August was an interesting month for the stock market. During the first half of the month, the market continued its rally off the June lows. However, the second half of the month brought selling pressure that intensified over the final week. Concerns have risen over the economy, the Fed’s intention to continue raising rates, and the worsening energy crisis in Europe. While the United States should be mostly okay heading into winter, European nations are in big trouble. This will probably cause economic disruption that could bleed over into the US. Additionally, China has been dealing with its own problems surrounding massive drought, its Covid zero policy, and increased political tensions.

While I did make a few buys and sells for the month, this was done by shuffling around existing money in the portfolio. I haven’t made any new deposits/contributions since early July, and am not in a rush to do so in the next couple weeks. One thing I’ve learned since 2020 is, “don’t fight the Fed” and the Fed is clearly signaling that they plan to keep raising rates. This should lead to additional downward pressure on the stock market. And while I don’t necessarily see the US entering anything more than a very mild recession, I’m more concerned about the impact on foreign markets heading into winter. Therefore, I am simply raising cash and waiting for better deals to open up.

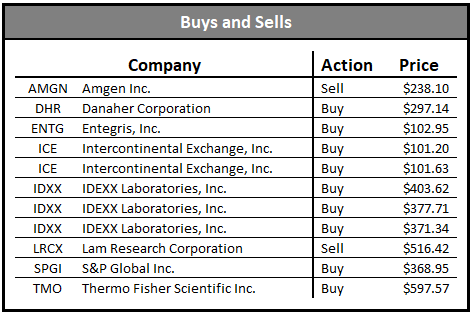

Buys

For August buys, I added to Danaher, Entegris, and Thermo Fisher. I also started new positions in Intercontinental Exchange, IDEXX Laboratories, and S&P Global. The S&P position is essentially a tracker position, as I expect the stock to fall as debt issuance slows in the near future. During that time is when I am planning to add more shares. The proceeds from these buys were made from recent selling over the last month, in addition to last month’s sales of JPMorgan and Tractor Supply. Life science companies like Danaher and Thermo Fisher always look kind of expensive to me, so I’ll likely continue to dollar cost average here and there into both stocks.

I did a recent post on IDEXX breaking down why they could do very well in the future. As I did my research alongside that post, I decided I wanted to start a position in the company. While I apparently started buying too early, I am more than happy to continue averaging down on a high-quality company that rarely goes on sale. For perspective, even during March 2020 IDEXX didn’t drop below a 34x P/E ratio. Intercontinental Exchange is a great toll booth stock for US capital markets. As owners of the NYSE, they benefit greatly from the increase in total trading volume we have seen over the years. They also operate in the mortgage and fixed income markets.

Sells

I made a couple sells this month, those being Amgen and Lam Research. While both are solid companies, I sold because I had higher conviction plays in each of pharmaceuticals and semiconductor equipment. With both positions in the green, I felt it was better to lock in profits, allocate some of that money to existing positions, and save the rest for deploying during a steeper market downturn.

Amgen has been a very strong dividend growth stock over the last decade, but seem to be reaching a key inflection point. They have several key drugs coming off patent over the next few years, and many of their up-and-coming drugs haven’t yet demonstrated they are capable of offsetting those losses. Debt has also grown considerably, partially fueled by all of the buybacks. They have made a few acquisitions in recent months, but I’m not sure if it will be enough to continue the growth story. Management did guide for mid-single digit revenue growth through the end of the decade, but that seems like a tall task with the way things are currently going.

There’s also the risk associated with their ongoing dispute with the IRS. It is claimed they under-reported income by $24 billion and as a result could owe almost $11 billion in back taxes from 2010 to 2015. Additionally, it’s been reported that the company’s 2016-2018 tax returns are also under scrutiny by the IRS. While I don’t see them ever having to pay the entire $11 billion back, assuming it even goes that far, it’s just another cloud of uncertainty alongside everything else currently challenging the company.

Ultimately, I don’t really want to have to monitor the state of a pharmaceutical company’s pipeline while relying on others to tell me if the results are promising. There are a lot of uncertainties with drug companies, and Abbvie already carries a considerable amount of risk within my portfolio. I’d rather be buying life science companies that provide supplies and equipment to the pharmaceutical industry instead of invest in it directly. Johnson & Johnson and maybe Eli Lilly would probably be the only other companies I would consider adding in the industry. In the end I sold Amgen for about a 6% gain without factoring in dividends.

Lam Research was sold because I think KLA Corporation is the stronger of the two equipment companies, and better positioned going forward. Lam has heavy exposure to the memory industry, which looks poised to go through a slowdown in the upcoming years. They also have high exposure to China and are at risk of some of their machinery being banned from selling to China. Lastly, they operate in a more competitive area than KLA, who has better margins and higher returns on capital over the long term. I was down around 20% on Lam at one point but after averaging down and the stock’s rally off the June lows, I was able to make a little over a 3% gain before dividends.

Neither sale generated large gains, but with the current volatility in the market I can’t complain with locking in a little profit to add to higher conviction plays.

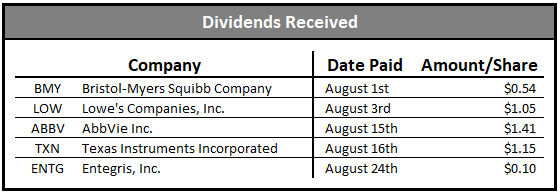

Dividends Received

August was a big month for dividends, mainly because I sold Bristol Meyers after the ex-dividend date last month and ended up buying most of my Texas Instruments position before the ex-dividend date. I also had bought more Lowe’s in July, which helped the totals as well. Moving forward, Texas Instruments should essentially offset Bristol Meyers, so my long-term dividend payouts will be roughly the same. Hopefully TI’s impressive free cash flow growth can lead to higher dividend growth as well.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

Dividend News

There were no announced dividend raises (or cuts) this month for my holdings.

Future Plans

For now, the plan is to simply monitor the markets and watch for value to present itself. I’m not confident on the economic outlook but if a company drops to what I consider fair value I’ll start buying regardless. Veeva Systems recently reported earnings and fell 15% the following day. It’s still a little higher than I’d like to pay, but is definitely a possibility in the coming weeks or months. I continue to closely monitor other stocks that I’ve mentioned before such as West Pharmaceutical and Ametek. Nordson, which I sold a few months ago because it was such an insignificantly small position, is another I’d be interested in adding back to the portfolio.

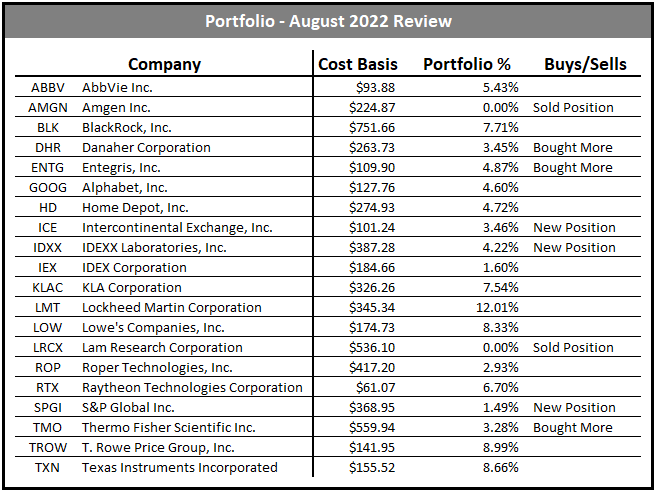

Currently the portfolio has 18 positions. I’d like to stay around 20, but would probably put the absolute hard limit at 25. There are still several companies I would like to add, but am pretty content with the existing stocks in the portfolio. Given that I have been shedding a lot of yield for higher growth lately, I’d also like to bolster the core dividend growth positions. Hopefully the next few months provide an opportunity to add to Texas Instruments, Home Depot, Lowes, and maybe even Raytheon Technologies at more attractive prices. Given Lockheed’s size, I probably won’t add more there. I like the stock but with it already being 12% of the portfolio I’m content with keeping the position as is.

Disclosure: I have a beneficial long position in ABBV, BLK, DHR, ENTG, GOOG, HD, ICE, IDXX, IEX, KLAC, LMT, LOW, ROP, RTX, SPGI, TMO, TROW and TXN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.