The S&P 500 temporarily entered a bear market in May, with intraday lows on May 20th surpassing a 20% drop from all-time highs. Despite this mid-day drop the market actually closed slightly in the green for the month of May. The last week of May was the first green week the market had over the last 7 weeks. With volatility climbing and market fears growing, I increased my buying throughout the month, making a number of purchases and starting a few new positions. While we may not have seen the bottom of this market downturn, valuations are finally starting to look more reasonable, justifying additional buys.

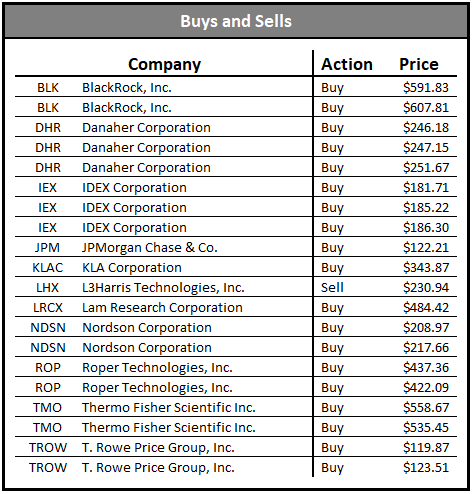

Buys and Sells

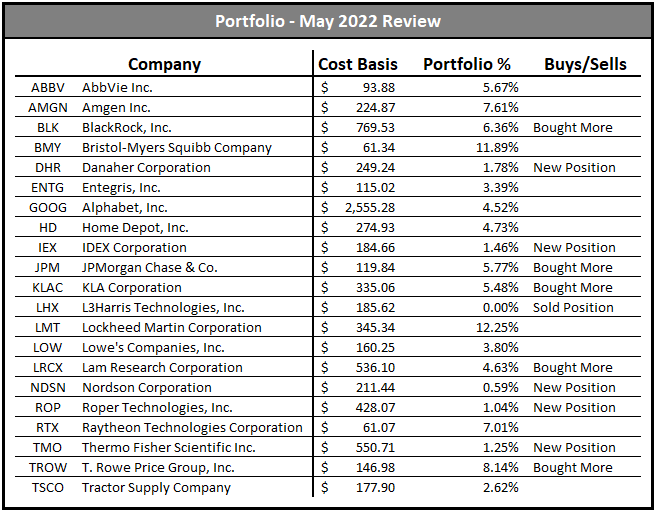

May one was of my busiest months ever for buying. I used the lower prices in the market to help initiate several new positions, those being: Danaher (DHR), IDEX (IEX), Nordson (NDSN), Roper (ROP), and Thermo Fisher (TMO). As discussed in an earlier post, sectors I’m targeting for long-term growth include life sciences, water and semiconductors. With the below list of purchases, I capitalized on some of my favorite names in these industries with DHR and TMO for life sciences, IEX and ROP for water, and more buys of KLAC and LRCX for semiconductors.

Nordson was a new addition due to the company’s strong historical performance as well as adjacent role to several of the previously mentioned industries. They serve customers in semiconductors/electronics, medical devices and equipment, and industrial applications such as aerospace, automotive, chemical, defense and machinery. Nordson has extremely high margins for an industrial business, with gross margins averaging 55% from 2017-2021. Future M&A focus includes expanding their medical device portfolio, test and inspection systems, and other precision technology. The company is also a dividend king with 59 consecutive years of increases.

I also continued adding to some beaten down financial names that I had already been DCA-ing into over the past several months. BlackRock and T. Rowe Price have been hit hard over the last year, and are now providing considerable yields. Both are great companies with low enough dividend payout ratios that I’m not worried about any repercussions from short-term market uncertainty. JPMorgan is arguably a bit riskier due to leverage and complete exposure to the economy, but Jamie Dimon has been a phenomenal CEO for the company and I’m confident they’ll be able to weather any storm. They handled ’08 much better than the other big banks (as well as many regionals) and learned a lot about how to be better positioned in the future.

Reflecting back on BlackRock a bit more, I bought my first shares back in December of 2021 at $959 per share. It was a matter of impatience on my end, as I had wanted the stock in the portfolio and the economic risks we are seeing now hadn’t manifested back then. Since then, I have lowered my cost basis almost $200 per share down to $769. The stock closed at $666 on Friday the 27th, so there is still more room to average down. However, given that it’s starting to grow into a larger position in the portfolio, I probably won’t contribute quite as much towards them during future buys.

Another notable move from May was selling out of L3Harris (LHX). There were a few reasons I made this decision. First, out of the defense companies I own, I felt L3 was the weakest. The combined portfolios and backlogs of Lockheed (LMT) and Raytheon (RTX) are stronger and their primary focus on aircraft and missiles seem important given the current political landscape.

Second, due to my feelings about Lockheed and Raytheon being stronger companies, should the entire defense sector sell-off I wouldn’t prioritize adding to LHX over LMT and RTX. As a result, I didn’t see a point in holding a stock that I wouldn’t buy, even if it dropped, due to other stocks in the sector being a better purchase. And lastly, I already have such high exposure to the aerospace and defense industry that I wanted to reduce it in favor of other sectors.

L3Harris is still a solid company that I can see doing well over the next decade. They provide products in services in a number of key areas of military spending. However, due to my belief that Raytheon and Lockheed will display better performance, as well as my high concentration in defense stocks, I decided to sell out of L3.

Without factoring in dividends, I locked in gains of about 25% on the L3Harris sale.

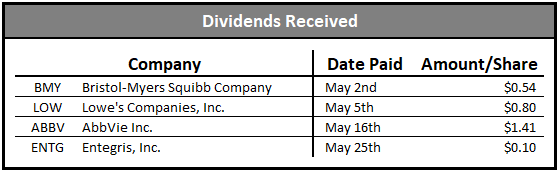

Dividends Received

May was a solid month for passive income, with a few of the big hitters in my portfolio paying out dividends. BMY is one of the largest positions in my portfolio, and ABBV is another considerably large one when looking at it from a dividend perspective. With an average cost of $93.88 on ABBV, my yield on cost sits just over 6%. Therefore, despite being the 8th biggest stock it provides the 5th most income. Dividends from this month were used to add to my newly established position in Nordson.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

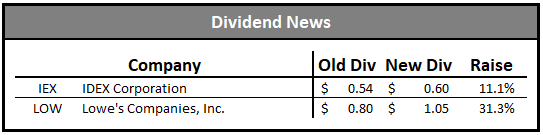

Dividend News

IDEX Corporation (IEX) announced a dividend increase of 11.1% to $0.60 quarterly, up from $0.54 quarterly. This raises the annual dividend payout to $2.40, up from $2.16. The company has now increased its dividend for 13 consecutive years with a 5-year dividend CAGR of just over 10%.

Lowe’s Companies (LOW) announced a whopping 31.3% dividend increase at the end of the month, raising the quarterly payout from $0.80 up to $1.05. This raises the annual payout from $3.20 to $4.20. LOW has now raised their dividend by 75% over the last 2 years, going from $2.40 to $3.20 to $4.20. They have a 5-year dividend CAGR of almost 21%. This was also their 60th consecutive year of raising their dividend. Truly fantastic numbers from one of the best dividend growth stocks out there.

Future Plans

The plan for now is to continue adding money to the portfolio regardless of which way the market moves. There are a number of stocks that are trading at reasonable and/or attractive valuations. Timing the market is a losing strategy long-term and if the opportunity presents itself to add quality at a discount, I think it makes sense to take advantage.

On a more tactical level, I am in the process of trimming down my watch list and analyzing my portfolio for possible rebalancing or adjustments. As seen with LHX, I am willing to cut a position if I feel more strongly about other positions, especially when they operate in the same space. My combined holdings of Home Depot, Lowe’s and Tractor Supply have me thinking about potentially taking similar actions. But nothing is set in stone at this point in time.

I also have a few new names on the watch list that I need to take a deeper dive into, namely being Ametek (AME), SS&C Technologies (SSNC), and Intercontinental Exchange (ICE). Another company I came across that looks interesting is Veeva Systems (VEEV), although they currently don’t pay a dividend and look somewhat expensive at first glance. I’m always looking for new companies to analyze, especially because it seems like 10% of stocks generate 90% of discussions of social media. Finding lesser-known businesses that have the potential to generate strong long-term returns is something I’m always interested in.

Disclosure: I have a beneficial long position in ABBV, AMGN, BLK, BMY, DHR, ENTG, GOOG, HD, IEX, JPM, KLAC, LMT, LOW, LRCX, NDSN, ROP, RTX, TMO, TROW and TSCO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.