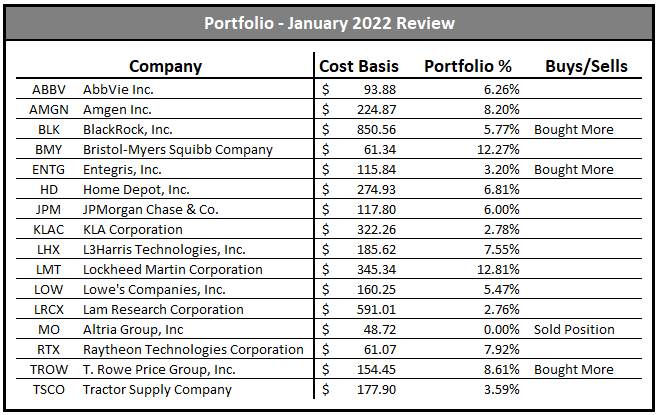

January was a pretty busy month for my dividend growth portfolio. Several of my holdings announced dividend increases, I made a few buys, and even sold out of one of my existing positions.

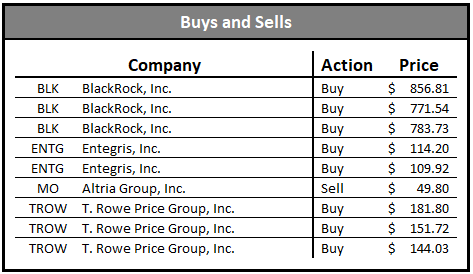

Buys and Sells

In January, I averaged down on my position in BlackRock (BLK), buying shares at $856.81, $771.54 and $783.73. I also added to T Rowe Price (TROW) at $181.80, $151.72 and $144.03 during it’s multi-week selloff. And lastly, I added more shares of Entegris (ENTG) at $114.20 and $109.92.

While market uncertainty isn’t good for asset managers like BLK and TROW, both have strong balance sheets and solid long-term fundamentals. Short term volatility shouldn’t significantly impact their profitability over a decade or longer timespan. One main reason asset managers dropped in recent weeks is due to concerns over customers pulling money out of the market due to fear of a crash. Less money invested means fewer fees collected. However, this fear is unlikely to last over the long run, so any money being pulled out will eventually go back in. Both companies also have great dividend growth track records, with TROW being a dividend aristocrat (25+ consecutive years of dividend increases).

Entegris is currently my favorite stock in the semiconductor business, so I took the drop in tech as an opportunity to add more. While I don’t consider them much of a dividend play at the moment, I think they have a promising future as a dividend growth stock. I recently published an article on the company, you can read more about my analysis here: Entegris – Smaller Chips Means Bigger Revenue

On the sell side, I sold out of my position in Altria (MO) at $49.80. There were two main reasons I sold, despite it being a position I held for less than a year. First, my plan had never been to hold the stock long term. It was always intended to be a 2 year or 3 year hold at most to provide cash flow to the portfolio. When I first started buying shares last year, I felt it was slightly undervalued and offered some safety in the event of a market drawdown. However, I took some time to reflect on my decision and applied a popular quote from Warren Buffett. Buffett says if you don’t feel comfortable owning a stock for 10 years, you shouldn’t own it for 10 minutes.

No matter how you look at it, tobacco is a declining industry on a global scale. Sure, some emerging markets are still seeing growth, but developed countries are seeing declining users, including the US. Altria only serves the US market, and while pricing power may work in their favor in the shorter term, beyond that things aren’t so bright. Tobacco still has the potential to deliver strong cash flow to companies operating in the sector, but I wouldn’t be comfortable for holding for 10 years.

This leads me into my second reason for selling. Other stocks in my portfolio dropped a significant amount in recent weeks, opening up an opportunity to buy companies I had a stronger conviction about. BLK, ENTG and TROW are all companies I feel more confident holding over the long-term. As a result, I sold my shares in Altria to put that money towards the others. Altogether I made about 4% on the sale of Altria including dividends. If I had been down on my Altria position, I may have held longer. But being up a couple percent combined with it going against my long-term investment goals made it a straightforward sale.

BlackRock – An Exercise in Patience

BlackRock was a stock I bought more of in January. I initiated a position back in early December, despite the stock looking overvalued by my own metrics. I had some leftover money I wanted to invest at the time and knew I wanted to add BlackRock to the portfolio, so I added some shares at an expensive price at $959.87. Judging by prices the last week, that was a poor decision on my part. In an effort to just start a position, I ignored valuation and took a bit of a hit. Deposits + the Altria sale allowed me to average down, but looking back on it I should have just waited to buy in the first place.

Patience is often rewarded in the stock market, and if a company is trading at a price beyond what you are comfortable paying, it’s usually a better idea to wait. During market lows of the last week of January, the stock was within only a few percent of my own fair value estimate, which would be an ideal time to add shares.

While nobody can accurately predict the future moves of the market, over the long run the market tends to revert to the mean. This means stocks trading at very high or low valuations can revert to their historical trend barring any dramatic changes to the business (such as Microsoft shifting to a cloud-focused business in 2016). I don’t think anything significant has changed with BlackRock, meaning the valuation being placed on them at $950 per share was high.

Ultimately, this is just a reminder to be patient and wait for good deals to present themselves. Over the long run, this shouldn’t make too much of a difference in the performance of my holdings, but I still could have handled the situation better.

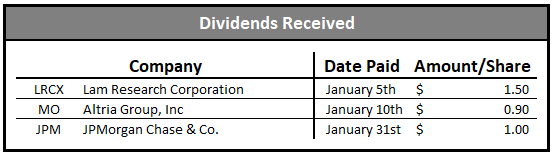

Dividends Received

During the month of January, I received dividends from Lam Research (LRCX), Altria (MO) and JP Morgan (JPM). The one disappointing part of selling Altria is that they were one of my only sources of dividend income for Jan, Apr, Jul, Oct. While I don’t base my investments around which months they pay out in, it’s still nice to be paid roughly the same amount each month if possible. But again, it’s not something I rely on when making investing decisions.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go. Dividends received for January went towards TROW and BLK.

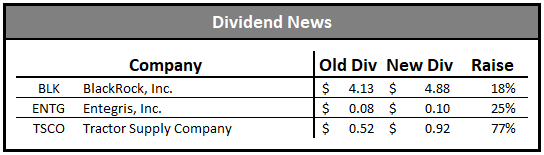

Dividend News

Tractor Supply (TSCO) announced a dividend increase of 77%!! to $0.92 quarterly, up from $0.52 quarterly. This bumps the annual payout per share to $3.68, up from $2.08. Perhaps even more impressive, this comes after a 30% dividend increase last year. While we can’t expect raises like this every year, it’s a great reward for existing shareholders.

Entegris (ENTG) announced a 25% quarterly increase to $0.10, up from $0.08. Entegris did not raise their dividend last year, so this is a pleasant and welcome surprise. For now, the yield remains extremely low but the company is well positioned for continued growth. I think over time they will continue to raise the dividend, especially with the current payout ratio so low.

BlackRock (BLK) announced an 18% increase in their quarterly dividend, raising it from $4.13 to $4.88. With almost a 15% five year dividend CAGR and a moderately low payout ratio, BlackRock has been a fantastic investment for investors who got into the stock years ago. I only recently initiated a position myself, but expect to be able to hold this for the long term with plenty of additional dividend increases.

Future Plans

The only stock I have been taking a serious look into is Discovery (DISCA). Their upcoming merger with AT&T’s Time Warner + HBO network should create an exceptionally attractive streaming platform. Discovery is trading at a relatively cheap valuation, probably amplified by concerns over the debt the new company will assume thanks to AT&T. However, the business should generate extremely strong free cash flow, enabling them to aggressively pay down debt. Discovery alone already generates more free cash flow than Netflix, despite being a much smaller company. I don’t think there will be any plans for a dividend during the early years of the company, but I think that’s the rational choice from a business perspective. Streaming is a relatively competitive industry, so re-investing back into the business and/or paying down debt is the best use of capital.

Of course, in the event the market continues dropping or any individual stock on the watch list drops significantly, I wouldn’t rule out adding them to the portfolio either. Roper Technologies (ROP) and Thermo Fisher Scientific (TMO) are two companies I’d love to have in the portfolio – at the right price. Outside of that, any money I can invest will go into the existing positions and be allocated based on how those stocks are priced relative to my fair value estimates.

Disclosure: I have a beneficial long position in BLK, ENTG and TROW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.