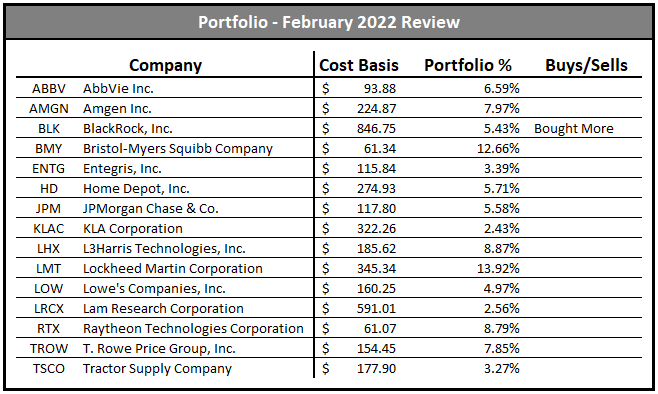

February was a volatile month for the markets, and a relatively an uneventful month for my portfolio. I didn’t make many moves, but am keeping an eye on my watch list for potential deals to open up in March.

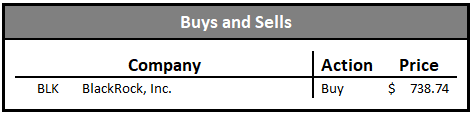

Buys and Sells

In February, I added to my position in BlackRock (BLK), buying shares at $738.74. As discussed last month, I continue to pay the price for initiating a position at a time when the stock looked overvalued. Despite multiple buys to average down last month, the stock has continued to decline. However, now that its around my fair value estimate, I feel much more comfortable buying more.

I funded this addition with dividends received over the past month from other positions, and did not deposit any money directly into the portfolio this month. While many stocks sold off over economic concerns, the potential for multiple rate hikes, and war breaking out in Ukraine, most of my positions didn’t make any large moves to the downside. Some of my stocks actually had big moves to the upside, mainly Lockheed Martin (LMT) and L3Harris (LHX) due to the Russian war in Ukraine.

I do not look to time the market specifically, but instead watch for buying opportunities in stocks I am interested in. If a stock is attractively valued, I will use excess cash to initiate or expand my position, regardless of market sentiment or macro conditions.

Many are speculating that markets continue dropping over the economic ramifications of Russia invading Ukraine. Maybe they do, maybe they don’t, but it doesn’t change my own buying strategy. If a stock on my watch list drops to my fair value estimate, I’ll add shares even if the expectation is that the market continues to drop. Nobody can predict the future of the market, and often times while the retail investors are selling the institutions are buying. Ignoring the short-term fluctuations is the only way to generate strong returns over the long run.

If you’re confident in the company, a short-term dip should be used to buy additional shares. It should not be taken as a sign to panic and sell out of your position.

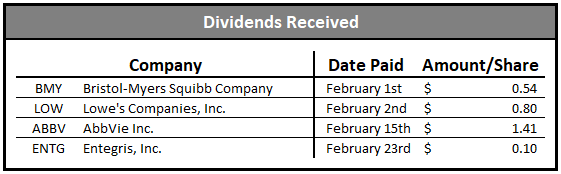

Dividends Received

During the month of February, I received dividends from AbbVie (ABBV), Bristol-Meyers (BMY), Entegris (ENTG), and Lowe’s (LOW). These dividends were used to buy additional shares of BlackRock.

I do not automatically reinvest dividends and instead choose to selectively reinvest them at the end of each month. This enables me to put the money towards the best valued stocks in my portfolio. I set a deadline of the end of the month for these purchases in order to prevent myself from wanting to hold in hopes of a better deal. The dividends will always be reinvested regardless of market conditions, similar to actual DRIP, except I give myself the choice as to where those dividends go.

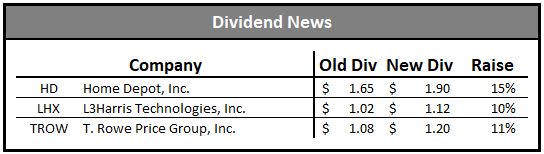

Dividend News

Home Depot (HD) announced a 15.2% dividend increase, raising their quarterly dividend from $1.65 per share to $1.90 per share. This raised their annual dividend from $6.60 to $7.60. The company’s five-year dividend CAGR actually declined from 19.1% to 16.4%, despite this substantial raise. With forward guidance calling for low revenue growth in 2022, I wouldn’t expect a big raise next year. This weak guidance was also the reason the stock sold off significantly.

L3Harris (LHX) announced a dividend increase of 9.8% to $1.12 quarterly, up from $1.02 quarterly. This raises their annual payout to $4.48 per share, up from $4.08 per share. A portfolio-wide 10% dividend CAGR is my target for my portfolio, so this raise falls right in line with that goal. Following this raise, the five-year dividend CAGR is now 15.28%, and this is their 20th consecutive year of raising the dividend.

T Rowe Price (TROW) raised its quarterly dividend 11.1% from $1.08 to $1.20. This raised their annual dividend from $4.32 per share to $4.80 per share. The company has now raised its dividend for 35 consecutive years and is currently showing an impressive five-year CAGR of 16.05%. This is a stock that’s been beaten down over the past 3+ months, and its now yielding an attractive 3.3%.

Future Plans

I am continuing to keep an eye on my portfolio and watch list for any and all opportunities. Like mentioned previously, I’m not watching for macro developments in areas such as the war in Ukraine, but instead watching for stocks to reach my fair value estimates. If stocks drop to a level I feel indicates fair value, I will add shares. Similar to last month I am continuing to watch companies such as Roper Technologies (ROP) and Thermo Fisher Scientific (TMO).

Last month I mentioned Discovery (DISCA) as a stock I was potentially interested in. I’m still interested in it, although I haven’t made any steps towards actually initiating a position. I think it has an attractive content library and the potential to generate strong cash flows. The main concern is the debt load that AT&T is dumping onto the business. With few hurdles remaining, the deal looks poised to complete in Q2 of this year.

Disclosure: I have a beneficial long position in BLK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Always do your own due diligence before making investment decisions or putting capital at risk in the market.