Business Overview

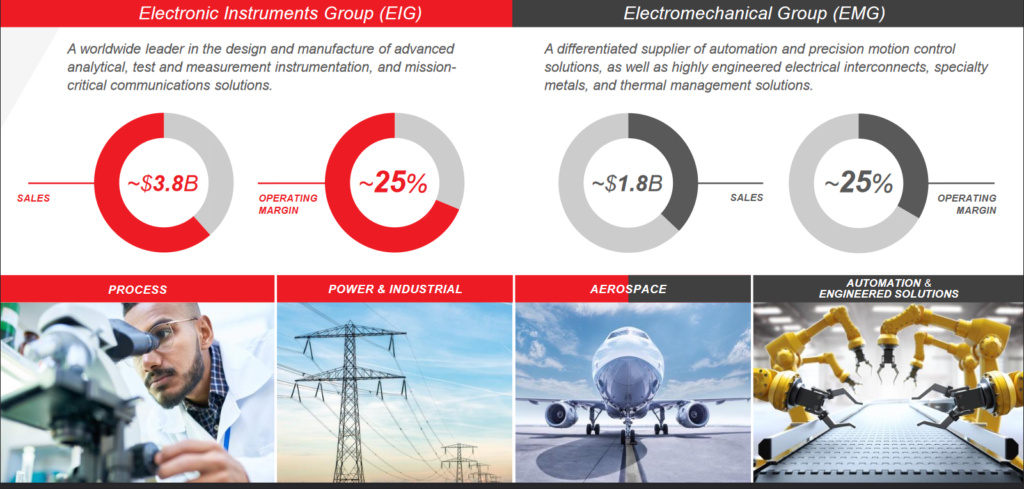

Ametek is an industrial conglomerate operating in the electrical equipment and component space. They focus on acquiring smaller companies operating in similar end-markets, or companies that are complimentary to the existing business structure. They break their operations down into two business segments: Electronic Instruments Group (EIG) and Electromechanical Group (EMG).

The EIG segment offers advanced and analytical instruments used by the aerospace, industrial, power, oil & gas, semiconductor, and healthcare industries. It also provides power quality monitoring and metering devices alongside other electrical and electromagnetic sensors, devices, and test equipment. The EMG segment offers electrical components, precision motion control products, and thermal management equipment. Products sold in this segment include electronics packaging for sensitive devices and mission-critical electronics, control products for medical devices, data storage, and automation, and heat exchangers. This segment also operates a network of aviation maintenance, repair, and overhaul facilities.

The company focuses its efforts towards businesses in niche, oligopolistic markets, allowing them to carve out an average market share of 30%-50% within many of these subindustries. From their own website “Growth is focused on expanding share within existing niches and expanding into new, adjacent niches.” These niches are strategically aligned with within industries such as healthcare, automation, energy production and supply, and aerospace and defense.

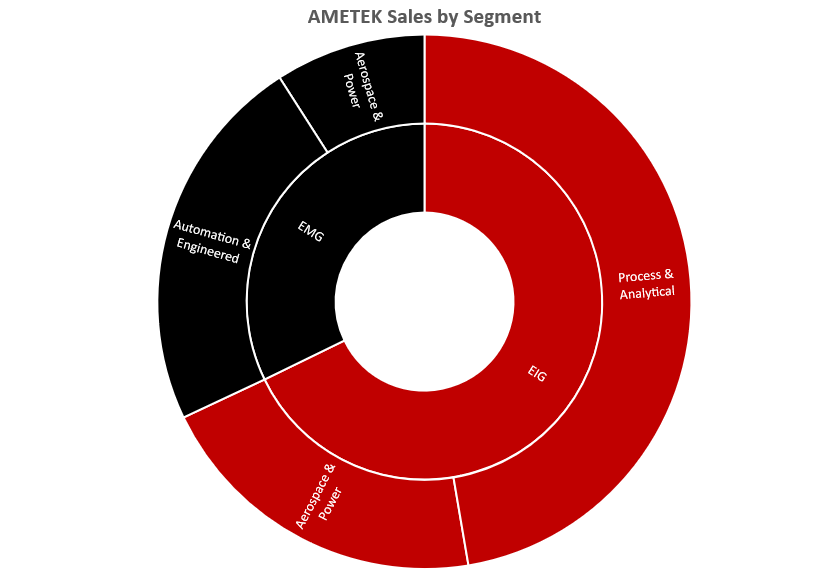

The company generates roughly half of its revenue from the US, with the other half being evenly split between Europe and Asia/rest of the world. In total, Ametek operates in 31 countries. About 2/3 of sales come from their EIG segment with the other third coming from the EMG segment.

From their 2021 annual report, Process and Analytical Instrumentation accounted for 70% of EIG sales and 47% of sales overall. Aerospace and Power accounted for 30% of EIG sales, 28% of EMG sales, and 30% of overall sales. Automation and Engineered Solutions accounted for 72% of EMG sales and 23% of overall sales.

Morningstar’s Overview

The below excerpt is from Morningstar’s analyst report on Ametek, and I think it does a great job of summing up the overall business strategy and why it’s so successful. Note the mention of other high-quality companies in their comparison, several of which I also own in my portfolio (Roper, Danaher and Idex).

“Ametek is a cash compounder that combines premier elements of best-in-class conglomerates. First, like Roper, Ametek prefers allocating capital through acquisitions. Its asset-light model’s firepower focuses on companies that compete on differentiated technology and hold dominant positions in oligopolistic niches. Second, like Danaher and Fortive, the company materially improves its targets’ underlying operating margins. Ametek often reduces the amount targets spend on raw material costs through superior supply chain sourcing.

Third, like 3M, Ametek allocates a large amount of dollars as a percentage of sales to research, development, and engineering (about 5.5% of Ametek’s sales). RD&E expenditures allow Ametek to charge a premium for its products relative to the market. They also provide Ametek with greater than inflation pricing power, typically a 50-basis-point spread. Finally, like Idex, Ametek generally focuses its acquisition activities on pre-existing adjacencies. In our view, this focus minimizes the firm’s execution risks.”

Morningstar also rates Ametek as a narrow moat, although it is close to wide. They say, “We assign Ametek a narrow-moat rating, although we believe the overall business is on the wider side of narrow. In Ametek’s case, however, it’s difficult to separate the horse from the jockey given the firm’s acquisition-heavy model… We believe the firm’s moat sources primarily include switching costs, followed secondarily by intangible assets.”

Financials and Balance Sheet

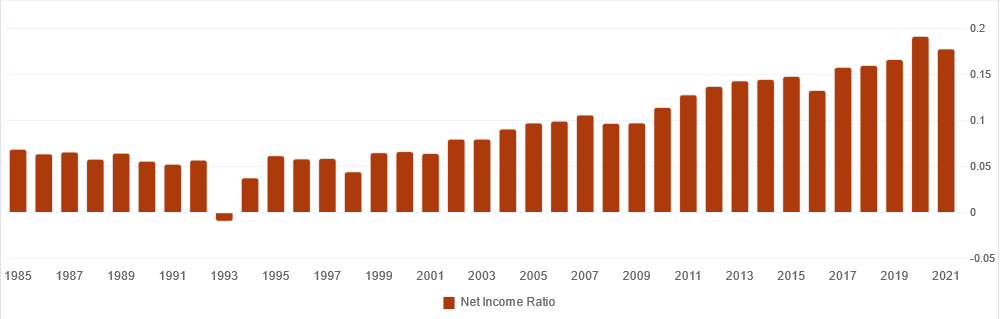

Ametek has grown revenue at a 6.37% CAGR and EPS at a 10.36% CAGR over the past decade. Margins have also trended up going as far back as the 1990s. In the mid-late 90s, net profit margins were around 6%-7% while over the past several years they’ve been around 17%-19%. This combination of growing revenue and expanding margins has led to Ametek being a high-performing and high-quality business to invest in. The company has outperformed the S&P 500 over the last 5-, 10-, and 15-year time spans.

While not a direct competitor, Roper Technologies is also an M&A focused (former industrial) corporation that is highly regarded within the space it operates. Roper has grown revenue at a 7.52% CAGR and EPS at an 8.87% CAGR over the last decade. Margins are higher overall thanks to their focus on software, but haven’t grown quite as much as Ametek. Over the last 20 years, Roper has grown EPS at a rate of 14.57%, while Ametek has grown at a rate of 14.67%. While they don’t offer the same products and services or serve the same industries, their results have been very similar. This speaks to the quality of both companies.

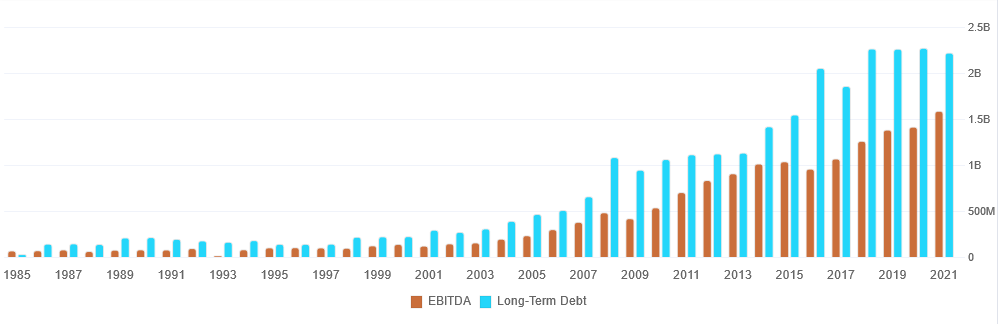

Ametek has a relatively light debt load despite being a heavy acquirer of other businesses. Long-term debt for FY2021 was $2.2 billion, and total liabilities were $5 billion. In 2021 they generated $1.6 billion in EBITDA, giving them a Debt/EBITDA ratio of only 1.4x (short term debt and cash cancel each other out in their case). Debt accumulation has slowed in recent years while EBITDA growth has accelerated. The company has $12 billion in total assets, with the one shortcoming being that a large percentage come from of goodwill and intangibles ($8.6 billion, or 72%). S&P gives them a credit rating of BBB+, which is investment grade although not quite classified as having “strong payment capacity.”

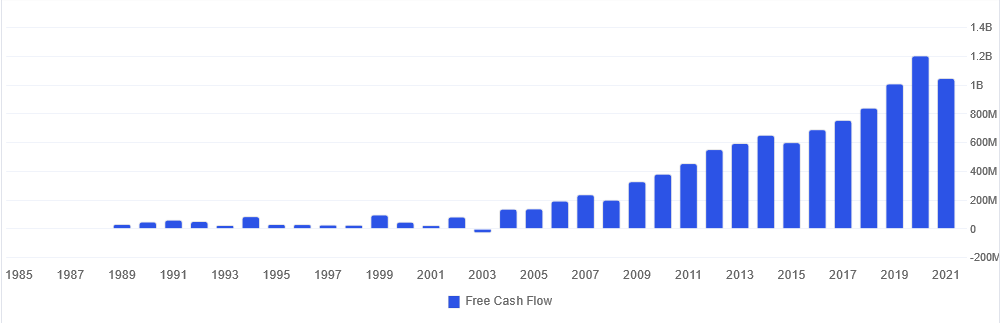

Free cash flow has grown at the enterprise level at a CAGR of 8.65% and at the per share level 9.12% over the past decade, helped by margin expansion and a few share buybacks. While they haven’t cut their dividend over the past 20 years, they also haven’t grown it consistently, sometimes keeping it the same for multiple years in a row. This is due to the company’s primary focus on M&A, although its good to see buybacks are also selectively used when management feels the stock is appropriately valued. On a FCF basis, the dividend payout ratio is only around 15%-17%, and when combined with buybacks they are spending about 21% of FCF on returning capital to shareholders.

Ametek reported Q1 earnings at the beginning of May, beating analyst estimates for EPS ($1.33/share, beat by $0.05) and reporting revenue in-line with expectations. They have now beat on EPS estimates for at least 10 consecutive quarters with 6 beats on revenue over that time. For Q1 2022 the company reported $1.46 billion in revenue, which was a 19.7% increase year over year. However, they did slightly lower guidance, calling for high single digit sales growth as opposed to previous expectations of 10.2%. Q2 sales are expected to be up low to mid-single digits year over year vs 8.9%. I think these revisions are to be expected with the current economic landscape, although it remains to be seen if management is underselling the potential impact in their guidance.

Acquisitions Fueling Growth

Ametek has made 44 acquisitions since 2011, deploying $7.8 billion in capital in the process. Since 2000 they have made 90 acquisitions. As mentioned previously, these acquisitions tend to be complimentary pieces to the industries they already operate in. This differs from other conglomerates that acquire just for the sake of growth without considering execution risk. When a conglomerate becomes too big, business units may not operate in a synergistic manner, creating inefficiencies and a scenario where the company’s sum of parts are worth more than the enterprise as a whole.

In 2021 the company made 6 key acquisitions, all of which help compliment their existing business units. Note that these companies have common products and markets that align with Ametek’s existing markets served. I like the emphasis on technology with these acquisitions, with the acquired companies providing solutions for embedded systems, automation, and communications testing and measuring services.

As pointed out by Morningstar, Ametek often reduces the amount [acquisition] targets spend on raw material costs through superior supply chain sourcing. In turn, this improves the profitability of the companies being purchased, leading to even better overall returns for Ametek. It also allows them to spend less on acquisitions since they can buy the company based on its current sales and expenses while projecting what integration into their own operations can save the acquired business.

Secular Growth Trends

Ametek continues to make acquisitions in industries poised for long-term, secular growth. The company’s focus also aligns with my own beliefs about future growth trends, which makes them a compelling investment choice. Medical and health care, automation, and test, measurement and detection are all areas that overlap with some of the industries I’m targeting. Aerospace and defense is another sector that should do well long term, although I’m not sure the growth runway is quite as strong the others. However, even if growth isn’t as strong it should be more stable and consistent, so there is still value having exposure to the industry. Stable and predictable cash flows can help management better project how much they can spend on future acquisitions.

Besides focusing on markets with long-term growth, another growth opportunity for Ametek is based on their M&A strategy. They already operate in niche, oligopolistic markets, but acquiring companies that serve related fields has the potential to make them a “one stop shop” for some customers. Customers that already order products from them may be more likely to switch to them for other parts, as dealing with a single supplier is more convenient than dealing with many suppliers. This concept would allow them to generate more revenue per customer, as well as make those customers less likely to switch away to another competitor.

Business Risks

Ametek is prone to some cyclicality within the industrial space, although growth in other markets like healthcare may help to offset those cycles. An economic downturn in the US (or globally) would also be detrimental to short and mid-term growth. Poor decisions by management when it comes to M&A is also a risk. Since they put more emphasis on acquisitions than other companies, management needs to ensure they do their due diligence and ensure the acquired company is a good fit, will generate positive growth, and is purchased at a fair or reasonable price.

Subsequently, rising interest rates can also make acquisitions more expense, although a market downturn may open the door for them to scoop up quality businesses at a discount. The world is still facing challenges with supply chains and shortages, which will remain a headwind for them in the short and potentially mid-term.

Finally, while there is execution risk by management, there is also risk in the long-term sustainability of having a quality management team. The current CEO has only been in charge since 2016, but joined the company as a product engineer in 1990 and was President of the Electronic Instruments segment from October 2003 to January 2013. The current President of Electronic Instruments joined Ametek in 1997 as a Technical Support Engineer. These guys have been around for a while and have track record of success. But what happens if they leave or retire? Will the next round of executives be as competent as them?

There’s a famous quote by Warren Buffett saying “I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.” While there is no reason to believe the company’s future managers will be idiots, it’s certainly something to consider. Strategies such as keeping M&A complimentary to existing operations should help reduce some of this potential risk.

Fair Value Estimate

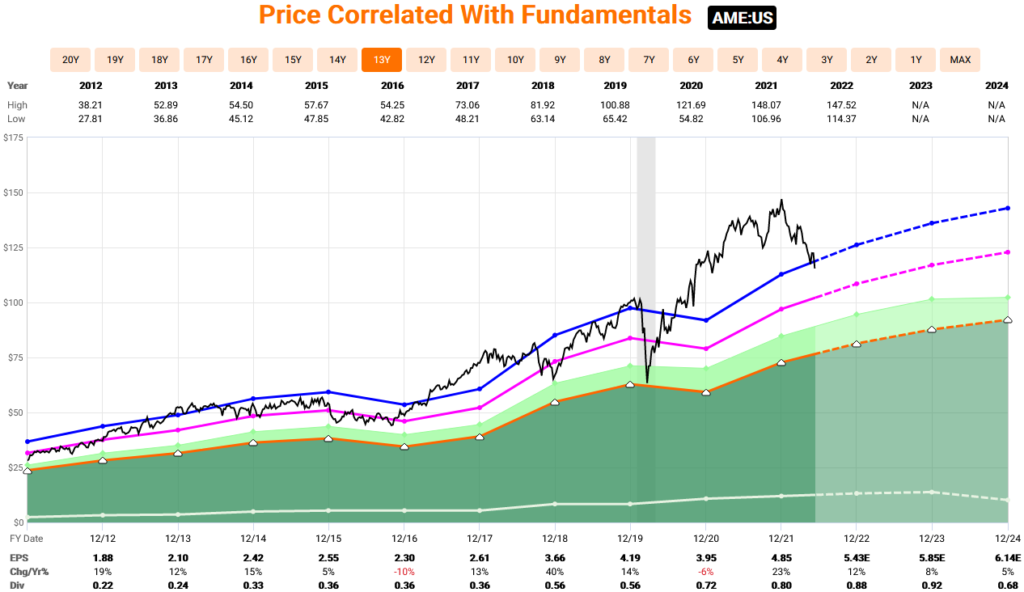

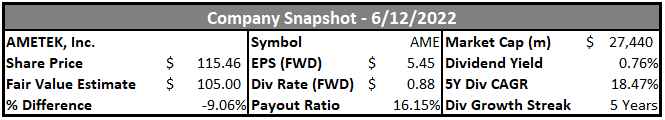

On a forward earnings basis, Ametek is currently trading at its 10-year historical average P/E of 23.3x (blue line). However, its important to consider that they recently lowered guidance slightly and future growth expectations aren’t particularly high. 12% in FY22, 8% in FY23 and 5% in FY24. Of course, these are merely estimates and a lot can change over the next couple years, but buying at these levels doesn’t provide much, if any, margin of safety.

The pink line on the chart above represents a P/E of 20x. This is still a relatively expensive valuation, but their 20-year average P/E is 21x, meaning the company always seems to trade at a premium. I think 20x P/E is a reasonable entry point for starting a position, and based on 2022 estimates that puts a fair value estimate of $108.50 on shares of Ametek.

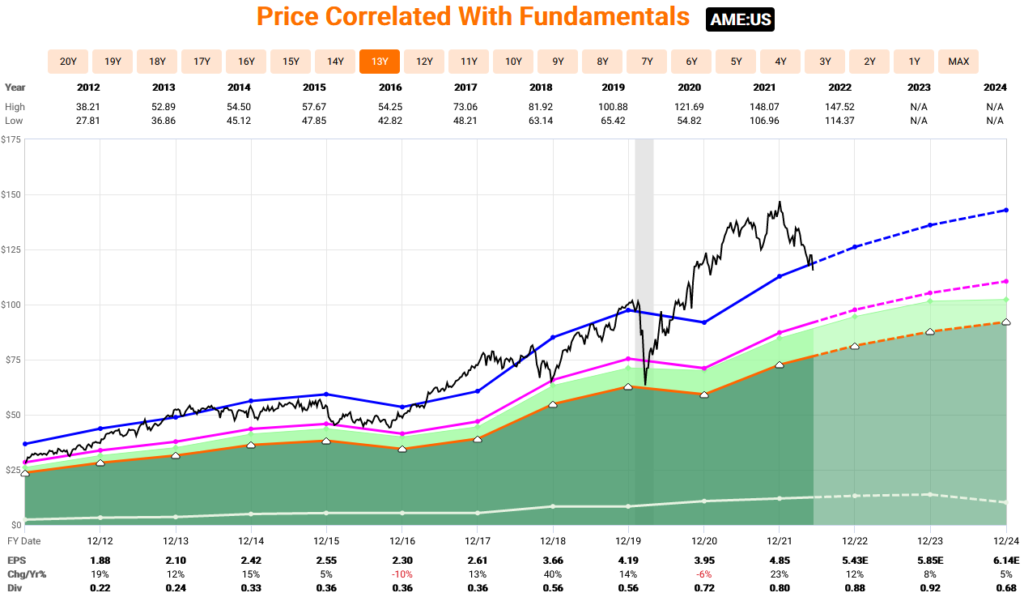

An 18x multiple (pink line in the following chart) appears to be an excellent price point to buy the stock based on historical valuations. As we can see from FAST Graphs, the stock has only dropped below an 18x P/E once in the last decade, that being the pandemic market crash in 2020. Otherwise, every time it has gotten down to around an 18x P/E it bounces back. Using 2022 estimates again, an 18x P/E puts the stock at a price of $97.65, or about a 15% below the current price.

Just remember, if economic conditions deteriorate, earnings will likely fall. $97.65 is an 18x P/E based on today’s expectations, but if earnings fell 10% to 4.89 per share that same price would now be equivalent to a 20x P/E. Therefore, all things considered I think initiating a position around $100 to $105 is a decent starting point, and a price around $90 is where it looks like a great deal. At $90, you have a wide margin of safety, where even if EPS fell 15% the stock would still be valued at a 19.5x P/E.

Summary

Ametek is a high-quality industrial conglomerate with exposure to a number of key growth markets. While there is some execution risk in the company being heavily focused on M&A, current management has an excellent track record of making the right moves. An economic downturn could open the door to cheap acquisitions, but higher interest rates are also a headwind. The company’s strategy of acquiring complimentary pieces rather than branching out to other industries allows them to remain focused and prevent inefficiencies.

Ametek mainly focuses on deploying capital for acquisitions rather than using it for buybacks or dividends. This has allowed them to generate strong returns without running the risk of damaging their balance sheet or passing on acquiring more expensive targets. Should we see a prolonged market downturn where stocks fall another -10% or more from their current prices, Ametek would be a compelling choice within the industrial sector for long-term buy and hold investors.

Disclosure: I do not have any position in Ametek and no plans to initiate one within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.