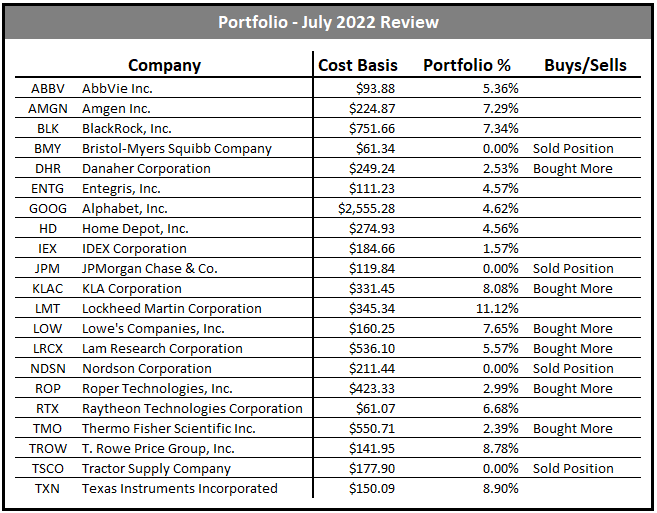

July was a busy month for buys and sells in the portfolio. I have been working towards moderately rebalancing and adjusting my industry exposure and concentration. For example, coming into the month I owned 3 retailers, all with similarities/overlap in Home Depot, Lowes, and Tractor Supply. In Pharmaceuticals, I owned AbbVie, Amgen, and Bristol-Myers. With a number of other high-quality companies on my watch list, I also want to keep the door open for new positions in the future. The portfolio at the start of the month had 20 stocks, which is pretty close to my own personal limit. In order to free up the portfolio I bit, I consolidated some of these industries.

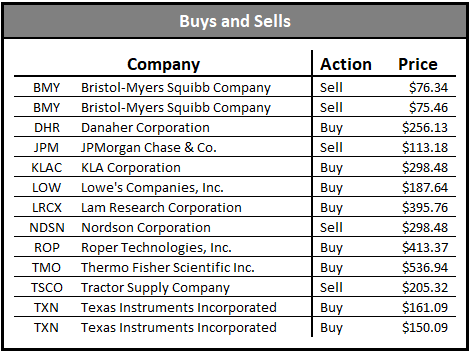

Buys

For buys, I continued to dollar cost average into life science juggernauts Danaher and Thermo Fisher. These stocks look somewhat expensive, even more so at the time of writing this. Both had strong beats in their quarterly results and the stocks rallied significantly as a result. I also made purchases of semiconductor equipment stocks KLA and Lam Research. These stocks are now essentially full positions in the portfolio, and I don’t expect to make further adds anytime soon. Lowes was added to with proceeds from selling Tractor Supply and Roper was added to with proceeds from the JPMorgan sale.

I also started a new position this month in Texas Instruments. This position was started on the back of my sale of Bristol-Myers. Texas Instruments is a high-quality company with a top-notch management team and an emphasis on growing free cash flow. Free cash flow growth is essential for dividend growth, and the company already offers a respectable yield with strong dividend growth. The yield when I bought was very similar to Bristol-Myers, so there wasn’t really a change in projected income but there was an increase in average dividend growth rate for the portfolio.

Sells

I made several sales this month, including the previously mentioned Bristol-Myers and Tractor Supply in addition to JPMorgan and Nordson. The Nordson sale was simply because it was less than 1% of the portfolio and I didn’t have plans to add more anytime soon. It was essentially a meaningless position to hold given its size. Still keeping the company on the watch list and not ruling out adding it back in the future.

I sold JPMorgan for a few reasons. First, I admittedly bought shares due to its payout schedule of January, April, July and October. There aren’t many other good payers for that set of months, so I made a poor excuse for buying shares. Always focus on the business over the dividend payout. With the bank now pausing buybacks and not raising their dividend, I don’t trust their ability to operate as a long-term dividend growth stock. They’re also in a cyclical industry and subject to many rules and regulations. I still think they are the best US bank you can buy, and Jamie Dimon is a top-notch CEO. I wish I had sold when it was a lot higher, but I think it was the best move for the portfolio.

In regards to the Bristol-Myers sale, while the company still looks cheap, has a respectable dividend yield, and has started to increase its dividend growth rate in recent years, the company is plagued by patent cliffs. All of their top drugs come off patent over the next 5-7 years. The stock trades cheaply because of concerns about how they will offset that revenue. I’ll still keep an eye on the pipeline for future developments but for now I’m content with selling. Texas Instruments essentially replaced Bristol-Myers in the portfolio, which I think was a good move.

Despite selling, Tractor Supply is a company I’m still potentially interested in owning and it remains on my watch list. It was just a matter of cutting one of the retailers, and they were the smallest position plus the most overvalued at that point in time.

Without accounting for dividends, I ended up with gains of 26% and 22.2% for Bristol-Myers, 15.5% for Tractor Supply, and a 5% loss on JPMorgan. All of those numbers should technically be a little higher when also including dividends received.

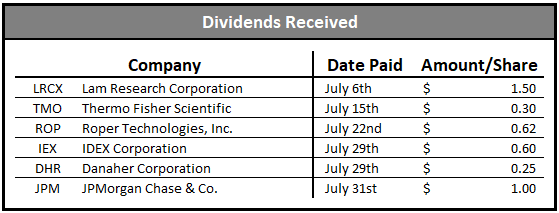

Dividends Received

July is one of those months where I receive dividends from quite a few companies, but all are low yielders and don’t provide meaningful income. Which is okay, since I don’t prioritize buying stocks based on the months that they pay out dividends. Dividends for July will be reinvested on August 1st based on how the calendar fell this month, but will likely be put towards adding more Lowe’s to the portfolio.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

Dividend News

There were no announced dividend raises (or cuts) this month for my holdings.

Future Plans

I’m not sure if I am done making moves and repositioning within the portfolio. Currently, I have 17 holdings and would like to limit things to 20. However, there are 4 or 5 companies I’d like to eventually add to the portfolio. While I’m not opposed to having 22 positions, I’m also not ruling out additional consolidation in an attempt to stay at about 20.

Almost everything on my watch list is expensive, so while I may eventually start positions in some of these stocks, they will be small in order to allow for me to dollar cost average. IDEXX Laboratories, West Pharmaceutical Services, S&P Global and Intercontinental Exchange are all higher priority targets for the portfolio. Ametek, which I analyzed in a past post, is also a stock I’d like to add. However, I’m waiting to see how their earnings report goes and the sorts of challenges the company is facing in the current economic environment.

MSCI, Veeva Systems, and ANSYS are a few others that look pretty good but are quite expensive. I admittedly haven’t done enough research into them to determine if they are worth starting a position in, so they are low priority for the time being.

The portfolio is currently heavily weighted towards strong dividend growth stocks as its largest holdings, with a bunch of low dividend/no dividend stocks having smaller weights. I like this balance, as it enables the portfolio to still generate meaningful dividend income while also allowing for room for some more aggressive picks. Currently Alphabet is my only non-dividend paying stock, but IDEXX will likely soon become the 2nd. West Pharmaceutical has a tiny yield and lackluster dividend growth, but Thermo Fisher, Danaher, and Entegris also have low yields. Ultimately, I like having a foundation of dividend growth with a second tier consisting of higher growth alongside those dividends.

Disclosure: I have a beneficial long position in ABBV, AMGN, BLK, DHR, ENTG, GOOG, HD, IEX, KLAC, LMT, LOW, LRCX, ROP, RTX, TMO, TROW and TXN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.