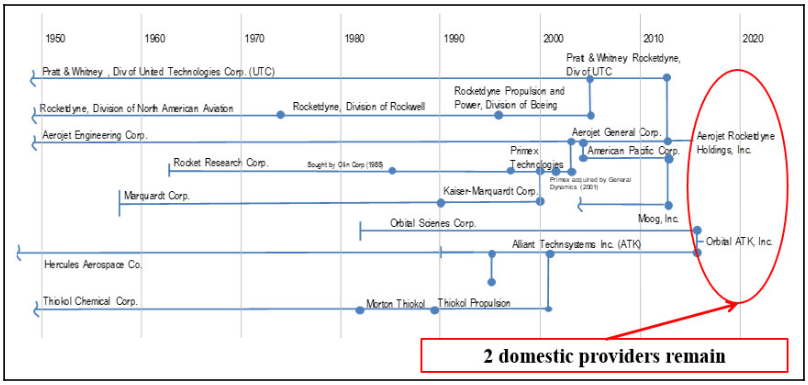

After the FTC sued to block Lockheed’s deal for Aerojet Rocketdyne on January 25th, the acquisition was officially terminated on February 14th. If it had been successful, I think it would have been a great move for Lockheed, unlocking cost synergies and accelerating its space and missile segments. Unfortunately, current regulators felt such a deal was an antitrust concern and could lead to reduced competition within the defense industry. With Aerojet one of two remaining rocket engine providers and responsible for 70% of solid rocket fuel, it’s understandable why these concerns would arise.

Defense Contractors – The End of Consolidation?

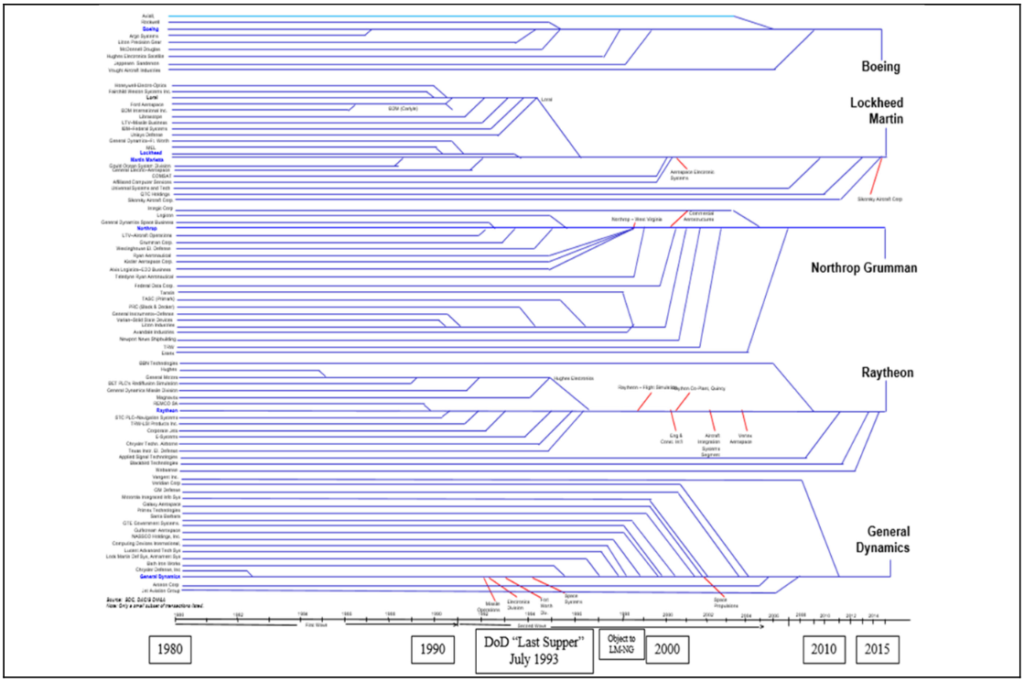

In the wake of the failed Aerojet deal, the Department of Defense has warned against future consolidation in the defense industry, voicing concerns over the shrinking number of prime contractors. From a recent DoD report, since the 1990s the defense sector has consolidated substantially, transitioning from 51 to 5 prime contractors. The DoD claims this has led to “significantly reduced competition,” which in turn could have “serious consequences” for national security.

The DoD argues that greater competition benefits the government, leading to improved cost, schedule, and performance for the products and services needed to support national defense. When considering that Aerojet is responsible for 70% of solid rocket fuel motors, its understandable why Lockheed would receive scrutiny for trying to acquire them. In some ways though, an acquisition could have also been beneficial. An infusion of cash from Lockheed’s much larger business operations could have increased R&D spending for future projects such as hypersonic missiles.

I also want to offer a counterpoint to the report, that being in some cases having a greater number of competitors could also mean greater fragmentation of military technology. A more consolidated group of companies means less variability in software, training, maintenance, and spare parts. If there were 20 major players in the sector, all with their own proprietary systems, there would be greater inefficiencies across US military operations. More time and money would have to be spent on operations such as training if every aircraft, land vehicle, or ship was made by a different company.

Acknowledging DoD Concerns

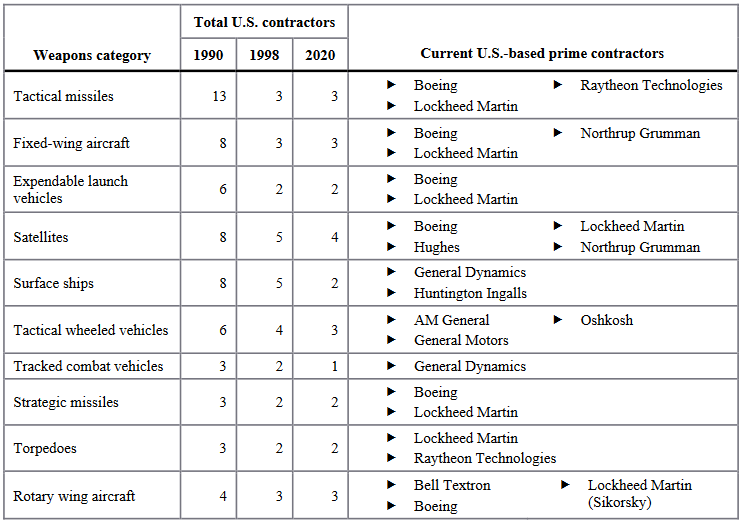

Despite this counterpoint, I still understand the DoD’s concern for a lack of competition leading to reduced military innovation. While there is overlap in many sectors, there are also areas where only one or two prime contractors offers products or solutions. For example, out of the major players General Dynamics is the only one manufacturing tanks and tracked vehicles. They are also one of only two shipbuilders for the US Navy, with Huntington Ingalls being the other.

From the DoD’s report, they summarize the consolidation as follows, “Over approximately the last three decades, the number of suppliers in major weapons system categories has declined substantially: tactical missile suppliers have declined from 13 to 3, fixed-wing aircraft suppliers declined from 8 to 3, and satellite suppliers have halved from 8 to 4. Today, 90% of missiles come from 3 sources.” The link to the full report can be found here: Dept. of Defense Report

Looking at the above chart, I think having a minimum of three competitors in each category would be a preferable situation. Four would probably be sufficient, and five ideal. However, even in the categories with three of four competitors, we can obviously see it’s a lot of the same names repeating. Perhaps having closer to seven or eight prime contractors instead of five would be better, especially if it meant having more players in land combat vehicles, naval vessels, and some new names in missiles.

Any Value in Aerojet?

Aerojet on its own is an interesting proposition. They are responsible for 70% of solid rocket fuel motors, and are already selling to large customers like Lockheed and Boeing. They also provide liquid fuel and propulsion systems in addition to air and electric powered engines/systems. Hypersonic rockets and missiles use liquid fuel instead of solid fuel, so there may be future growth opportunities there. However, I’m not sure if the company has the capital or capabilities to take things beyond the rocket engine space long-term. I’m also not sure if just being in the rocket engine space is enough to drive considerable long-term returns.

But perhaps more important than the company’s operations is the controversy surrounding the management team and board of directors. There appears to be disagreements on the company’s board regarding how to handle the company’s future. Warren Lichtenstein, a board member, is waging a proxy battle with the company in order to push for a sale to private equity. He was also involved in the attempted sale to Lockheed. The current CEO of Aerojet is opposed to Lichtenstein’s plan, and both sides are currently fighting for control of the board. It’s already gone far enough that court cases and judges are involved.

These sorts of problems can be a big deal, as they are disruptive to company performance and profitability. In this situation it’d probably be best if an entire new team was brought in, ousting existing members of both the board and management. If the company has long-term growth potential, it won’t be unlocked with this sort of in-fighting. With the current dysfunction, I don’t have any interest looking deeper into the company. But things could always change if there is a shakeup.

Lockheed Martin – My Future Expectations

This deal being cancelled does lower my long-term expectations on Lockheed slightly. Northrop Grumman with its Orbital ATK division will provide tough competition for classified space projects. Additionally, companies like SpaceX and Blue Origin (if they get their act together) may challenge some of their non-classified space contracts as well. An Aerojet acquisition alongside their own investments in their space segment would have more favorably set the company up for long-term success.

Another reasons I was enthusiastic about the acquisition was due to the prospects for improved revenue diversification within Lockheed. The F-35 program alone accounts for 40% of company revenue, which means there is significant risk of poor performance if the F-35 is cancelled or dramatically scaled back. There aren’t any outstanding plans to do so, but given some of the criticisms surrounding the cost of the program it’s always a concern.

While adding Aerojet’s revenue to the picture wasn’t going to be something that dramatically moved the needle away from the F-35, it would still be an overall net positive. Having the rocket maker as part of the larger company would also enable other programs to become more competitive, paving the way for future revenue growth beyond the F-35. During the acquisition process they could have also gotten rid of the existing management team, which would further unlock value from the deal.

Fair Value and Dividend Outlook

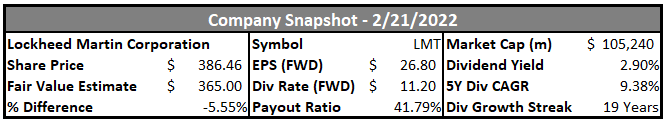

After reflecting on this news and looking back at my previous expectations for the stock, I have decided to keep my fair value estimate at $365 per share. While I had previously considered lowering it in the event the acquisition failed, I think the stock is still a compelling offer around the $365 mark due to the company’s push for developing hypersonic missiles. With their new “smart factory” opened in Alabama, Lockheed is looking to establish itself as the US leader in hypersonic development.

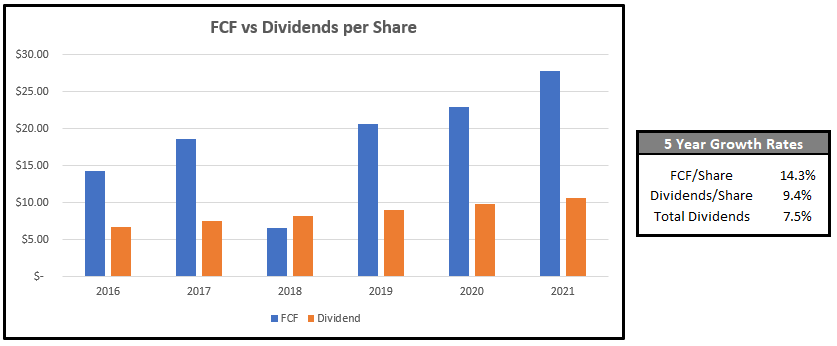

My estimates have free cash flow growing at about 4.5% – 5.0% a year for the next seven years, which is well below their five-year CAGR of around 12%. I don’t think 12% is a realistic, nor an accurate reflection of the business. If we zoom out and look at the past 8 years, the CAGR drops to around 8%. I think some of the growth shown in those more recent years won’t be repeatable by the business heading into the future. Therefore, I think closer to 5% is a more reasonable estimate.

My dividend outlook remains unchanged. I’m reaffirming my previous estimate of mid to long term dividend growth at around 8% per year. For 2021 they finished the year with a payout ratio of only 38%, which was actually a decline from 43% and 42% the prior two years. With the company planning to continue spending on new technologies like hypersonic missiles, I don’t think they will look to raise the dividend by anything greater than 10%/year.

And let’s not forget, they also buy back a considerable amount of shares each year, which is a more tax efficient way to reward shareholders. This practice will also enable them to continue the consistent dividend raises, as retiring shares means fewer dividends need to be paid on an enterprise basis while FCF per share continues to increase. Barring any unexpected changes in the business, I have no intention of selling out of my current position in the stock.

Summary

Overall, I’ll admit I’m a little disappointed in the deal being blocked and cancelled. When a group of lawmakers came out in support of the acquisition at the beginning of the fourth quarter of 2021, I was relatively confident it would go through. With all of the lobbying that goes on in DC, I figured this move would be another result of the way things work in government. Unfortunately, that wasn’t the case this time. I think I foolishly underestimated the impact that Aerojet has on the rocket industry with a 70% share of that market.

Despite the failed acquisition, I think Lockheed is still strongly positioned for the future. The F-35 continues to be the main revenue driver for the company, but areas such as hypersonic missile development may lead to significant future revenue. As we’ve seen with recent reports of China testing hypersonic missiles, other countries around the world are no longer significantly behind the US in terms of cutting-edge military technology.

With global tensions increasing, the pressure is on the US to maintain its military superiority. Just recently the Biden administration was reported to be seeking $770 billion for next fiscal year’s defense budget, which eclipses the record budget requests by the previous Trump administration. With spending set to continue trending upwards, defense companies like Lockheed should be well positioned to capitalize on this increase.

Disclosure: I have a beneficial long position in LMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.