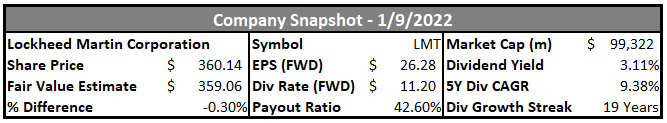

Lockheed Martin Corporation is one of the largest aerospace and defense companies in the world. It’s also one of the largest positions in my dividend growth portfolio. The stock is currently trading at what I would consider a fair valuation, making it an attractive choice in a market subject to volatility, speculation, and rising interest rates.

Air Superiority

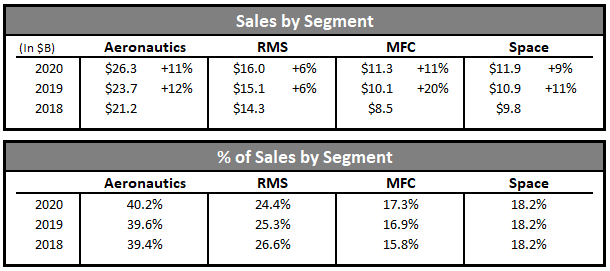

Lockheed Martin is a US-based aerospace and defense company. Their primary focus is on the development and production of aircraft, missiles, and space systems. Based on the industry they operate in, the overwhelming majority of their business is done with their single largest customer: the US government. Their largest segment, Aeronautics, is spearheaded by the massive F-35 program, which has accounted for approximately 40% of revenue from 2018-2020. The company has also been responsible for aircraft such as the F-22, F-16 (in collaboration with General Dynamics), and top-secret SR-71 Blackbird.

Lockheed also has a Rotary Missions Segment (RMS) which includes their Sikorsky helicopter division. Sikorsky accounts for about 40% of segment revenue. Their Aegis Combat System is also part of this segment, and functions as a naval missile defense system integrated with cruisers and destroyers. The Missiles and Fire Control (MFC) segment is pretty self-explanatory, consisting of missile production and systems such as the Hellfire Missile program (in service since the mid-1980s) and the Joint Air-to-Ground Missile (in service since 2009).

Space – The Next Frontier

Lockheed’s last segment is Space, and this is where the company has the most opportunities for growth and competition. This segment develops satellites, rockets, and other space systems, as well as sea-based intercontinental ballistic missiles (30% of segment revenue). You may have heard the recent news of China testing a hypersonic missile, something even the US hasn’t successfully created yet. Conveniently, Lockheed recently opened a new facility at its Alabama plant for the development of hypersonic missiles. With concerns about China’s technological innovation, the US government may be prompted to increase spending in this area, which would greatly benefit the company.

Back to space itself, as technology advances and human civilization begins to look beyond Earth, Lockheed’s expertise in the area may help establish it as a leader in the industry. SpaceX and Blue Origin are companies that may challenge some of its space launches and contracts, but classified projects involving military intelligence should remain relatively safe. Those companies have also faced recent challenges of their own, so at this point many contracts and potential revenue is still up for grabs. For classified projects, the biggest competitor will most likely be Northrop Grumman. In order to strengthen its own position, Lockheed has made a recent move to acquire Aerojet Rocketdyne. This acquisition should bolster Lockheed’s missile, rocket, and space segments.

Aerojet Rocketdyne – The Missing Piece?

Originally announced in 2020, Lockheed Martin presented plans to acquire rocket maker Aerojet Rocketdyne in a $4.4B deal. With Aerojet being one of the largest makers of rockets in the US, the deal has been met with some resistance, as regulators and government officials have warned it could disrupt competition in the segment. However, in more recent months some lawmakers came out in support of the deal, citing defense competitor Northrop Grumman’s acquisition of rocket maker Orbital ATK back in 2018. Lockheed buying Aerojet would create greater equilibrium, as there would now be 2 major competitors in the space, while also having outsiders like SpaceX developing their own rockets.

Regardless of if space exploration doesn’t pan out like some have projected, the move to acquire Aerojet is fantastic for Lockheed. 43% of Aerojet’s sales already go to Lockheed or United Launch Alliance, a joint venture with Lockheed and Boeing. The merger would enable better cost synergies for Lockheed’s missiles and space segments, as well as allowing them to vertically integrate their supply chain. It will enable them to continue winning contracts for satellites, missiles, and other systems with the opportunity to expand their space presence if demand calls for it. Altogether the acquisition will offer long term growth and competitiveness for Lockheed, as well as improving costs for their existing business. Barring any further disruptions, the deal is expected to close in Q1 of 2022.

Lockheed Martin – Fair Value

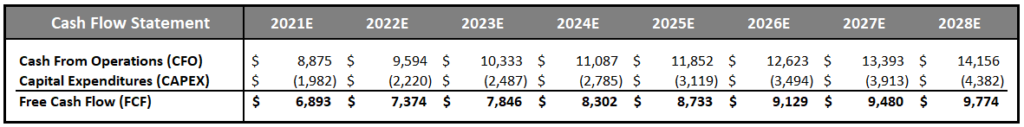

To calculate fair value, I tend to do a simplified DCF where I forecast cash from operations and capex to figure out how much free cash flow a company will generate. In Lockheed’s case, historically cash flow has grown at 13.3% over the last 7 years and 12% over the last 5 years. The company recently lowered guidance for 2022 and into 2023 based on lower sales, supply chain disruptions, and pension settlement charges. Their 2022 revenue forecast is $66B as opposed to the consensus estimate of $70.5B. To account for these challenges, I’m using a much more conservative growth rate for cash flow of 8.5%, which is also de-incremented by 0.4% each year. Reducing cash flow by 0.4% each year helps protect against the possibility for some of their sales to be eroded away to competitors.

In terms of capex, their 7 year growth rate was 13.1% and 5 year was 13.7%. So capex has been both constant and in line with cash flow growth. Ideally, we’d want to see capex lower, but the current numbers are still okay. Forecasting out, I’m using a steady 12% growth rate. This is slightly lower than the averages, but I think the cost savings and synergies offered by the Aerojet acquisition should help capex, (as well as the above cash flow numbers). For the time being 2021 is still listed as an estimate since Lockheed hasn’t released their 4th quarter results.

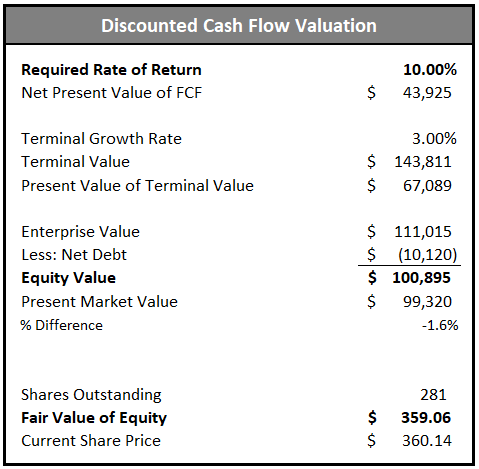

In the DCF I’m using a required rate of return of 10% and a terminal growth rate of 3%. When we put everything together, we get a fair value estimate of the company at about $101B and a fair value per share of about $359. Lockheed is currently trading at a valuation of $99.3B and a per share price of $360. Therefore, based on my estimates the company is sitting at what I would consider fair value.

Dividend Outlook

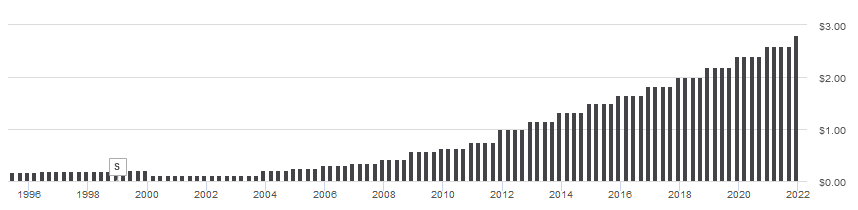

Lockheed Martin is also a great dividend growth stock, with a current 5 year dividend CAGR of 9.4% and a dividend growth streak of 19 consecutive years. Their most recent raise was 8% in September of 2021, which is a respectable increase given the headwinds the company is facing. One important consideration when looking at dividend growth is to analyze whether it could hurt the business in the long term to significantly raise the dividend during economic uncertainty. We want to avoid companies that sabotage their future in order to generate short-term shareholder value.

Based on Lockheed’s historical and projected free cash flow, this raise keeps them around a 45% payout ratio based on free cash flow. Under 50% is ideal since it still allows the company to make extra debt payments, buyback shares, make acquisitions, or invest more in R&D. I think they can sustain an 8% dividend growth rate over the long term, making them an attractive buy and hold.

Speaking of buybacks, back in September of 2021 Lockheed announced an additional $5B share repurchasing program. $5B at current levels is about 5% of the total market cap, and the stock is up about 5% since the announcement. When a company buys back its shares, we want to see them doing so when the stock is undervalued or around fair value. Given that the stock is approximately fair value, I think this is a good move that will continue to enable strong dividend growth over the long term. Over the past 5 and 7 years they’ve been buying back shares at a rate of about 2% per year.

Summary

Lockheed Martin looks to be fairly valued at this point in time. Although they have lowered guidance for revenue and earnings over the next year or potentially two, the long-term growth potential is still there. Their impending acquisition of Aerojet Rocketdyne should provide continued opportunities for growth in their space and missile segments, as well as cost synergies and improved integration of their supply chains. Additionally, with tensions remaining high between the US, China, and Russia, defense spending should continue to be prioritized by lawmakers.

They also have a strong record of raising their dividend and buying back shares. With a conservative estimate on future cash flow growth and steady increases in capex, I have Lockheed’s fair value at about $360 per share. In a market of many highly valued stocks and an impending rate hike (or two) from the Federal Reserve, I think Lockheed Martin is a good investment at this time.

Disclosure: I have a beneficial long position in LMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.