Advancements made in modern medical technology have been truly astounding over the past couple decades. We’ve seen science pave the way for both higher quality and longer lifespans, with more medications, procedures, and devices enabling higher levels of human comfort throughout life. Moving forward, I think the trends we have seen will not only continue, but also expand. From a report by Fortune Business Insights, “The medical device market is projected to expand at a CAGR of 5.4% between 2019 and 2025. In 2018, the market accounted for a value of US$ 425.5Bn and is likely to reach US$ 612.7Bn by 2025.”

A Fragmented Device Industry

The medical device segment is relatively crowded compared to other sectors and industries. There are around major 10 device companies in the S&P 500 alone, and 40 globally with a $1B market cap of at least $1B. There’s also another 100 or so smaller (public) companies specializing in niche areas or individual devices.

These companies compete in countless subcategories of treatment and care. Orthopedics, cardiology, neuroscience, pharmaceuticals, surgical devices, diabetes, and monitoring systems are some of the most popular, but there are countless others. Most companies specialize in only a few of these areas, enabling them to obtain large market shares and competitive advantages. This also leads to certain areas of the market operating in an oligopolistic fashion.

From top to bottom this space is highly competitive, with innovation paving the way for newer and more effective devices. This means companies in this segment must spend considerable amounts on both R&D as well as SG&A. Marketing products to doctors, surgeons and hospitals is an important part of the business process, as good relationships can lead to long-term deals, and a stickier client base. Once specialists become familiar with a certain company’s products, they are less likely to switch to an alternative.

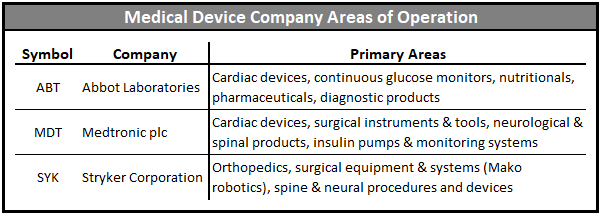

In this article we are going to look at three of the larger players in the medical device space: Medtronic plc (MDT), Stryker Corporation (SYK) and Abbott Laboratories (ABT). We’ll look at the areas they compete in, their valuation, and lastly their dividend growth prospects.

Medtronic Overview

Medtronic is one of, if not the largest, pure-play medical device maker on the market. They primarily operate under the following segments: Cardiovascular – pacemakers, defibs, stents, valves and neuromodulation; Surgical instruments and tools; Neurological and spinal; Diabetes – insulin pumps and continuous monitoring systems.

In recent years the company has slightly shifted towards partnering more closely with their hospital clients, which helps them operate more efficiently and allows for closer integration with Medtronic’s products. With improved integration Medtronic is better positioned to take advantage of business opportunities in value-based reimbursements, as well as create stickier customers who are less likely to switch to competitors.

The company currently has a roughly 50% share in the core heart devices market, and their recent acquisition of Covidien helps deepen their competitive advantages. In fact, Covidien currently ranks at or near the top in all product categories where it competes in devices, with Johnson & Johnson being its main competitor. Most of Covidien’s subsegments operate in an oligopolistic fashion, which in turn can be favorable for margins as well as creating higher barriers to entry.

Stryker Corporation Overview

Stryker is a large player in the Orthopedics space. In recent years they’ve also made a big push to get their Mako robotics systems into hospitals ahead their competitors’ products. They operate under the following segments: Orthopedics – hip & knee replacements; Spinal and neurological implants; Surgical equipment; Medical instruments and systems; Neurotechnology – minimally invasive products for brain, cranial, chest and heart procedures.

The company has essentially had a three-year head start in getting its Mako robot systems into hospitals ahead of competitors Zimmer Biomet and Johnson & Johnson. This leaves Zimmer and J&J playing catch up, which can be both a good thing and bad thing for Stryker. On one hand, medical facilities will already have signed deals and become familiar with using the Mako systems. On the other hand, if there are any significant shortcomings, competitors will likely have an easier time adapting to those issues and correcting them in their own systems first.

Morningstar considers Stryker’s orthopedics segment to be their moatiest, highlighting the significant switching costs for surgeons. Surgeons who have been using a certain brand of products for years are unlikely to switch, and given the company’s solid reputation, there is also little reason for changes to even be considered. The company also holds over 5,800 patents globally.

Abbott Laboratories Overview

Abbott is one of four companies that dominate the market for nutritionals, cardiac devices and continuous glucose monitors. The company primarily operates under the following segments: Pharmaceuticals; Diagnostic products – DNA, RNA and infectious agents; Cardiovascular – cardiac rhythm devices, heart valves, and stents; Diabetes – glucose monitors and care products; Nutritionals – pediatric and adult nutrition products.

Abbott isn’t known to innovate at the same level as some of its competitors, often opting for incremental improvements to existing platforms rather than creating something completely new. This mindset can be seen as both a negative and a positive for the company. It’s a positive because incremental improvements mean the underlying products remain relatively consistent for customers. They could also save money on R&D if they aren’t having to create entirely new platforms. The negative is that if the existing products aren’t designed with future adaptations in mind, upgrades can create overcomplicated solutions that end up costing more and cause the company to fall behind its competitors.

Morningstar views the main competitors of Abbott to be Boston Scientific, Medtronic and Edwards Lifesciences. Boston Scientific, Edwards and Medtronic all compete against Abbott in the cardiovascular segment, and Medtronic also competes on insulin/diabetes products. None of those other companies compete heavily in pharmaceuticals or nutritionals. Morningstar also assigns Abbott with a narrow moat, whereas Medtronic and Stryker are both viewed as having wide moats.

Company Valuations

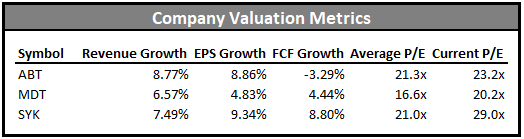

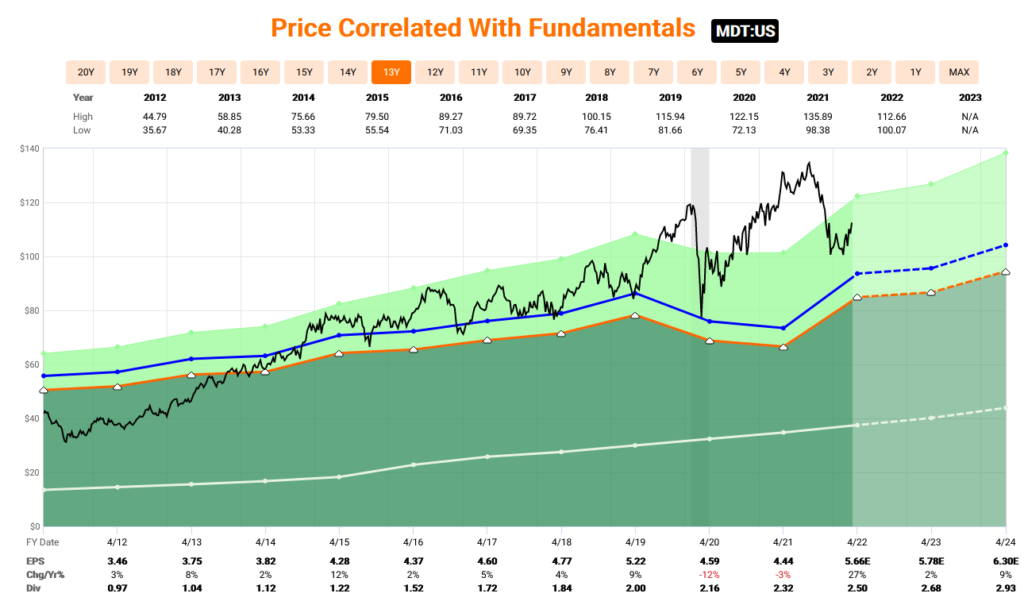

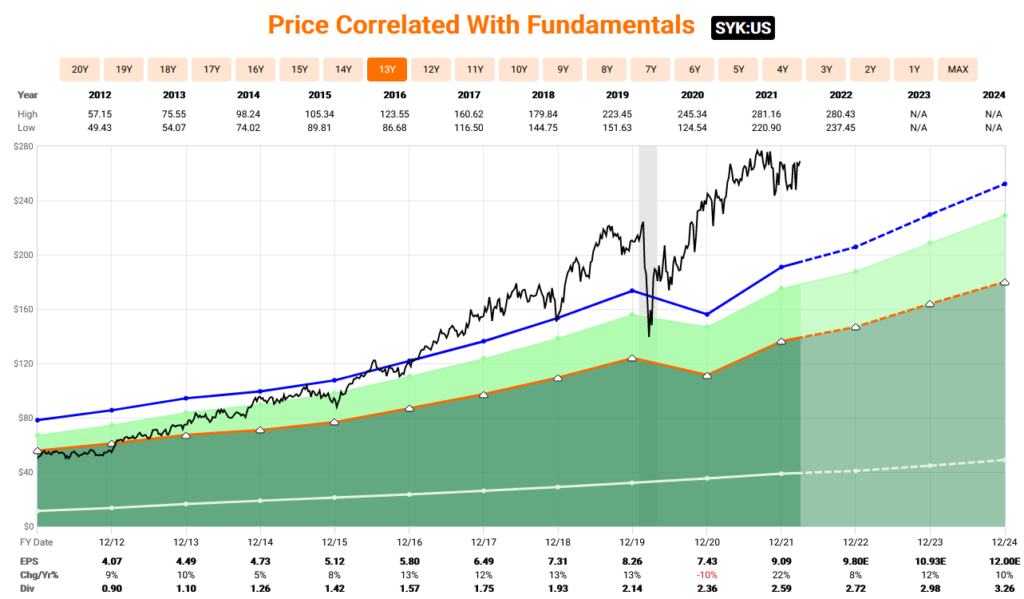

Since these companies all operate in the same segment, valuation metrics have the ability to create a meaningful comparison. Over the last decade, Medtronic has lagged Stryker and Abbott in terms of EPS growth, growing at approximately half the rate of the other two. In terms of company-wide revenue, the numbers are much closer between companies. The reason it’s important to consider both per share and company-wide numbers is because share buybacks and dilution can heavily influence per-share metrics. Abbott has seen a slight decline in FCF/share over the last decade, although the numbers line up with their spin-off of AbbVie. In more recent years they have been growing it consistently.

All companies are currently trading above their historical average for P/E. While P/E is not usually a great metric to use, in this case we are looking at similar companies operating in the same industry. We are also using it to compare to the companies’ historical averages, which can help highlight gaps in valuation. Abbott and Stryker have traded at a higher valuation around the 21x range, while Medtronic has traded somewhat lower around 17x. I think the lower P/E for Medtronic makes sense given the lower revenue, EPS, and FCF growth rates. Stryker is trading at the highest premium relative to its historical average.

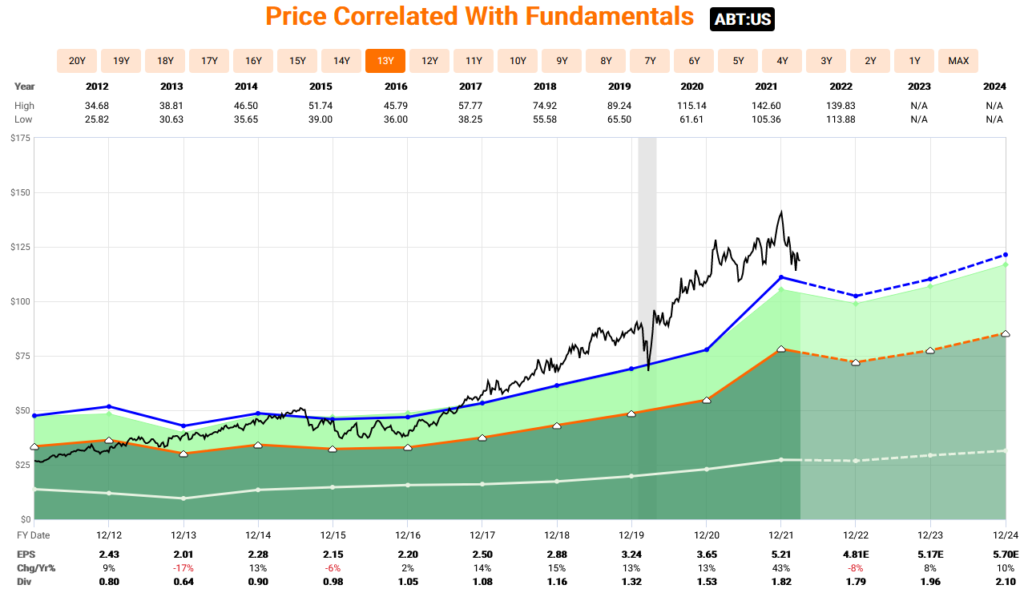

Going forward, analyst estimates are most bullish for Stryker, forecasting around 10% growth in earnings the next three years. Abbott is projected to grow earnings at a high single digit rate, while Medtronic trails again with mid-single digit growth. It is important to note that analysts are expecting Medtronic to bounce back with higher growth in 2024 (FAST Graphs image below). Subsequently, the dividend yields for each company are also inversely related to their earnings growth, with Medtronic offering the highest yield and Stryker offering the lowest yield.

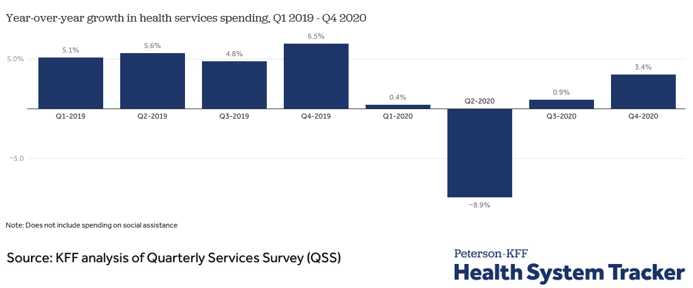

Altogether, Stryker’s performance sticks out as the strongest of the group. They have demonstrated the most consistent historical growth, and are forecasted to have the strongest future growth with earnings estimates in the low double digits. The dip we see in 2020 for Stryker and Medtronic was due to elective surgical procedures being suspended during the pandemic. Abbott doesn’t have a dip during this time due in part to their diagnostics and testing solutions that were utilized for Covid 19 testing.

Ultimately, Stryker has the highest valuation of the group and they are also the highest over their historical average. Medtronic and Abbott are much closer to their averages, although I’d argue that Medtronic may be a better deal due to the forecasted drop in earnings that Abbott is expected to post in 2022. Based on the growth numbers, Stryker might be the best performing company of the group, but that doesn’t necessarily make it the best investment at this point in time.

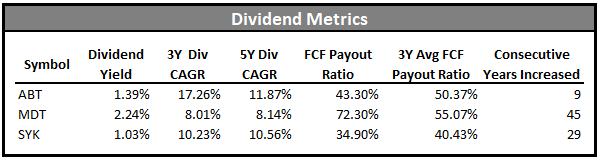

Dividend Review

All three companies have extensive histories of rewarding shareholders with consistent dividend increases. Abbott having only a 9-year history of increases is due to their spin-off of AbbVie. Prior to that split they had a much longer streak. Medtronic is quickly approaching dividend king status, with only 5 more years of increases needed to reach 50 years. However, Medtronic also has the highest payout ratio and highest average payout ratio. This is largely due to the hit they took during the pandemic, and I believe the payout ratio will return more closely to the 45%-50% range in the coming years.

Abbott has shown the strongest dividend growth in recent years, although they were also the only company of the three to benefit from the pandemic. Stryker has the best payout ratio of the group, and had very similar dividend growth to Abbott over the past 5 years. Going forward, Stryker’s stronger forecasted growth should enable the company to continue raising its dividend at low double-digit rates. My guess is that 5 years from now they will have the best dividend growth rate of the three.

Post-Pandemic Rebound

The pandemic and suspension of elective procedures was a major headwind for the medical device industry over the past couple years, especially for companies like Medtronic and Stryker. In the case of companies like Abbott (or Johnson & Johnson), they also have pharmaceutical divisions and other segments that weren’t as heavily impacted, offsetting some of their losses. As we can see in the image below, healthcare spending was down significantly in 2020 compared to 2019, although things started to rebound by the end of the year.

2021 also saw new variants and waves of Covid cases, along with a rise in staffing shortages at hospitals. This combination led to a growing backlog for procedures, as there simply wasn’t enough availability to meet demand. I think 2022 should fare better overall as the effects of the pandemic continue to wane. Unfortunately, it seems like staffing shortages will remain an issue, which will probably lead to a moderate reduction in total procedures relative to 2019. However, the numbers should be considerably better than 2020 and an improvement over 2021.

In 2023 and beyond, as things return to normal these companies should all benefit significantly. Abbott and Stryker saw 13% earnings growth in 2019, and Medtronic saw 9%. While its unlikely we see identical results in the years to come, I think comparable growth is likely. Keep in mind there are still supply chain challenges, material cost increases, and the negative impacts of inflation that will probably persist for at least the next couple years.

Final Review – Which is the Best Investment?

I expect older generations and future generations of people to have more procedures than we’ve seen historically, opening up strong growth opportunities for all of these companies. Today’s procedures are faster, safer, have shorter recovery times, and have greater impacts on an individual’s health or capabilities. There are also emerging markets that are working to catch up to first world countries in terms of medical care, and when elective procedures become more available in those economies these device makers should profit considerably. Therefore, I think all of these companies should all do well in the long-term.

Assuming Medtronic is able to rebound from their down years during the pandemic, they should make for the most compelling dividend investing choice thanks to their higher starting yield. They have also shown they can offer respectable dividend growth at around 8%/year. Combined with their more reasonable valuation, they might be the best investment choice at this time, as long as you believe in their portfolio of products. I also like their heavy involvement in both cardiac devices and diabetes care, two segments that unfortunately seem poised to grow over time.

Ignoring valuation, Stryker might be the best of the bunch, demonstrating the highest growth historically and being forecasted with the highest growth moving forward. I also think the orthopedics market should do very well in the long-term, and they appear to be the industry leader in that segment. But when it comes to investing, valuation plays a key role in determining your returns, so the current premium on shares is definitely something to consider. For me personally, the company would just be too expensive to buy at this time.

Keep in mind, this post is a relatively high-level overview of these medical device companies. If I was actively looking to start a new position, I would do further research such as analyzing the growth rate of the individual segments, looking at the balance sheet, and so on. It would also be important to identify if there are any standout competitors that may out-innovate and gain market share in certain segments.

From the numbers and data I’ve seen so far, I think all of these companies have their strengths and weaknesses. If I had to pick one based on what I now know, I’d probably go with Medtronic. Stryker looks like a great company but is just too expensive, and Abbott looks decent but seems to be the intermediary between the other two when it comes to dividends and growth. If we take out the impact from the pandemic last year, Medtronic has a better payout ratio and dividend yield than Abbott. And if we look at just growth, Stryker offers stronger numbers. That being said, they all look like good companies and I think they all have the potential to offer strong long-term returns.

Disclosure: I have no beneficial long position in ABT, MDT or SYK and no plans to initiate a position over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.