When investing for the long-term, it’s important to identify sectors that are poised to experience sustained and/or significant growth. Heavily investing in declining industries like tobacco may do okay in the short and mid-term, but isn’t an ideal strategy for multi-decade time horizons. There are many industries I think will do well over the next couple decades, and in this post I’m going to touch on several of them at a high-level.

However, just like any other investing strategy, valuation matters. Not every company mentioned in this post is trading at what I would consider a fair value, even if they are part of an industry I expect to grow considerably. Growth has a price, and paying too much for it can lead to poor returns. My philosophy has always been to try and beat the S&P 500 on a total return basis, as underperforming means you are better off just buying an index fund. Therefore, while I am interested in owning many of the companies mentioned below, I would only buy them at what I consider a reasonable price.

Life Sciences

The life science industry is somewhat of a picks and shovels play on healthcare, biotechnology and other scientific industries. Companies here mainly provide analytical and diagnostic equipment, laboratory products like microscopes and measuring devices, diagnostic tools, specimen storage solutions, filtration systems, and other precision equipment.

Given the high levels of competition in sectors like biotechnology and pharmaceuticals, billions are spent on research and development, and for good reason. There’s a lot of potential money to be made for developing the next blockbuster drug. Companies are in search of the next Humira, which has singlehandedly generated AbbVie $114 billion in sales over the last 6 years. Life science companies benefit from the increase in R&D spending, as their products are used when building new labs as well as expanding and improving existing ones.

While high tech and complex equipment is a large portion of sales for life science companies, they also sell a considerable number of consumables. Single-use products, tools, and equipment help create recurring revenue streams for these companies, as customers will have to repeatedly order more test kits, storage containers, safety products, and transportation devices.

These companies also sell products and services to the food and beverage, research and education, commercial and industrial industries. In more recent years there has also been a push to expand into software-based services for customers, which opens the door for additional high-margin, recurring revenue. It also helps keep customers within their product ecosystems, as software and hardware are typically only compatible with devices made by the same company.

Given that the healthcare sector is one that I’m bullish on long-term, I like the potential that life science companies have in contributing to those trends. I’ve seen a few forecasts estimating around 5%-8% annual growth through 2030 for the life science industry. Ultimately, I think these companies offer less volatility than actual biotech or pharmaceutical companies while still capturing strong growth potential. For now, the main players are all companies I would be interested in owning, those being Agilent Technologies (A), Danaher (DHR), and Thermo Fisher Scientific (TMO).

My sector favorites: A, DHR, TMO

Pharmaceuticals & Medical Devices

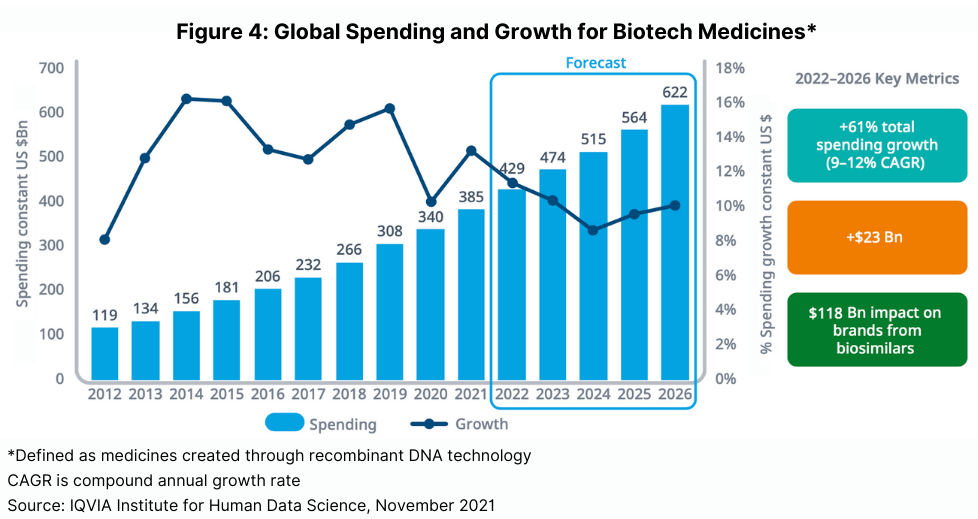

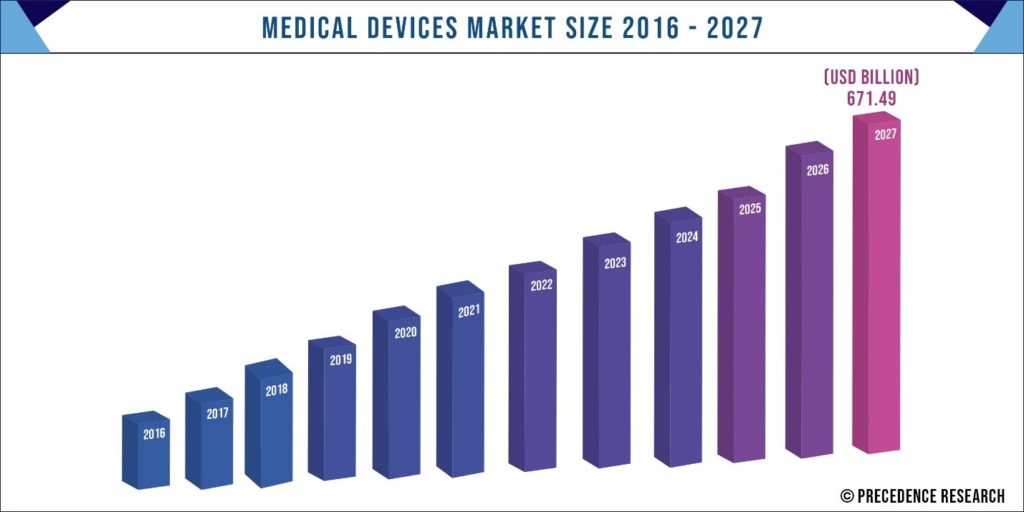

My previous post was a high-level overview of three of the major players in the medical device space: Abbott Laboratories (ABT), Medtronic (MDT), and Stryker (SYK). What I found from that research was that all three companies look like solid long-term investments, and that the medical device market looks poised to continue growing well into the future. Similarly, I think pharmaceuticals are going to demonstrate strong growth as well. As science continues advancing, new cures and treatments will be developed, offering significant revenue growth for companies capable of developing such drugs. The forecast in the following chart calls for a roughly 10% CAGR over the next 5 years in biotech medicines alone.

One point I briefly mentioned in that medical device article was how developing countries are still working to catch up when it comes to healthcare and available treatments. As these countries mature and stabilize, they will offer yet another market for pharmaceutical and device companies to sell to. Life expectancy is shorter in emerging economies, and fewer healthcare facilities means fewer options for treatment. Currently, many people don’t have the same opportunities to undergo procedures that are available in the West. These markets should provide considerable growth opportunities in the future.

With the US being the largest and most profitable market for these industries, there is concentration risk if any meaningful reform takes place in healthcare and/or health insurance. However, given the oversaturation of pharmaceutical lobbying within the US government, it seems unlikely that any major changes or overhauls would take place. It’s not a risk to ignore though, as even a 3% reduction in revenue could considerably impact the long-term value of these companies.

Still, the potential for profit is enormous. As mentioned above, AbbVie has generated $114 billion in sales off of Humira in the past 6 years. The company’s exclusivity protection on Humira expires in 2023, but thanks to a “thicket” of patents surrounding the drug, they have legal ownership of certain elements extending out until 2037. Obviously not every drug is going to be that profitable, but the leaders in the space have large pipelines of up-and-coming drugs, as well as large portfolios of already launched drugs. Even a new drug that is half as successful as Humira will generate significant revenue growth for any pharmaceutical company.

Drug companies tend to trade at lower valuations and are susceptible to volatility due to risks surrounding the approval of new drugs. For example, a setback in clinical trials could mean that a new treatment is no longer eligible to be approved, causing the stock to drop considerably. A failed drug means that R&D spending didn’t create a new revenue stream for the company, and can greatly increase negative sentiment in the short-term. These swings can also create excellent buying opportunities, as long as you can identify whether the rest of the company’s portfolio and pipeline can offset such challenges.

On the medical device side, the industry is less susceptible to volatility but not immune to external factors. We saw device companies drop due to the pandemic, as elective procedures were suspended. However, the companies have mostly rebounded by now as the pandemic wanes and surgery volume increases. Stryker, for instance, is back to trading at pre-covid valuations when looking at metrics like P/E. From estimates I’ve seen, the device industry is forecasted to grow at around 5.4%/year through 2025 and 5%/year through 2030. I think a long-term 5%+ CAGR is a reasonable estimate for the next few decades.

My sector favorites: ABBV, ABT, AMGN, BMY, LLY, MDT, SYK

Semiconductors

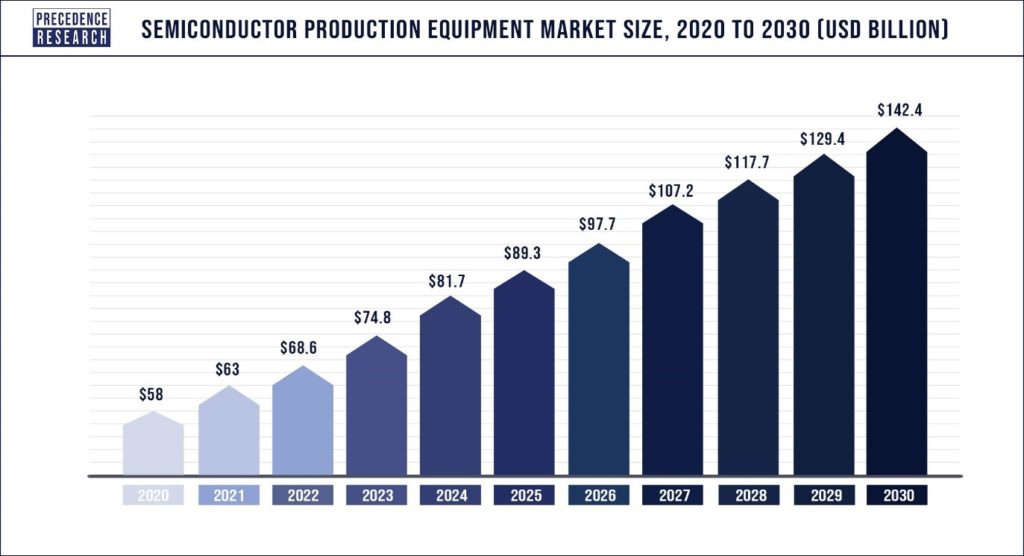

The semiconductor industry is forecasted to double from $500 billion to $1 trillion by 2030. Semiconductor equipment sales are forecasted to grow at 9.5% per year over that same time frame. As a whole, the industry is being driven by a feedback loop of technological advances and increased reliance on interconnectivity. We see increases in demand for chips in vehicles, smart devices, wearable tech, automation, data centers and AI every year. With an ever-increasing number of devices connected to the internet, the infrastructure that powers global networks also continues to grow. More data centers are needed to process, store and collect data from everyday devices. Companies are also continuing to migrate their operations to the cloud, continuing the demand for robust and high-performance data centers.

These trends are beneficial across all areas of the semiconductor industry. Chip designers like AMD and Nvidia are seeing higher demand for their products. Chip manufacturers like Taiwan Semiconductor can’t keep up with orders for new chips and are working on expanding. This expansion means more money spent on equipment, benefiting that sector. A greater number of chips in cars and smart devices increases the demand for analog chips, which increases sales for companies like Texas Instruments and Analog Devices. And lastly, greater numbers of memory chips are needed to work in tandem with the processors themselves, benefiting companies like Micron.

Across the board, there are lots of opportunities to generate fantastic long-term returns. Many of these companies also pay growing dividends. I personally prefer the equipment side of the industry for reasons similar to the life science companies discussed earlier: they are a picks and shovels play on an industry expected to see significant growth in the coming years. There also seems to be more risk and greater volatility on the design side of things.

Apple, for instance, is designing their own chips to go in their laptops and phones, reducing their reliance on ordering from others. This shift led to Apple no longer using Intel CPUs in their high-end Mac workstations, and could mean phasing out wireless chips provided by Skyworks and Broadcom. But regardless of if Apple buys from those companies or designs their own, they still need to either work with a foundry like TSM to have the chips made, or create their own foundry. And in either case, more semiconductor equipment will be needed in order to produce the chips.

Other companies like Amazon, Google, and Facebook/Meta are also looking into designing their own chips. Amazon is working on chips used for networking and moving data, while Google is currently working towards creating its own CPUs for its Chromebook laptops. However, none of these companies are looking to actually manufacture any of the chips themselves, meaning they will rely on foundries like TSM. But again, just like in the case of Apple, this is good news for equipment suppliers, as they win regardless of who actually designs and makes the chips.

Within the equipment space, the companies I like most are KLA Corporation, Lam Research, and Entegris. Some other popular ones are ASML and Applied Materials. My current issue with ASML lies in the fact that it’s traded at such high valuations in recent years, and given the complexity in the machinery it produces, there is no easy way to scale operations and capitalize on demand. If it fell to a more attractive valuation, I wouldn’t be opposed to buying shares.

Applied Materials is what I would consider a “jack-of-all-trades, master of none” company. KLA specializes in inspection equipment, while Lam specializes in deposition and etching equipment. ASML specializes in lithography and essentially has a monopoly in leading edge Extreme Ultraviolet (EUV) technology. Applied Materials provides many equipment types, but doesn’t appear to be an industry leader in any particular segment. They are larger than KLA and LRCX, but I think specialization will lead the other two companies to produce better products and capture more market share.

My sector favorites: ADI, ENTG, KLAC, LRCX, TXN

Water

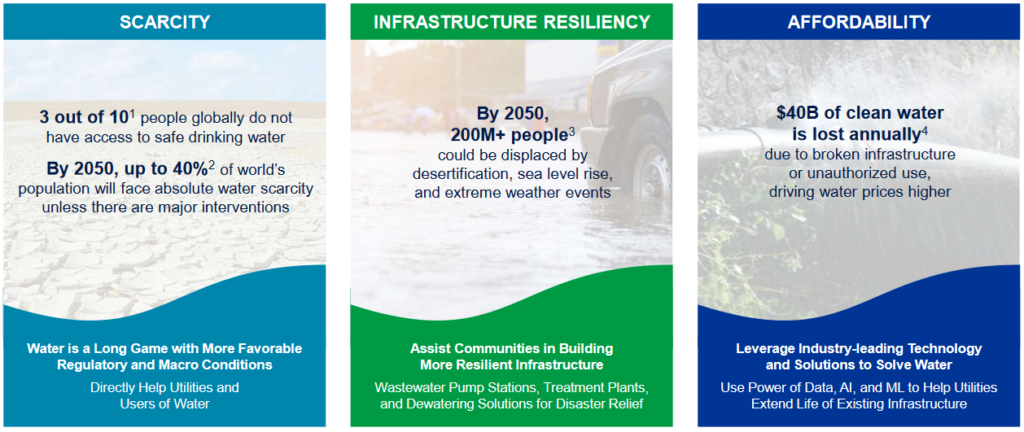

I’m using “water” as an umbrella term for stocks that provide solutions for working with, managing, and treating water. This means companies that provide solutions for the utility, industrial, agricultural and energy spaces, as well as commercial and residential applications. Due to the impact of climate change and an increase in demand for clean water, society will require improvements to existing infrastructure in addition to new water management products and solutions.

In general, this industry is led by companies that provide various types of pumps, flow meters, valves, sealing solutions, dispensing equipment, compressors, leak detection equipment, and precision devices. Many of the top companies also provide software for monitoring and optimizing the delivery and handling of water as well as other fluids. The combination of precision equipment and software also provides use cases in the health care and applied science industries.

There are a number of secular tailwinds that should collectively benefit water companies. Those include upgrading aging infrastructure in modern countries, installing infrastructure in emerging market countries, and finding solutions to better manage our increasing demand for water in the face of climate challenges.

Companies like Xylem (XYL) and Badger Meter (BMI) work more closely with companies in the municipal water utility space. Roper (ROP) is an acquisition firm that focuses heavily on buying niche software businesses, although it also has sub-segments that provide pumps, flow meters, controllers, and leak detection equipment. IDEX (IEX) provides a variety of products and solutions within the segment, including much of what was mentioned earlier. They also serve niche industries like firefighting and search and rescue equipment, in addition to banding and clamping products used in general industry and commercial applications.

Much of the water industry has consolidated over the past several decades, giving the remaining companies pricing power and steady moats. Looking at historical numbers, these companies also tend to be better insulated from the cyclical nature of other areas of the industrial sector, such as heavy machinery. Earnings can be choppy during times of slow economic growth, but they aren’t like Caterpillar (for example) whose revenue still hasn’t passed its highs in 2012. Selling to utility companies and other higher essential industries is probably a contributing factor in the lower volatility from water companies.

My sector favorites: BMI, IEX, ROP, XYL

Disclosure: I have beneficial long position in ABBV, AMGN, BMY, ENTG, KLAC, and LRCX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.