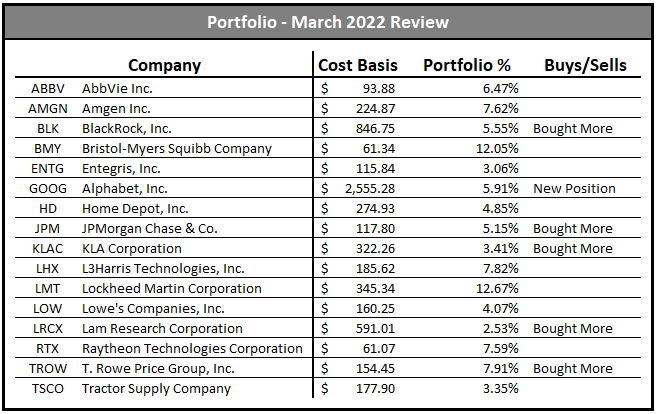

Market volatility continued over the course of March, opening up buying opportunities for a number of quality companies. As a result, I added my first non-dividend paying stock to the portfolio and continued to build up some of my other positions.

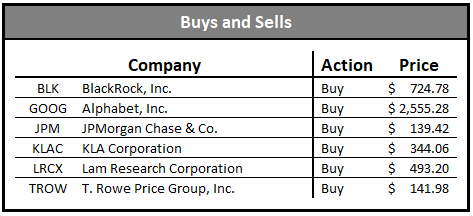

Buys and Sells

In March I primarily focused on adding to my financials and tech positions. In financials I added to BlackRock (BLK) at $724.78, JPMorgan (JPM) at $139.42, and T Rowe Price (TROW) at $141.98. In technology I started a position in Alphabet (GOOG) at $2,555.28 and added to positions in KLA (KLAC) at $344.06 and Lam Research (LRCX) at $493.20. Technically, GOOG is classified as communication services instead of technology but I think most of us inherently view it as a tech company.

BlackRock has been a continuation of averaging down over the past couple of months, and as of the end of March I am down 7.76% on the position. Not too bad, as I think I was down around 20% near the beginning of the month. T Rowe often trades similarly to BlackRock as they are both asset managers, although I am currently sitting at approximately breakeven on that position.

Alphabet was a new position I initiated, as the stock looked attractively valued around $2500 and has one of the widest moats in the world. I also think that the upcoming stock split is going to provide momentum for traders, which could push the stock higher and reduce the chances that it ever trades back down into a cheaper valuation range. I had fair value around $2400-$2500, so I was comfortable with my purchase and felt it made sense to buy now rather than hope for a better price later.

As Warren Buffett famously said, “It’s better to buy a wonderful company at a fair price than buy a fair company at a wonderful price.”

I’m still pretty bullish on the semiconductor industry long-term, so adding to KLAC and LRCX was an easy decision. There may be ebbs and flows in the industry overall, but I think by 2030 the total market for chips will be much larger than it is today. With semiconductor equipment companies being a “picks and shovels” play on that growth trend, I plan to continue adding to these companies over time. I am also still exploring other options in the industry, namely Texas Instruments and Analog Devices in order to capture growth in the analog/embedded chip markets.

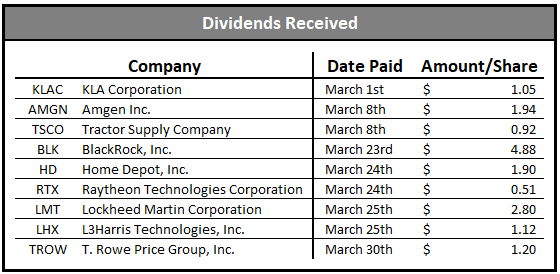

Dividends Received

During the month of March, I received dividends from quite a few of my stocks. Most of my holdings payout in months 3, 6, 9, and 12, making March the first of four major payouts expected for 2022. The stocks I received dividends from this month were: KLA Corporation (KLAC), Amgen (AMGN), Tractor Supply (TSCO), BlackRock (BLK), Home Depot (HD), Raytheon (RTX), Lockheed Martin (LMT), L3Harris (LHX) and T Rowe Price (TROW). These dividends were put towards my financials purchases for the month, mainly JPM and TROW.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

Dividend News

None of the stocks in my portfolio announced any dividend raises (or cuts) during the month of March.

Future Plans

I have had several thoughts going through my mind in terms of future portfolio plans. Aerospace and defense takes up an extremely large percentage of my overall portfolio thanks to the large rally we’ve seen since February. I’ve thought about rebalancing to reduce my exposure to the industry, as I’d prefer it to be closer to/not exceed 20% (currently sits at 28.3%). However, Russia’s invasion of Ukraine seems to have jumpstarted a global push for greater defense spending, which these companies are poised to benefit from. They also offer decent protection from economic slowdowns, should any such events take place.

A few other industries I am looking to gain exposure to include medical devices, life sciences, and water-focused industrials.

Companies in the medical devices industry should benefit from aging populations around the globe. I think companies that focus on cardiovascular and orthopedic products/solutions may be good long-term buy and holds. Some of the companies that come to mind include Abbot (ABT), Stryker (SYK) and Medtronic (MDT), although I still need to do a deep dive into the industry to see what products are offered by each company.

Life science companies have continued to trade at expensive valuations, pushed higher ever since the pandemic started. Thermo Fisher (TMO), Danaher (DHR), Agilent (A) and Avantor (AVTR) are all companies I’ve had on my watchlist for a while now, although I still need to understand what types of products they all offer. I think there is a decent amount of overlap between them all, meaning it won’t be necessary to buy them all and instead makes more sense to focus on which one(s) appear to offer the best long-term potential.

In terms of water-focused industrials, this is referring to companies that work with providing products and solutions for managing water. The primary companies I am considering in this area include IDEX Corporation (IEX), Xylem (XYL), Advanced Drainage Systems (WMS), and Roper Technologies (ROP). I think water management will continue to be important, as the impacts of climate change and increased water consumption will require new and improved systems. Plus, much of the infrastructure in the US (as well as other counties) is aging and will need to be replaced.

Beyond those industries, a few other stocks I’m watching that don’t fit into any of those categories are Adobe (ADBE), Nordson (NDSN), and Generac (GNRC). I’m also still looking to add to existing positions. However, before adding anything new further research into the company as well as their industry will be required.

Disclosure: I have a beneficial long position in AMGN, BLK, GOOG, HD, JPM, KLAC, LHX, LMT, LRCX, RTX, TROW and TSCO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.