The livestock segment provides tests kits used to identify common diseases that herds are susceptible to. There is also some overlap here with CAG in regards to diagnostic equipment and consumables.

IDEXX’s water segment, while small is a stable portion of the business with predictable future sales and growth. Most of the sales here go to municipalities and utility companies for testing water supplies for contaminants. The company offers a unique test that can detect two of the most common bacterial contaminants and is easier and faster to use than traditional testing methods. This test kit has allowed them to capture a sizable portion of the overall water testing market.

Financials and Balance Sheet

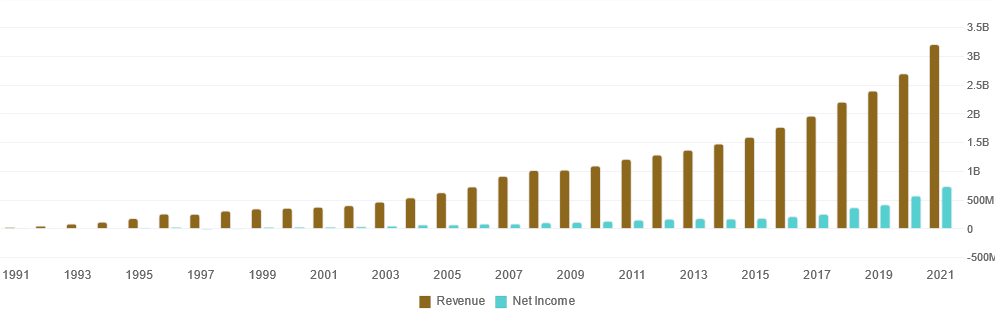

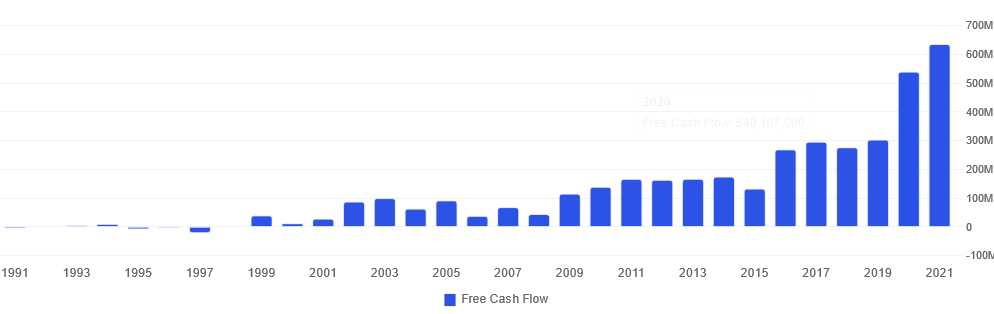

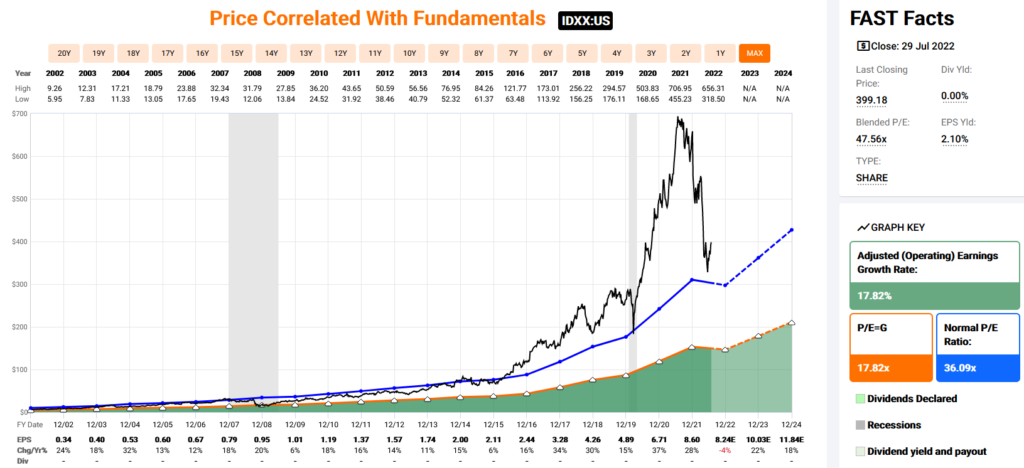

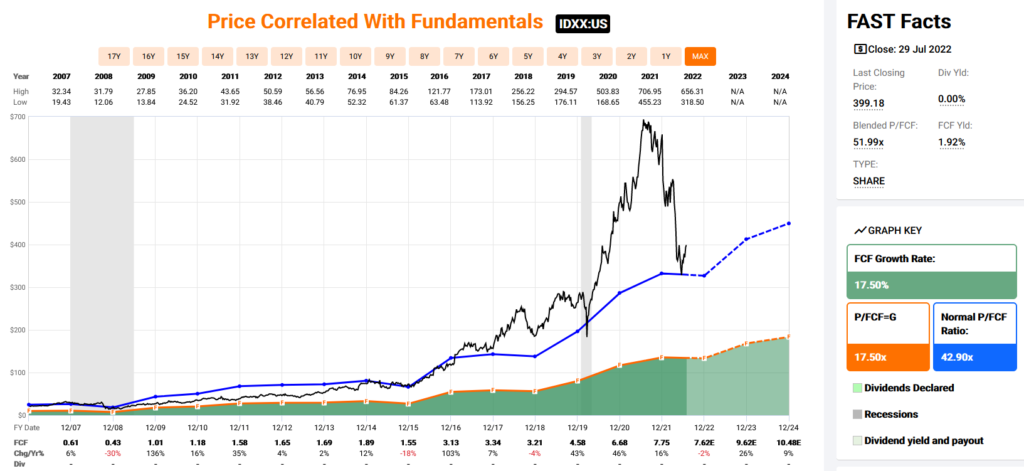

IDEXX has been a compounding machine going back the last 20+ years. Over the last 2 decades they have grown revenue at a CAGR of 11.2% and free cash flow at a CAGR of 21.2%. Revenue growth has actually accelerated in more recent years, with a 5-year CAGR of 12.6% and 3-year CAGR of 13.3%. EPS have grown at 18.7% over the last 20 years, and 19.9% over the last 10 years.

They’ve also done a fantastic job growing their margins, with gross margins increasing from around 50% in the early 2000s to almost 59% in 2021 and net income margins increasing from around 11% to 23%. Thanks to their strong performance, their stock is up a little over 6,800% since January 2001, even after dropping over 43% from its all-time high last year.

The balance sheet looks decent, although the company certainly likes to use leverage to help achieve its strong returns. They’re currently sitting at a debt/equity ratio of 2.5x. However, if we look at long-term debt/EBITDA we get a multiple 0.8x, which is relatively low. While the company still has other liabilities, this basically means it would take less than a year’s worth of EBITDA to pay off their long-term debt. The basics like current assets > current liabilities and assets > liabilities check out fine, and goodwill is only about 15% of their total assets.

Ultimately, IDEXX has just about everything going for it from revenue to free cash flow to margins. The company also generates extremely high returns on invested capital (ROIC), with 8 of the last 10 years being over 30%. In 2021 they had an ROIC of 59%!

Future Expectations

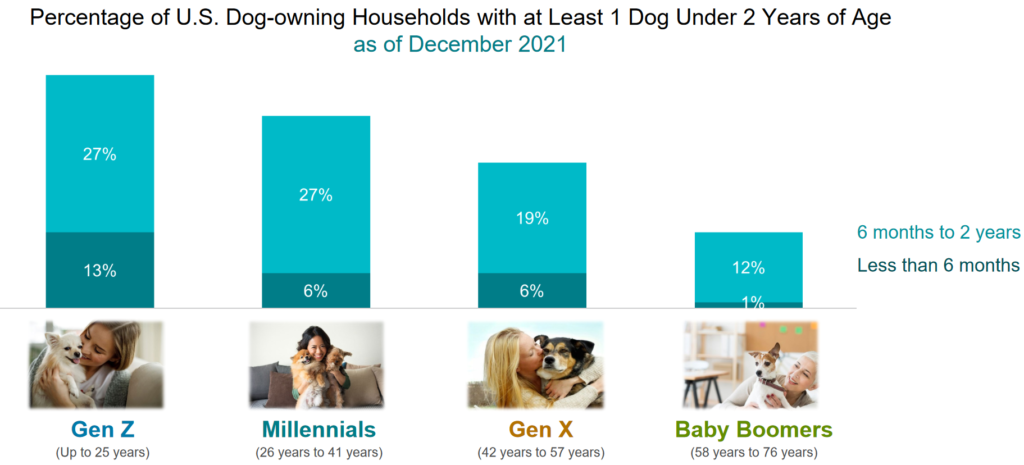

IDEXX is forecasting that younger generations will continue to expand the pet population in the US, with Gen Z and Millennials owning significantly more dogs than Gen X and Baby Boomers. This expansion should drive continued growth in their largest segment, Companion Animal Group. They also estimate that pet spending as a percentage of total household consumption spending is a little less than 2%, meaning that pet owners could theoretically afford to spend more on their pets. Greater spending combined with more pets is a strong tailwind for the company.

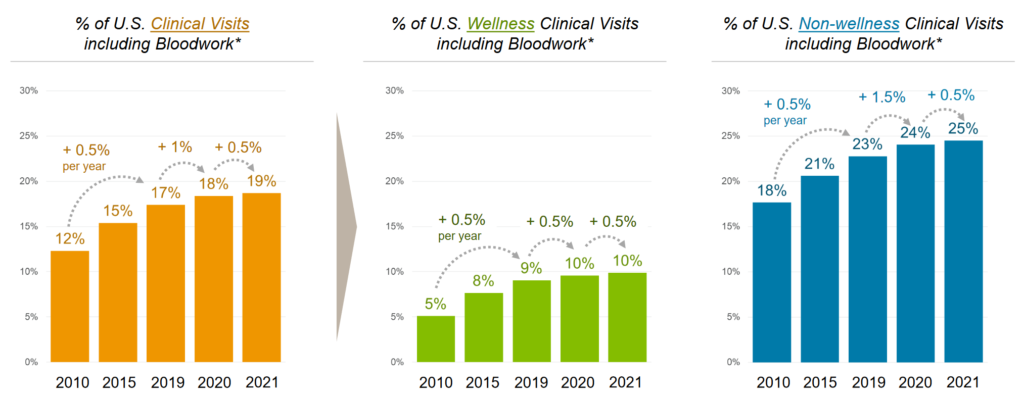

Bloodwork testing for clinical visits has also continued to increase over the last decade, providing another avenue of growth for the company. Consider that while percentage of visits including bloodwork has increased a slow rate, this is in combination with more overall pets and more overall veterinary visits. This compounds the total number of potential tests being carried out using IDEXX’s laboratory and diagnostic products.

The company also has continued to expand its presence in international markets, which provides another source of future growth. The main challenge here could be currency exchange rates due to a strong US dollar. However, the conditions currently impacting the global economic system are unlikely to persist over the long-term, and this is more of a short-term headwind in my opinion.

Lastly, IDEXX is forecasting a potential 10% CAGR in organic revenue growth through 2026. They are also aiming for 50 – 100 bps of operating margin gain per year over that time, and 15% – 20% earnings per share growth. While these are all impressive numbers, they’re actually a little below the averages we’ve seen over the past 5 years.

Business Risks

A large number of total sales come from their various animal test kits, and there is always the threat of a competitor creating a better value proposition for veterinary clinics and laboratories. IDEXX’s kits provide the companies with wide margins, so losing market share or being forced to lower prices (or both) could make strong future growth a challenge. For now they are the dominant leader, but technological innovation can potentially change the market’s landscape quickly.

Another headwind identified by IDEXX themselves is capacity constraints on the supply of veterinarians and vet techs. These groups may be challenged to keep pace with the increased demand from younger generations owning more pets. This could mean people passing on making as many vet appointments for their pets if there isn’t enough availability, which means missed opportunities for sales from IDEXX.

Fair Value Estimate

Historically, IDEXX has never been cheap. The company has traded at an average P/E of about 36x over the last 20 years, and a P/FCF of 42.9x. If we exclude everything after 2019 to discount for the pandemic and subsequent irrational exuberance, the stock still averaged a P/E of 32.8x and P/FCF of 39x. Based on the high-quality nature of the business and its expectations for future growth, this valuation is understandable.

Analysts are currently forecasting 2022 to be a down year for the company, with earnings declining 4%. If their prediction comes true, it will be the first time over the last 2 decades the company didn’t have year over year earnings growth. Even during the years surrounding the economic downturn of 2008 the company grew earnings. However, double-digit growth is forecasted to continue beyond 2022, with 22% in 2023 and 18% in 2024.

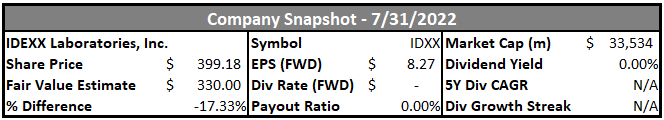

To get back to their “normal” P/E of 36x, based on FY2022 earnings estimates, we’d need to see a stock price of about $297. Currently, we’re about 25.5% above that price as the stock trades at $399.18. Even when the market reached 52-week lows back in June, IDXX still only got as low as $318.50. During the pandemic market sell-off of 2020 the stock only got as low as a 34x P/E.

On a free cash flow basis, the stock also trades at elevated valuations. The chart for FCF looks very similar to P/E, where the company has always traded well above its “intrinsic value” (orange line) based on the growth rate. To sum it up, the stock is always expensive.

So what would be a reasonable value to pay for the stock? It seems like the average of 36x earnings could be a fair price to pay, but we haven’t seen the stock below $300 since May of 2020. Average FCF of 42x gives us a price of $327, which is closer to where the stock currently trades, but still feels expensive overall. However, the stock rarely trades cheaper and given the company’s track record I think this is one where you just grit your teeth and buy. After holding for a decade or more the returns will speak for themselves. If I had to put a dollar amount on shares, I think around $330 is a good place to dollar cost average into the stock.

Summary

IDEXX is a high quality, compounding healthcare company focused primarily on companion animal markets. They’ve considerably outperformed the overall market going back the last couple decades, and have a strong business model that provides some protection during economic downturns. The company managed to grow revenue and EPS in both the 2008 and 2020/2021. With younger generations owning more pets, the future growth runway for the company looks promising.

The one major shortcoming of the stock is valuation. For most of the last 5 years its traded at a P/FCF of at least 50x and it doesn’t look like there will be opportunities for a cheap entry point anytime soon. Even a decline back to its long-term P/FCF average of ~43x would require shares to drop another 18%. And it’s not like 43x FCF sounds cheap either. However, I think a business of this pedigree deserves a premium price. As Warren Buffett once said, “It’s better to buy a wonderful business at a fair price than a fair business at a wonderful price.” I think IDEXX falls into the category of a wonderful business.

Disclosure: I do not have any position in IDEXX Laboratories and no plans to initiate one within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.