Markets continued to trend downward over the course of June, opening up new buying opportunities in previously expensive sectors. Despite recession fears and overall uncertainty, I am continuing to build up my positions. While nobody can predict the future, I wouldn’t be surprised to see markets bottom before the actual economy. Inflation may have already peaked or is peaking, and if oil prices decline it should help offset any serious economic downturn. Additionally, an end to the war in Ukraine would probably send markets soaring, as it would help stabilize commodity markets. Due to so many possibilities, I am sticking to the plan and continuing to dollar cost average the stocks in my portfolio.

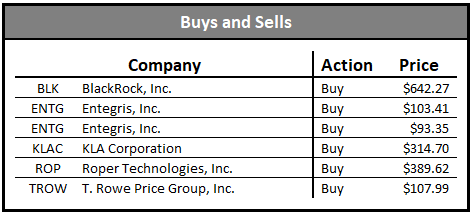

Buys and Sells

June provided me another round of buys in semiconductor equipment and asset management companies. In semiconductors I added to Entegris at $103.41 and $93.35, and KLA Corp at $314.70. For asset managers, I bought more BlackRock at $642.27 and more T. Rowe Price at $107.99. I also used the dividends I received this month to add to my position in Roper Technologies.

At this point, repeated buys of BlackRock and T. Rowe have pushed them to roughly 7% and 8.5% of my portfolio. Although I’m still down on both stocks, I am planning on reducing future purchases in both stocks due to the sizable weight they already take up in my portfolio. There are other opportunities out there and I don’t want to be too highly concentrated in asset managers as a whole.

Entegris announced they received full antitrust approval for their acquisition of CMC Materials and the transaction is expected to close July 6th. This is great news for the company and further establishes them as the one stop shop leader in semiconductor manufacturing consumables.

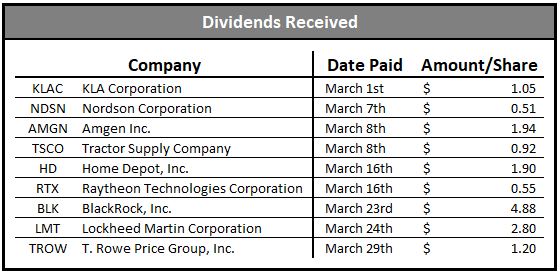

Dividends Received

June is one of the big months for dividends for my account, as most of my stocks pay out in March, June, September and December. Combined, these companies account for roughly 63% of my total dividend income. Lockheed Martin and T. Rowe are my highest paying stocks (other than Bristol Meyers), while Amgen and BlackRock are also heavy hitters. As mentioned earlier, proceeds from this month’s dividends went towards adding to my position in Roper Technologies.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

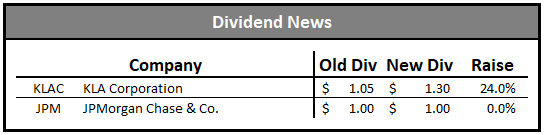

Dividend News

KLA Corporation announced a 24% dividend increase, raising the quarterly payout from $1.05 to $1.30. This raises the annual payout from $4.20 to $5.20. The company has now raised its dividend for 13 consecutive years with a 5-year dividend CAGR of 15.77%. On top of the raise, they also announced a $6 billion share buyback program, half of which would be an accelerated purchasing plan completed over the next 3-6 months. With a low dividend payout ratio and intentions to repurchase a considerable number of shares through buybacks, the dividend looks poised to continue growing at a high rate going forward.

JPMorgan did not raise their dividend at the end of the month, despite passing the Federal Reserve’s stress test. All major banks passed the stress test, and major institutions such as Bank of America, Morgan Stanley, Goldman Sachs and Wells Fargo all announced dividend raises. JPMorgan not raising is a surprise, as they’ve been a top performing bank with a fortress of a balance sheet and relatively conservative execution model. Unlike the other big banks, they fared relatively well during the financial crisis in 2008, so it’s a surprise they felt they weren’t positioned to raise the dividend here. This is something I will be keeping a close eye on moving forward.

Future Plans

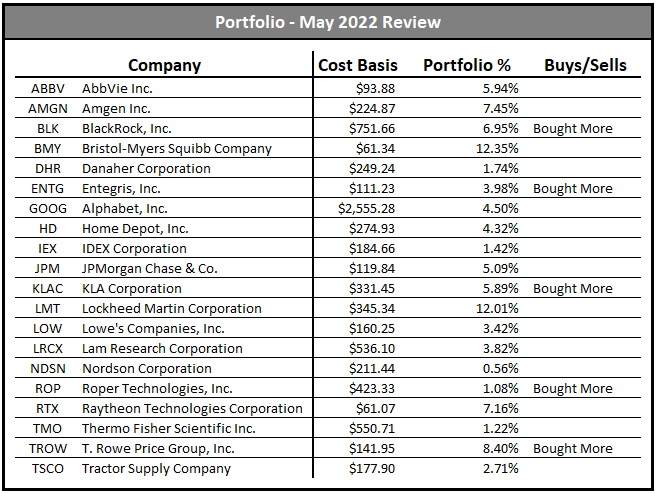

As mentioned above, asset managers are likely full positions or close to it in the portfolio. Semiconductor equipment is getting close as well, meaning I’ll be looking for other buying opportunities. Home Depot and Lowe’s are starting to look fairly valued, but probably aren’t great buys given the economic environment. Home sales have slowed and inflation is limiting disposable income for remodeling and upgrades.

Life science companies Danaher and Thermo Fisher are both potential targets, the only downside being that they aren’t trading at quite as attractive valuations as other companies. Defense companies are already large positions and trading above fair value, so those are unlikely adds. The pharmaceutical companies I own have the same problems as defense companies.

Nordson is a company I’m weighing cutting from the portfolio. Not because it’s a bad company, but because I can only prioritize so many companies at once. There are a few interesting companies I have on my watch list, such as Ametek, Intercontinental Exchange, and S&P Global. Others like Veeva Systems, Texas Instruments, ANSYS and Visa/Mastercard are also potential targets for the portfolio. Adding to any of those positions while keeping Nordson at a negligible weight makes Nordson seem unnecessary to own. Those other companies trade at such high premiums that any opportunity to buy needs to be jumped on immediately.

Most of those companies have yields under 1% or don’t even pay a dividend. While I prioritize dividend paying stocks when I can, I don’t want to pass up high quality companies just because they are using their capital in different ways. I’d imagine one or more of those stocks ends up in the portfolio over the next couple months, the only question is at what price. Intercontinental Exchange actually trades at what I would consider a fair value, while the others are still slightly overvalued or moderately overvalued.

Disclosure: I have a beneficial long position in ABBV, AMGN, BLK, BMY, DHR, ENTG, GOOG, HD, IEX, JPM, KLAC, LMT, LOW, LRCX, NDSN, ROP, RTX, TMO, TROW and TSCO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.