Semiconductors continue to be a highly sought-after product in today’s increasingly digitized world. Demand for semiconductors comes from three main factors: more overall demand, more (smart) devices requiring chips, and more chips being required per device. Consider that the average electric vehicle requires 2,000 chips, which is roughly double that of the average non-electric car. With chips shortages continuing to strain automakers, demand is outpacing supply for new EVs. These shortages have led to greater investments in semiconductor manufacturing, with foundries sinking tens of billions of dollars into new facilities.

Business Profile

KLA Corporation is a semiconductor equipment company that specializes in defect inspection, process control, and yield management products. Modern semiconductors are small, especially leading-edge chips found in modern computers, data center servers, and graphics processors. With manufacturing precision required down to the atomic and subatomic level, even the tiniest defect can render a chip unusable.

This is where KLA comes into the picture. Their solutions provide foundries with the ability to both inspect chips for defects as well as identify the source of underlying defects. With this information, foundries can make changes to their manufacturing process, which in turn can help increase yields. From start to finish semiconductor manufacturing isn’t a cheap process, so higher yields mean greater overall profits for manufacturers.

KLA also offers customers service contracts for maintaining, repairing, and upgrading existing equipment. An added benefit they provide is access to a database consisting of information on yield and defect improvements made by other customers. The information is anonymous, but creates a powerful networking effect that benefits all parties involved. If company A is dealing with higher-than-average defects during a certain portion of the process, they might find that company B had a similar issue and can gain insight into how it was resolved.

Currently KLA has around a 50%-55% share of the inspection equipment market making them the dominant player in the space. They have roughly 4x the market share of next largest competitor. And perhaps most importantly, they have maintained their 50% market share going back the last decade. This means other companies aren’t out-innovating them and stealing away customers. Additionally, since the semiconductor industry has grown significantly over the last 10 years, it means they now have 50% of a much larger pie.

Financial Performance

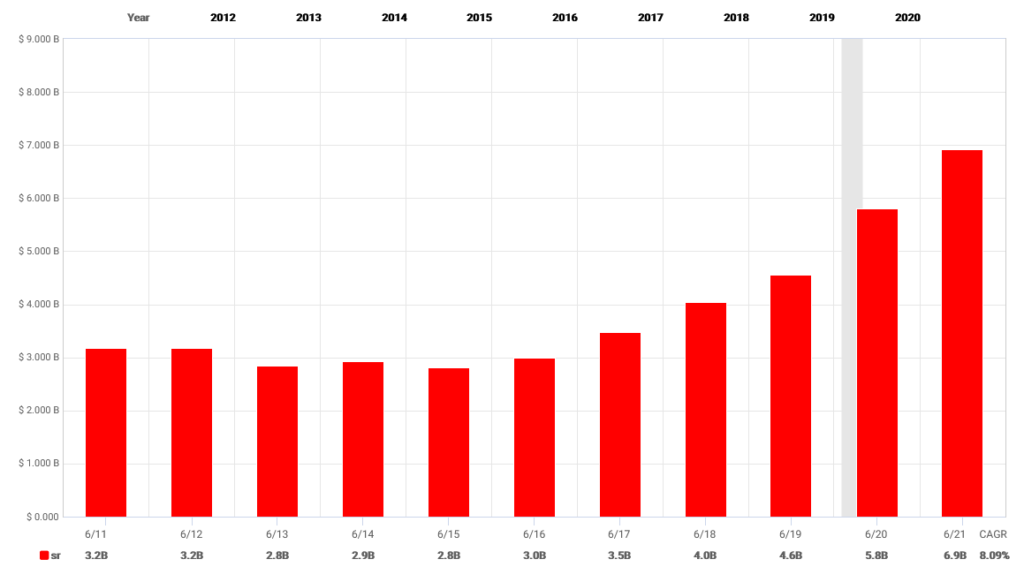

KLA has grown revenue at a ridiculous 18.3% CAGR over the last 5 years, with big jumps in both 2020 and 2021. However, when looking at the big picture we can see that prior to the last 3 years growth wasn’t all that impressive. From 2011 to 2017 revenue went from $3.2 billion to $3.5 billion. This is primarily due to the cyclical nature of the semiconductor industry, where there are periods of significant growth (investment) followed by relatively flat years. Besides revenue, the company has also demonstrated strong free cash flow growth, with a 5-year CAGR of 21.83%.

The company sports the best margins out of the semiconductor equipment space, with 5-year average gross margins of 60.7% and net margins of 25.3%. These numbers beat out the other big players like ASML, Applied Materials and Lam Research. High margins mean greater cash flow for the business, opening up opportunities for acquisitions, paying down debt, buying back shares or raising their dividend. It also shows the pricing power they have with their customers, who are willing to pay a premium for KLA’s inspection equipment.

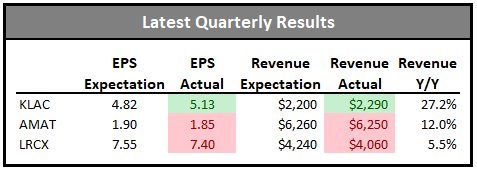

Turning to the most recent earnings, we can see another example of KLA’s exceptional performance compared to its peers. KLA beat on EPS and revenue estimates, with revenue up 27.2% Y/Y. Applied Materials missed on both EPS and revenue, although revenue was still up 12.0% Y/Y. Lam Research also missed on both EPS and revenue, and only grew revenue 5.5% Y/Y.

While all three companies grew year over year, KLA clearly had the best overall performance. And while this is only one quarter of results, it’s important to note that this was during a time of continued supply chain disruptions that impacted all three companies. KLA was able to better navigate the challenging environment and deliver results that beat analyst expectations. Of course, the other two companies still did well, and Applied Materials growing 12% Y/Y is still great growth, but they weren’t able to match KLA’s performance.

Investing in the Future

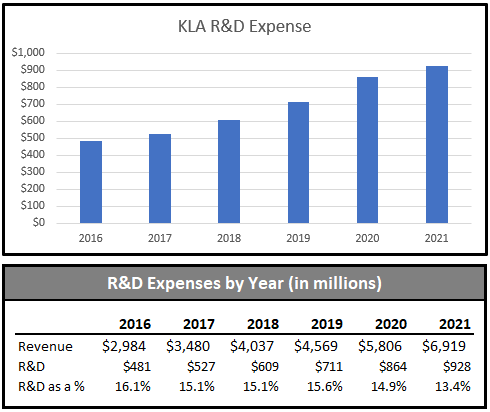

KLA is heavily investing in future products as chip sizes and process nodes continue to shrink. Their R&D expenses almost doubled between 2016 and 2021, and accounted for roughly 15% of revenue. Amazingly, due to strong sales growth R&D has actually shrunk from 16% of revenue down to 13.4% over the last 5 years, even though spending has doubled.

With new smaller node sizes, inspection and defect detection continue to grow in importance during the semiconductor manufacturing process. Think of it this way, smaller sizes mean more circuits can be fit onto a single wafer. Suppose 10 years ago, 100 circuits could be etched into a single wafer. Now, 300 can be etched in that same area. A defect that impacts one inch of the wafer will lead to a larger number of circuits being unusable compared to before.

As mentioned previously, KLA has maintained a roughly 50% share of this market, but the company can’t get complacent. We saw what happened to Intel when they stopped innovating, they fell behind TSMC in leading-edge manufacturing and are still struggling to catch up years later. KLA offers some of the best equipment out there today for chip inspection, but each smaller node brings its own challenges and just because they lead today doesn’t guarantee they will lead tomorrow.

One advantage KLA has over competitors like Applied Materials (AMAT) is that specializing in inspection equipment means a higher concentration of R&D spending goes towards the segment. AMAT competes across the semiconductor equipment spectrum, so even though they are a larger company that spends more on R&D, their spending is spread out across multiple business segments. They provide tools in not only for inspection but also deposition, etching, modification, packaging, solar panels, and flat panel displays. While KLA does have smaller segments for areas such as packaging and displays, they aren’t the primary focal point. For comparison, AMAT spent almost $2.5 billion on R&D in 2021, while KLA spent $928 million.

Growth Runway

In 2021, 19 new high-volume semiconductor fabs came online, with another 10 being built in 2022 in order to meet demand. These fabs contribute to KLA’s recent growth both from equipment sales up front and recurring service revenue over the following years. As a whole, the semiconductor industry is forecasted to double by 2030, growing from $500 billion to $1 trillion. Semiconductor equipment sales are forecasted to grow at about 9.5%/year over that time frame. Currently, inspection equipment is about 11% of the overall equipment market, meaning $7.5 billion based on 2020’s numbers. With a 9.5% CAGR we could see the equipment market hit somewhere around $150 billion by 2030, meaning inspection equipment would account for roughly $16.5 billion.

Company and Industry Risks

There are a few notable risks facing both KLA individually as well as the semiconductor industry as a whole. For starters, semiconductor spending tends to be cyclical, with increased chip demand leading to new chip fabs being built to increase supply. Once the fabs are complete, new equipment sales tend to drop until the next wave of demand hits and additional manufacturing capacity is needed. However, I think industry cyclicality will be less volatile moving forward compared to past cycles. As mentioned at the beginning, EVs require roughly 2x the number of chips as non-EV cars. Increased demand is present across all industries, not just cars, meaning current supply is nowhere near matching demand.

Another risk to the industry is a global recession or significant economic slowdown. Between inflation, supply chain disruptions, war, and other geopolitical factors there are significant concerns that the world may be facing a relatively impactful recession. If such an event occurs, demand for chips likely drops, as people buy fewer new cars, fewer new electronics, fewer smart devices, etc. Subsequently this likely means a drop in spending for semiconductor manufacturers, as lower demand no longer justifies additional new facilities.

One risk specific to KLA themselves in customer concentration. Over the past several years, both TSMC and Samsung have accounted for roughly 10% of revenue each. While TSMC, Samsung, and Intel remain the three main players in the foundry space for cutting-edge chips, it’s still a considerable amount of revenue to make off of a small customer base. Should anything happen to those companies, KLA could see a significant reduction in sales. They also generate about 25% of revenue from China, which comes with its own set of risks.

And lastly, while KLA is the dominant player in the inspection and defect space, they don’t really compete much outside of that area. With an already large market share, future growth opportunities could be limited, especially when accounting for potential recession risks.

Dividend Outlook

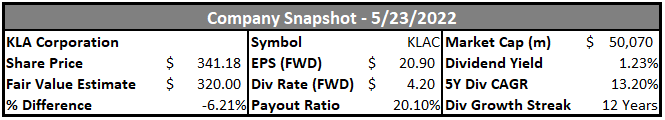

KLA has paid an increasing dividend for 12 consecutive years. Currently the company has a 5-year dividend CAGR of 13.2% and a payout ratio based on free cash flow of approximately 21.6%. Free cash flow is also projected to continue growing in the upcoming years. In terms of debt, they have de-levered themselves over the past five years, going from a Debt/EBITDA ratio of 4.6x down to 2.1x. Less leverage is always a good thing heading into a possible recession. Thanks to the low payout ratio and debt load, the dividend should be safe even if we encounter an economic decline.

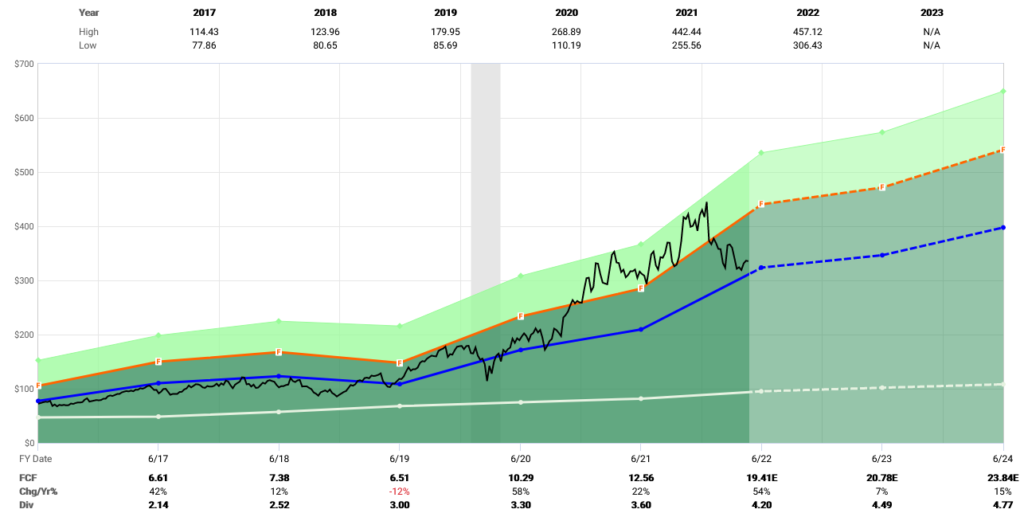

Keep in mind that while a 13.2% dividend CAGR is strong, they grew enterprise free cash flow at a rate of 21.83% over that same time period. If we account for share buybacks and adjust FCF to a per share basis, we get a CAGR of 22.04%. This should provide them with ample room to continue growing the dividend at a high rate. The following FAST Graphs chart showcases FCF/share over the last 5 years.

Note: Dark green is free cash flow per share, light green is dividends paid out per share, black line is stock price, blue line is the historical average Price/FCF, white line on the bottom is the dividend payout relative to free cash flow.

The company has also been slowly buying back shares, with an average annual decline of about 0.2% over the last 5 years. Diluted shares outstanding went from 156.8 million down to 155.4 million. Not amazing, but better than an increasing share count that diluting existing shareholders. Given their low payout ratio, should we see a market downturn I wouldn’t be surprised to see them shift more towards share buybacks than dividend growth if the stock becomes cheap enough.

Summary

KLA might be my favorite overall pick in the semiconductor space. The company is focused on solving some of the most important problems in the industry and holds a dominant position in the market. They’ve had great financial results in recent years, and while the numbers are impressive on their own, they are even more impressive when compared to their peers. They also pay a reasonable 1.3% dividend with strong dividend growth and a low payout ratio.

Disclosure: I have a beneficial long position in KLAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.