Entegris is a semiconductor equipment supplier that specializes in chemicals, micro contamination products, and advanced materials handling solutions. Their business model is primarily centered around foundry spending on a per-chip basis. This means demand for their products, and revenue, is heavily tied to the number of microprocessors being manufactured.

Historically, the semiconductor industry has shown to be a cyclical business, especially in the equipment space. Foundries like Taiwan Semiconductor (TSMC), Intel and Samsung will spend billions of dollars constructing processes for their cutting-edge chips, but then reduce spending until it’s time to build the next generation of processors. Entegris’ specialized role in the assembly process should reduce some of the cyclical churn experienced by other equipment providers. While other suppliers are dependent on new manufacturing processes and chip volume, Entegris’ is primarily dependent on chip volume. With demand for semiconductors continuing to grow, this bodes well for the business long-term.

Business Model – One Platform, Three Divisions

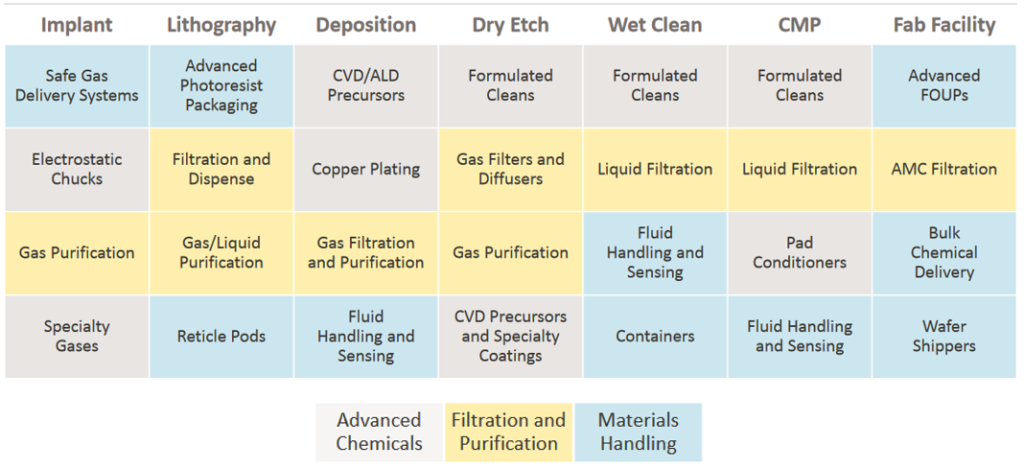

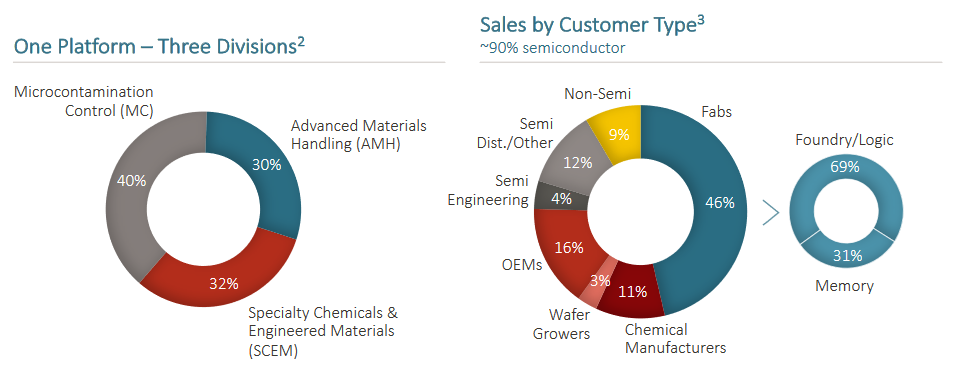

Entegris breaks their business operations down into three main segments. Specialty chemicals & engineered materials (SCEM), micro contamination control (MC), and advanced materials handling (AMH). SCEM includes chemicals, coatings and other materials used during the etching and deposition processes of semiconductor manufacturing. Etching and deposition are processes where material is selectively added or removed from the surface of a wafer. A wafer is a thin slice of semiconductor substance (such as silicon) used for making integrated circuits. MC includes liquid filtration and purification systems used to prevent contaminants from creating defects on the semiconductor wafers.

AMH includes chemical packaging as well as wafer handling solutions. These transportation products are used to move wafers between different manufacturing processes or facilities without being damaged or contaminated. Keep in mind, when it comes to modern day semiconductor manufacturing, the margins for error are tiny. Some specs call for accuracy to within a few atomic particles, meaning even tiny defects can be highly disruptive. In some cases, a single contaminant engrained into the wafer could cause an entire chip to be defective. Entegris’ products help to improve yields by reducing the likelihood of defects.

About 90% of company revenue comes from the semiconductor industry. 70% of that semiconductor revenue comes from manufacturing logic chips (like CPUs) while 30% comes from memory chips (like RAM). Entegris serves a relatively diverse customer base, with only one customer accounting for over 10% of sales and no single product generating more than 4% of sales. Collectively, their top 10 customers account for 43% of sales.

Acquisitions Fueling Growth

Entegris has been on an acquisition streak over the past several years, acquiring 8 different companies since 2018. These companies have been suppliers in areas such as gas purification, bioprocessing, specialty chemicals, filtration manufacturing and chemical-mechanical planarization (CMP) chemistries. Their latest move has been to acquire CMC Materials in a deal worth $6.5 billion. CMC provides consumable electronic materials to semiconductor manufacturers. The acquisition is expected to increase Entegris’ unit-driven revenue from 70% to almost 80%. This means that 80% of revenue will come from products used on a chip-by-chip (wafer-by-wafer) basis.

Strategically, this may seem a bit risky, as a drop in microprocessor demand would mean a significant drop in sales. However, given that we are currently seeing demand outpace supply for new chips, I don’t think this concern is something the company is concerned about in the short to mid-term.

Unit Driven Revenue Growth

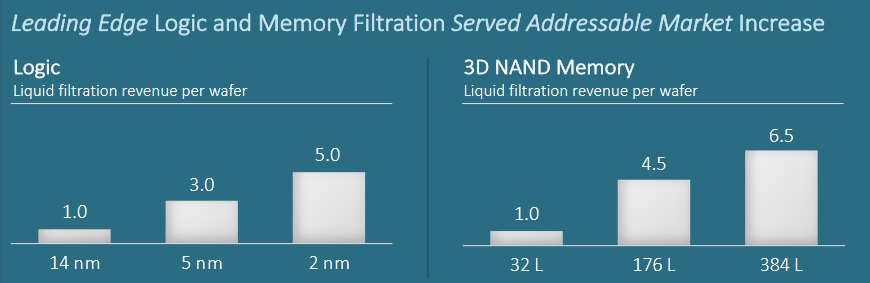

As chips have gotten smaller, foundries are spending more on chemicals, filtration, and handling systems on a per-wafer basis. From older 14nm chip processes to cutting-edge 2nm processes, wafer spending on materials has more than tripled in the logic space. In memory, spending has doubled over the past several nodes. In liquid filtration, Entegris has shown that customers are spending five times as much from 14nm to 2nm processes. The company is enthusiastic about technological breakthroughs used to fit more circuits into smaller nodes, calling it a “Perfect Storm” for the products and services they offer.

Additionally, modern technological trends are continuing the push for increased computing power across the spectrum. From internet of things (IoT) devices, to wearable technology, to cars, smartphones, servers, and everything in between, new microprocessors are needed to provide for ever-increasing demands. While industries such as automotive have lagged leading-edge sectors like laptops and servers, these businesses will eventually need to upgrade for advanced features like self-driving and AI. When that happens, they’ll need move to smaller process nodes, meaning the potential for higher sales for Entegris.

Currently, the majority of vehicle chip manufacturing takes place on nodes 40nm to 200nm in size, which is dramatically larger than top-of-the-line semiconductors. We may not ever see automotive chips reach sizes under 10nm, but any reduction in node size still opens the door for greater revenue. The automotive industry alone accounts for only about 8.5% of total semiconductor revenue, but is expected to grow at 10% per year at least through 2025. Despite this growth, the industry is slow moving so it’s less likely to be a large growth driver for Entegris anytime soon. However, they aren’t the only industry increasing their usage of semiconductors, so there are plenty of other upcoming opportunities.

Greater Protection From Cyclical Spending

Unlike other equipment manufacturers, Entegris isn’t entirely dependent on new semiconductor processes stemming from smaller chip sizes. Other equipment companies like KLA Corporation must design and produce machinery that is capable of creating, inspecting, or testing the smaller chips of each new generation. Foundries like Intel or TSM will spend billions on this new equipment in order to manufacture at those smaller sizes. However, following those initial capex investments, subsequent spending is lower. This means that companies like KLA may experience years where revenues flatline or decline, as the foundries using their machinery have finished constructing their production facilities.

Entegris differs from this model in that their chemical, filtration, and handling solution orders are primarily based on the number of chips manufactured. As discussed above, their products are used in both larger/older chips in addition to the cutting-edge microprocessors. Some of those older processes will eventually have to move to smaller, more resource intensive processes. But regardless of how those advancements are made, company revenue is still tied closely to chip volume. If current chip sizes around 3nm – 5nm never change, existing manufacturing will still require specialty chemicals and handling products that Entegris provides.

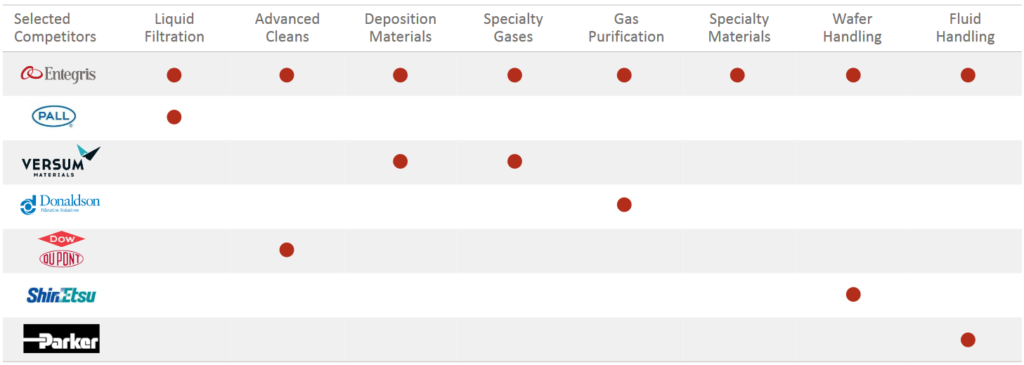

In addition to acquisitions, the company does spend substantial amounts on R&D to maintain their competitive advantages. This has enabled them to become a one stop shop for the areas they specialize in, whereas competitors may only offer products that satisfy contamination control or material handling. Their larger catalog also leads to their systems being designed or integrated into others’ processes, making switching costs higher and solidifying Entegris’ role.

While chip sales have historically tended to be somewhat cyclical (especially memory chips), they aren’t as volatile as equipment sales. With current demand for chips exceeding production, foundries are spending more on building new fabrication plants. Once operational, Entegris should experience even greater demand for their product offerings. Additionally, as discussed above, the shift to smaller and more capable microprocessors in traditionally industrial sectors like automotive means the company has a long growth tail with existing customers.

Opportunities Beyond Semiconductors

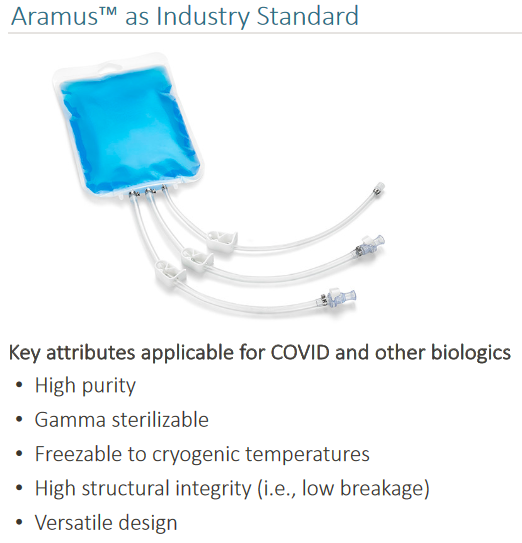

Given their expertise in specialty chemicals and filtration, the company also serves manufacturers and suppliers in the life science, electrical machining, glass and glass containers, aerospace, and biomedical device industries. They’ve even had the opportunity to design solutions used to deliver treatments such as the Covid-19 vaccines. From the company’s website, “Entegris’ Aramus™ critical fluid handling product line is used to produce and deliver vaccines worldwide like the COVID-19 vaccines.” I think this demonstrates some of the potential beyond semiconductors for the company.

Their skills are transferrable to other industries, and currently the company is projecting the opportunity for up to $300 million in life sciences sales by 2030. For reference, the company’s entire 2020 revenue was $1.86 billion. $300 million based on today’s numbers would be about 25% of total sales. However, the existing semiconductor business that accounts for about 90% of revenue is expected to continue strong growth over the next decade as well. If Entegris can expand beyond semiconductors without sacrificing growth in their primary segment, it will create a more diversified business as a whole.

Dividend Outlook

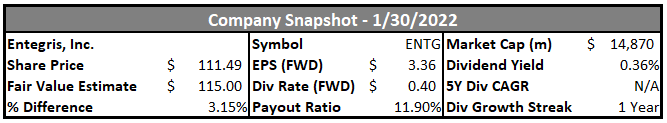

Entegris only recently started paying a dividend, with 2018 being the first year. At the time, they paid $0.07 per quarter, or $0.28 per year. They just recently announced a 25% dividend increase, raising the payout from $0.32 to $0.40 annually. Since initiating the dividend, they’ve raised it at an average rate of just over 9% per year. However, it’s important to note that they did not raise the dividend from 2020 to 2021. Also keep in mind that they have made quite a few acquisitions over that same time period. The company is still in an aggressive growth mode, making the dividend a lower priority for management. Rather than returning free cash flow to shareholders, they have been reinvesting it back into the company.

They have bought back a small number of shares over the past several years as well. Most of the acquisitions were funded by debt and cash, as shares outstanding haven’t increased since 2016. From 2010 until 2020, they traded at around a 17 P/E. However, since mid-2020 they’ve been consistently above a 30 P/E. This could mean they issue shares to fund future M&A, especially if interest rates increase and the company continues to trade at a high valuation. While issuing shares isn’t ideal for shareholders, if the company has the ability to make a key acquisition and shares are currently overvalued, it can be a better use of capital than issuing debt.

Overall, the company’s strategy makes sense to me. The semiconductor space is both one of massive growth and intense competition. Acquiring smaller competitors to become a more complete company in the chemicals and filtration space gives them significant advantages. On the dividend side, their current payout ratio based on FCF is only 13%, meaning they are already quite profitable and have plenty of money left over to invest back into their operations.

The dividend looks safe, but it doesn’t look like a priority for the company. Long term, the potential for significant raises is there, it will probably just take time for those payouts to materialize. In the meantime, Entegris is a rapidly growing company offering exposure to one of the strongest growing industries in the world.

Summary

Entegris is an interesting company in the semiconductor space. With revenue primarily driven by the number of chips manufactured, they are well positioned to benefit from the current demand for semiconductors. As we’ve seen over the past decade, chips are being used in more and more everyday devices, leading to steady long-term demand. Since Entegris serves customers on both existing processes as well as the cutting edge, demand for their products should continue to grow alongside chip demand.

The company is still in high growth/acquisition mode, with 8 acquisitions since 2018. This has led to less emphasis on returning capital to shareholders through dividends and buybacks. They do pay a small dividend and have bought back a few shares in recent years, but it doesn’t appear to be their main priority. Currently their dividend is only taking up 13% of their FCF, meaning they have the potential to substantially raise it in the future. Despite only yielding 0.34% today, I think Entegris has the potential to become one of those companies where buying shares today nets you a 5%+ yield on cost 10+ years from now.

Disclosure: I have a beneficial long position in ENTG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.